Summary

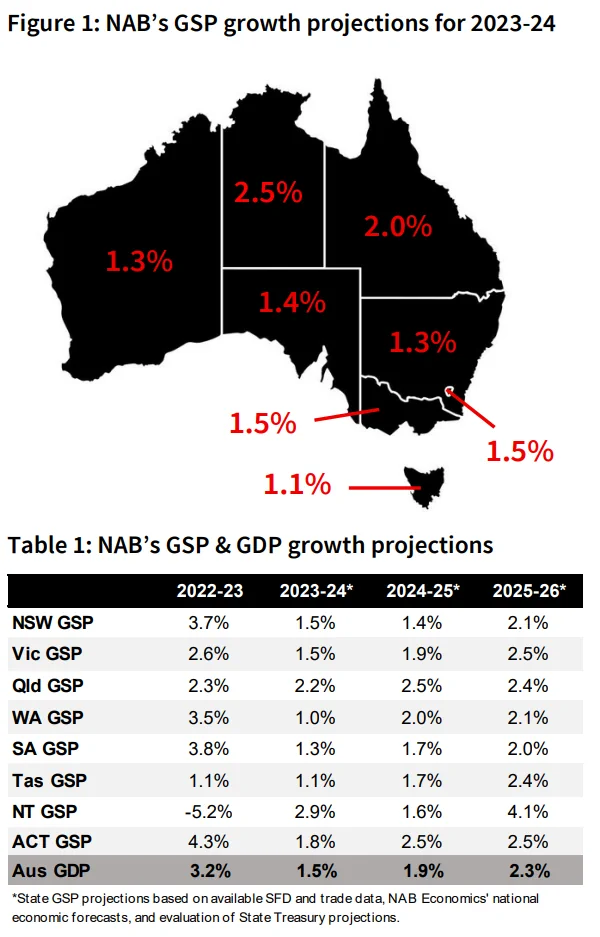

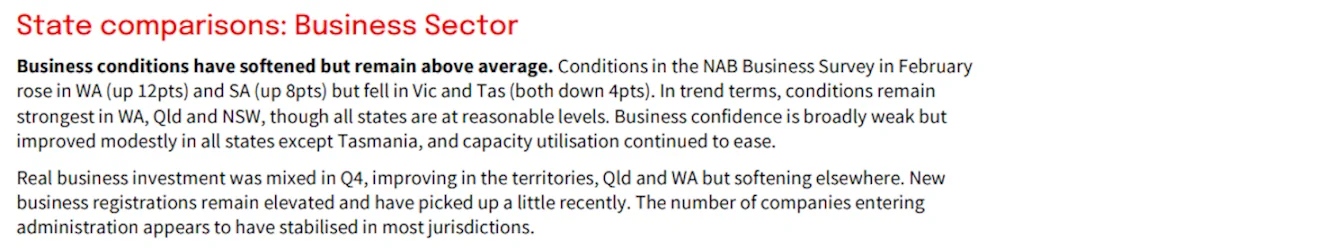

After a year of fairly strong growth in Gross State Product (GSP) across most states in 2022-23, overall growth is expected to be slower in the current year and into 2024-25 with high inflation and rates weighing on households and businesses.

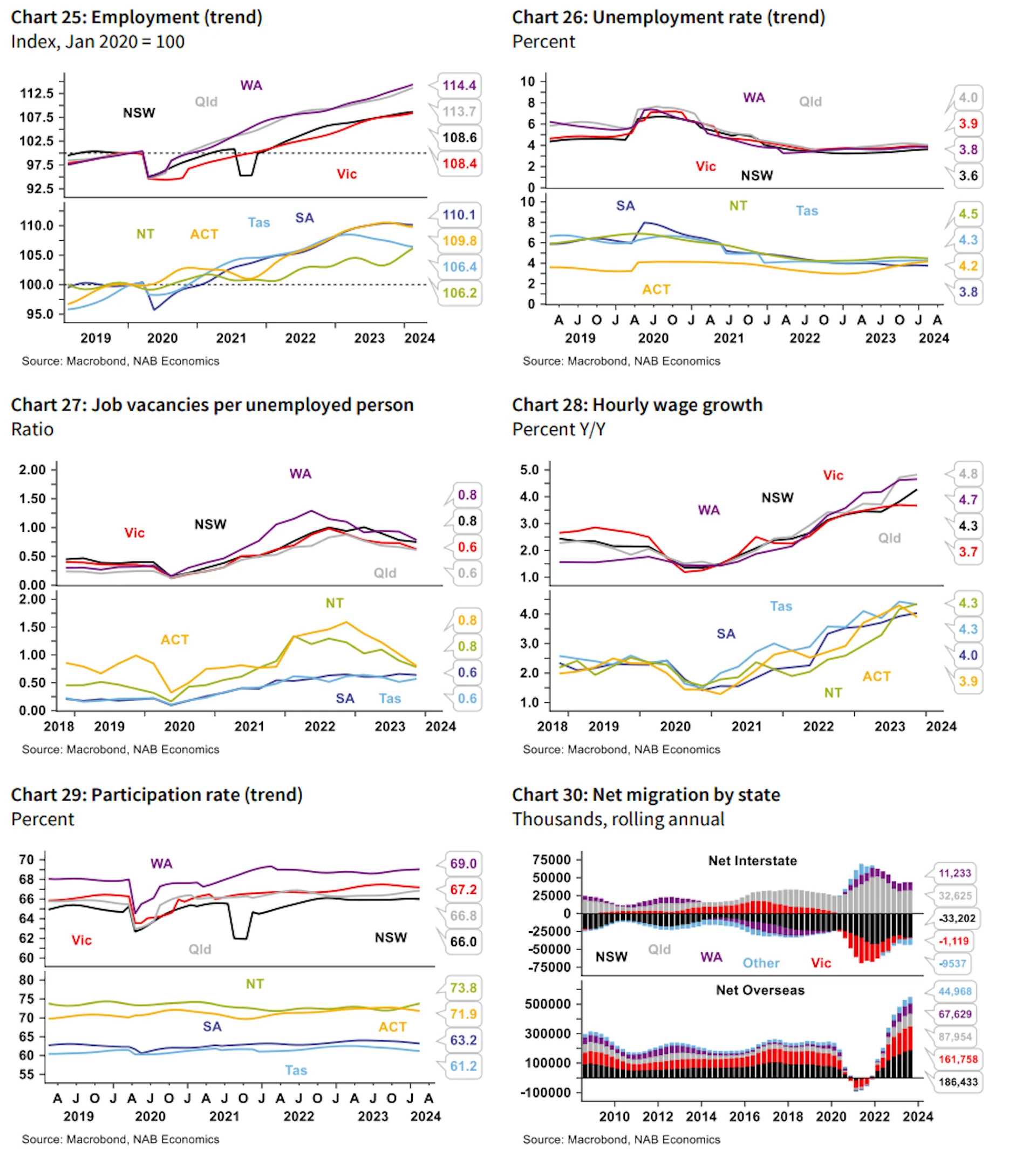

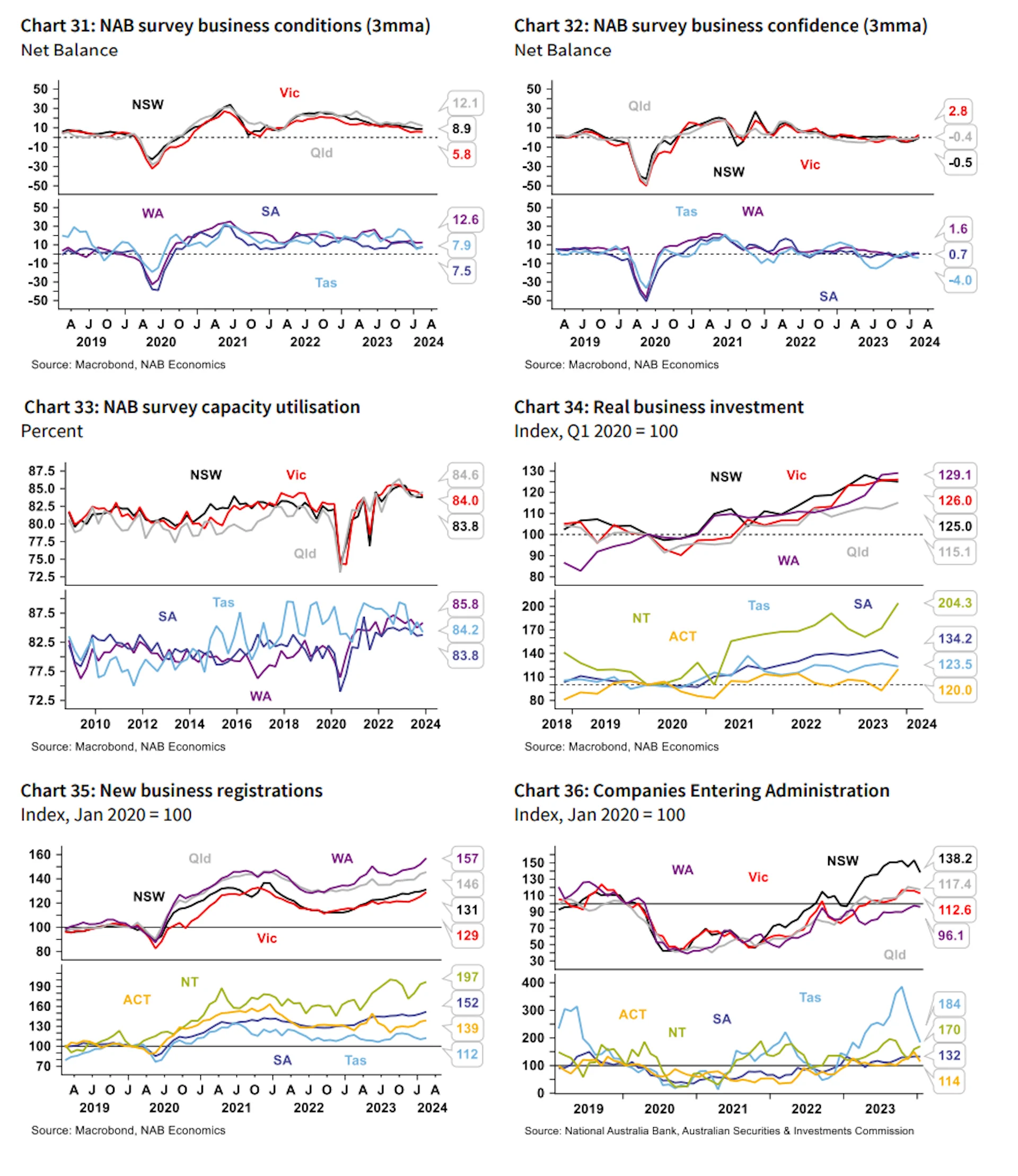

Consumption growth was flat in most jurisdictions in Q3 and Q4 and dwelling investment was in outright decline in most cases as supply issues lingered and rate rises impacted the flow of new dwelling approvals. However, strong public sector demand has been a key support across the board in 2023 driven by public investment. Business investment has also shown some resilience in the larger states (despite persistently low levels of business confidence in the NAB Business Survey).

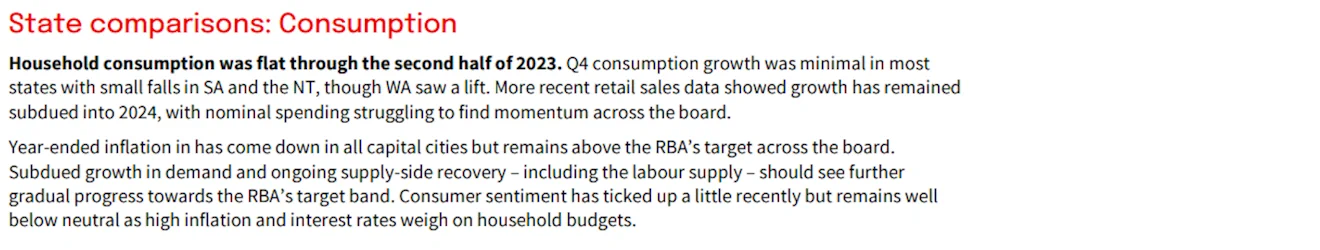

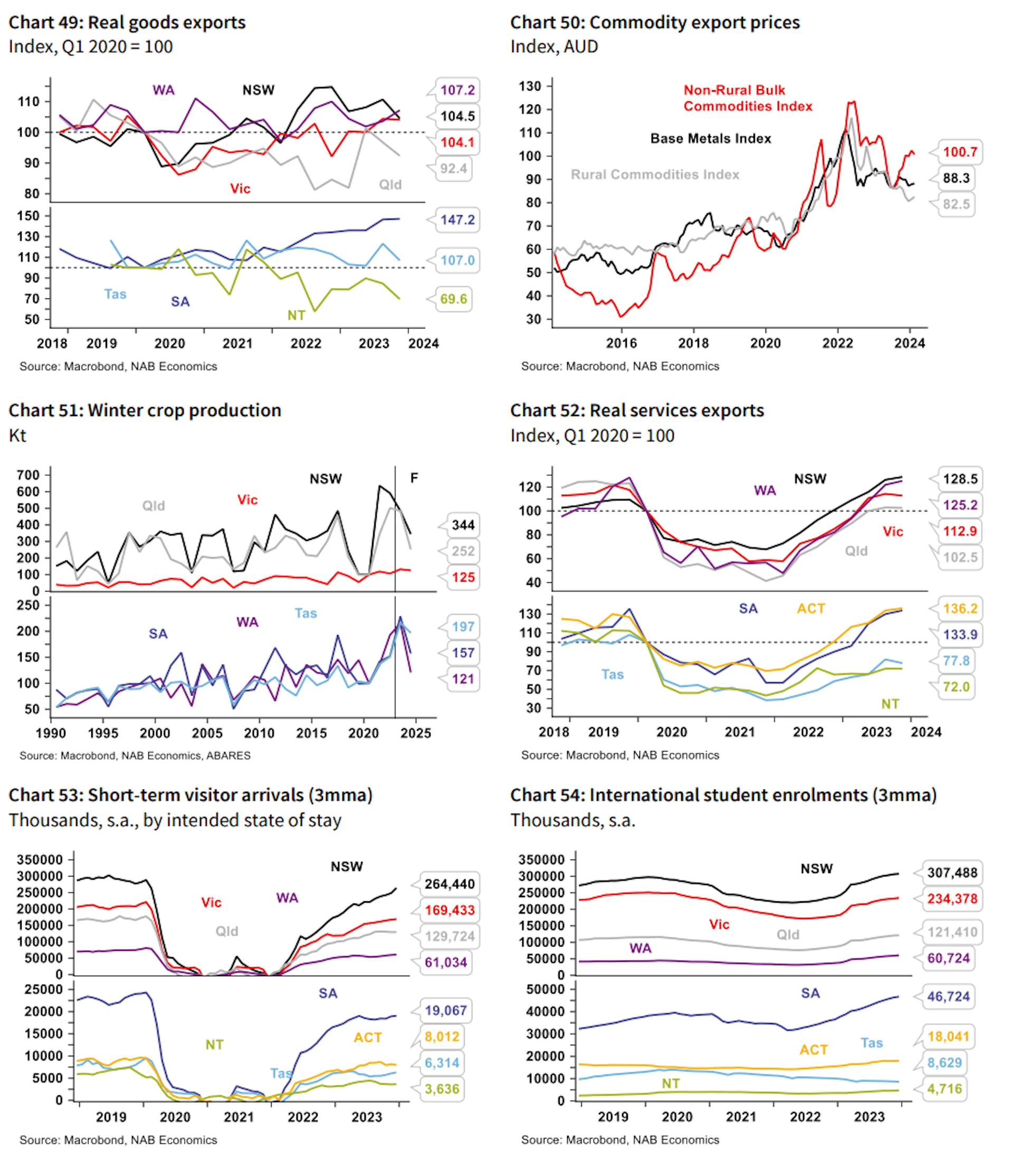

The weakness in demand has come despite very strong population growth of 2½-3% across the states. Notably, a considerably portion of this has related to the strong recovery of international student numbers, particularly in NSW and Victoria, with associated tuition fees and consumption spending counted as exports. Nonetheless, incomes and spending have clearly been squeezed in per capita terms.

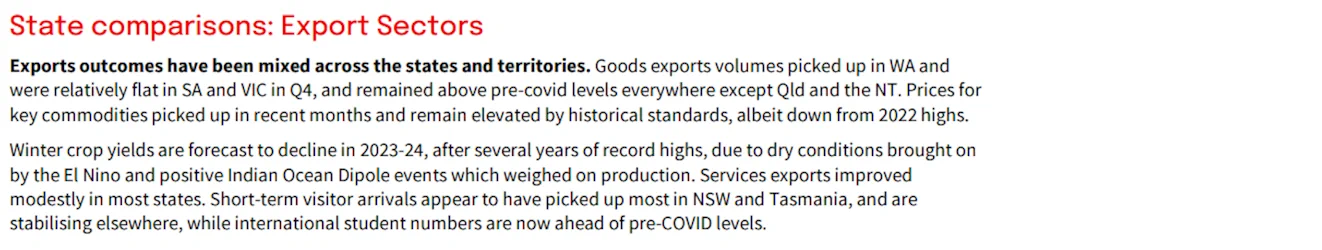

The recovery of education and tourism exports has been a key support to growth in the eastern states as well as the ACT. Elsewhere, resource exports have had a mixed impact with a strong recovery in coal export volumes in Queensland and LNG production coming back online for the NT, while the outlook for iron ore in WA has become more challenging give the slowing in the Chinese property sector.

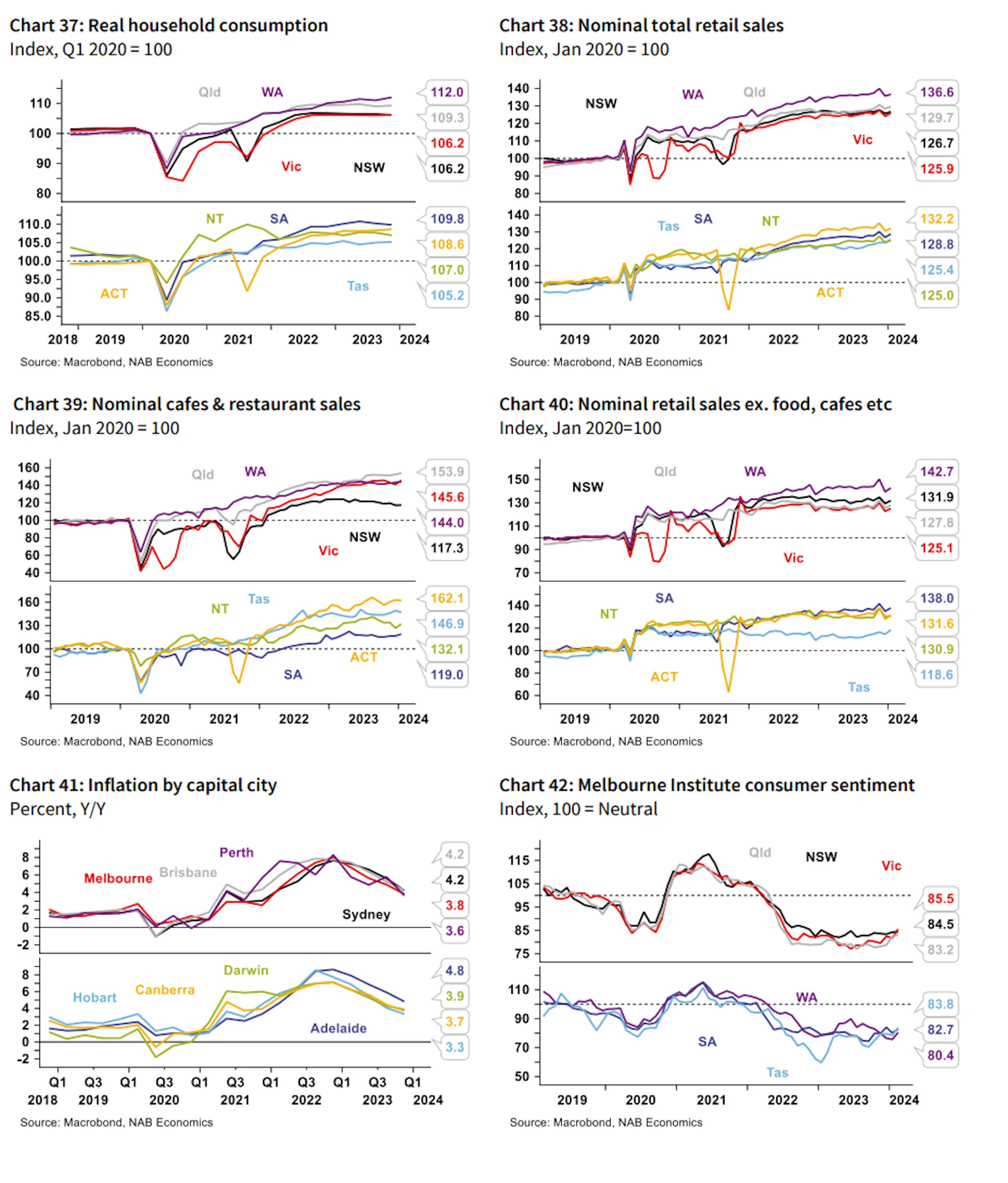

The ongoing combination of strong population growth and constrained supply remains a key dynamic in housing markets. Consequently, rental vacancy rates remain very low across the capitals – and are around just 0.5% in Adelaide and Perth – and rents growth generally remains strong. House prices growth has become more varied across the states, but generally remains solid despite the rapid increase in interest rates.

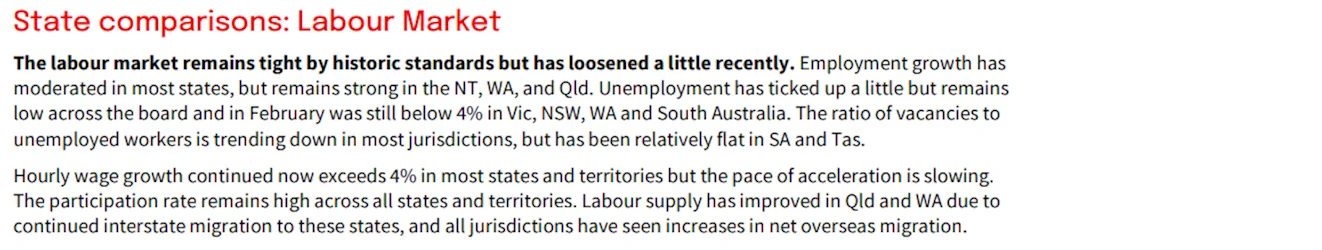

There are also signs of easing across labour markets as slowing economic activity has seen employment growth running below the pace of population. Nonetheless, the unemployment rate remains low across the board – below 4% in trend terms in NSW, Victoria, WA and the ACT – and wage growth is now running above 4% y/y in every jurisdiction.

Importantly, we expect inflation to moderate gradually with the RBA to keep the cash rate on hold through most of 2024 before beginning to cut from November. This will likely see household demand remaining subdued until real income growth begins to recover later in the year, supporting demand growth into 2025.

Offsetting this, we expect some normalisation in the rate of population growth over time, while the tailwind from recovering services exports will also fade. Agricultural production is also expected to decline amidst drier weather.

On balance, for most states and territories we see only incremental improvement in GSP growth into 2024-25 before growth returns closer to trend further out.

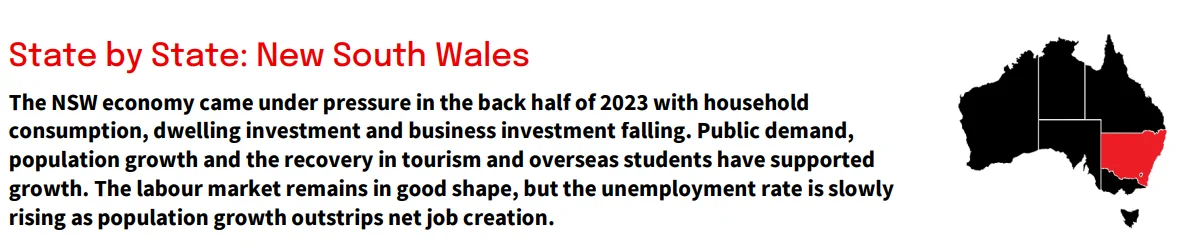

State Final Demand (SFD) declined 0.4% q/q in 2023 Q4, following a weak outcome in Q3 (0.2% q/q) and as a result annual growth was only modest at 1.4% y/y. Household consumption again fell (it has fallen in each of the last four quarters), while there were also falls in dwelling, business and public investment, partly offset by continuing strength in public consumption.

Net trade has also provided support to the economy. In particular, services exports rose 28% over the year to Q4, assisted by the recovery in tourism and overseas students.

With tourist arrivals now close to pre-COVID peaks, and student numbers fully recovered, the impetus from these sources is waning – service export quarterly growth in Q4 was the weakest in two years.

The NAB Business Survey indicates business conditions remain above average but have been trending down, consistent with soft forward-looking indicators. Capacity utilisation remains above average but is now well off its peak, which may help explain the pull back in business investment in recent quarters.

That said, business investment remains well above its preCOVID-19 level. Similarly, while public investment also fell in Q4, this followed strong growth in previous quarters.

Around 70% of public investment is state & local, and state government projections suggest its infrastructure investment will remain elevated at least to 2024-25.

The labour market remains healthy although job gains have not been sufficient to fully absorb population growth which strengthened again in Q3, to 2.3% y/y. The trend unemployment rate has risen from its low of 3.2% to a stilllow 3.6% in February but job vacancies remain high, so labour availability is still a challenge.

While population growth adds to housing demand, the sector is interest rate sensitive and has also faced supply constraints and large increases in costs. The result has been a large fall in dwelling approvals, although the decline in residential investment has been more gradual as there is still a large pipeline of work. House prices rose by more than 10% over the year to February (CoreLogic measure) although the monthly pace has slowed notably since mid2023. The rental market remains tight and rents growth

elevated.

In terms of the outlook, subdued household consumption and dwelling investment are expected to remain a key feature in the near term, with overall GSP growth expected to remain below trend this year and next.

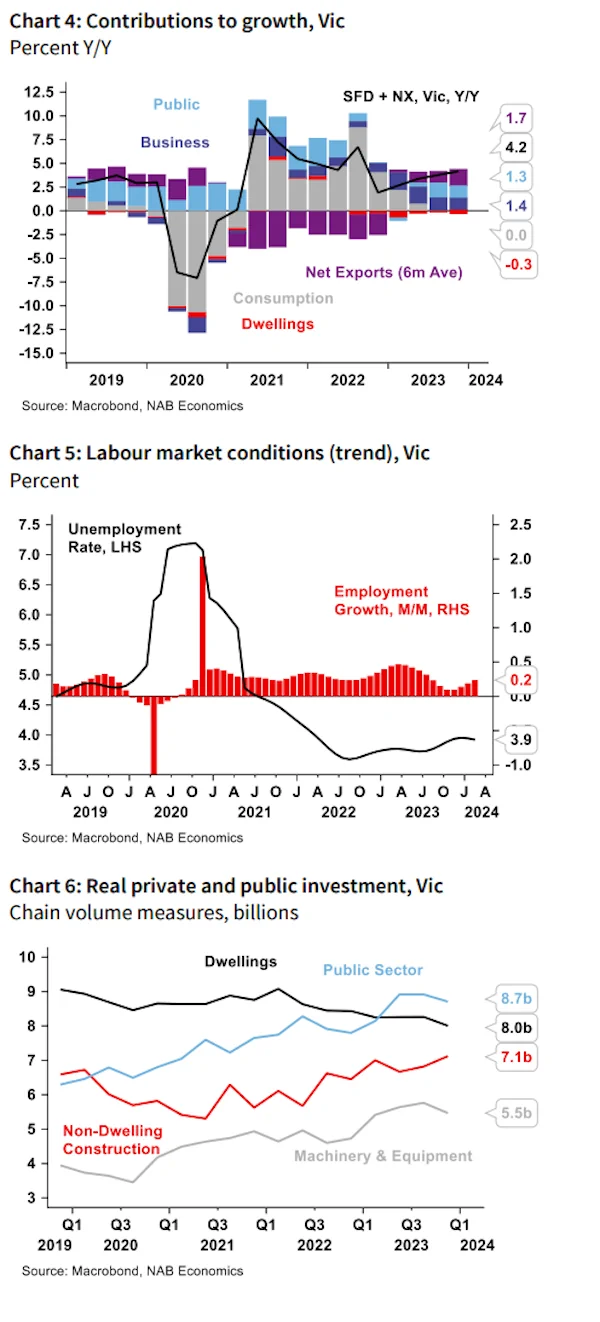

Victoria’s SFD growth remained modest but positive through the second half of 2023, rising 0.2% q/q in Q4 to be up 2.1%y/y. As has been the case nationally, household consumption growth was particularly subdued, rising 0.2% q/q and effectively flat over the year, as inflation and rates weighed on households.

In addition, dwelling investment continued to be impacted by supply challenges and rates, falling 3.1% q/q in Q4 to be down 5.1% for the year as a whole. Dwelling approvals declined later in the year and into early 2024, signalling housing activity is likely to remain subdued.

Business investment and public demand have been key sources of support. Despite low levels of business confidence, investment in non-dwelling construction and machinery & equipment both rose over the year. Public sector investment was also elevated for most of the 2023, up 11.7% y/y to Q4 – although this may turn out to be a highwater mark given the pressures on the state budget.

Importantly, net exports also contributed significantly to growth across 2023, driven by the recovery in international student numbers (for whom spending on goods and services count as exports, as well as tuition fees).

International student enrolments in Victoria now exceed their pre-COVID levels, though the number of tourist arrivals is still yet to fully recover.

The return of students along with other migrants has continued to drive very rapid population growth. Net overseas migration was over 160k in the year to September, while interstate flows were broadly neutral, seeing the state’s overall population rise 2.9% y/y. This has seen some easing in the labour market with the ratio of job vacancies to unemployed down to around 0.6 (from over 1.0 in 2022).

However, employment has continued to rise and the unemployment rate is still below 4% in trend terms.

With population growing and dwelling completions weakening, the housing market has remained very tight.

The rental vacancy rate remains around 1% and advertised rents were up around 11% over 2023.The recovery in dwelling prices was more muted in Melbourne than some other capitals, with prices rising 3.5% y/y in 2023 and down slightly to start 2024 – though we see prices rising over 2024.

Looking ahead, population growth will slow but easing inflation, robust wage growth and, eventually, some interest rate cuts should support a pickup in household demand. On balance, we see subdued growth in GSP in 2023-24 beforegrowth strengthens back to around trend into 2025.

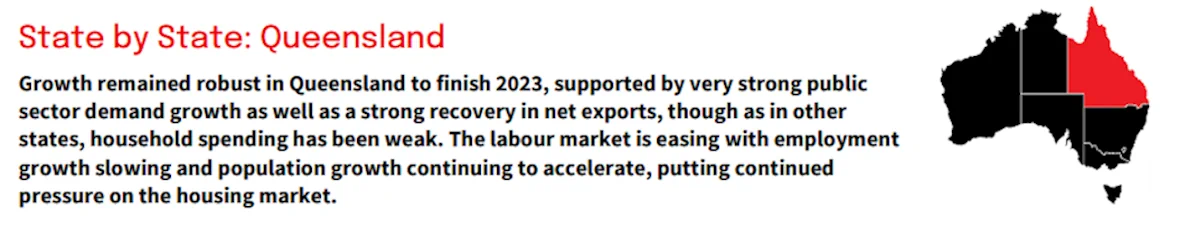

SFD growth edged up in Q4 after declining in Q3 – and is up 2.3% over the year. The rise in the quarter was driven by a solid increase in public sector consumption (health and transport), public sector investment (renewables and utilities) as well as private sector investment in machinery & equipment (mining and transport). Household consumption reversed its decline in Q3, recording a small rise, led by a rise in spending on food and utilities as well as household goods. Abstracting from quarterly volatility, while private sector growth slowed through 2023 public sector demand was a key support. Over the year net exports have also supported the economy.

Alongside the slowing in private sector growth, employment growth has slowed and the unemployment rate has drifted up albeit it remains well below its pre-pandemic level. Despite the slowing in growth, forward looking indicators remain positive. There are currently 38k outstanding vacancies, equivalent to one opening for every 1.6 unemployed – a vacancy rate of around 2.6%.

Population growth accelerated further in Q3, rising to 2.7% y/y. consistent with other states, the rebound in net migration – 88k – over the year has been the driver of the acceleration. Queensland also continues to benefit from a solid contribution from interstate migration. The civilian age population data from the labour force survey suggests that population growth has accelerated further, to over 3.0% in Q1 2024.

The housing market continues to be pressured by the strength in demand amid a sluggish supply response. The rental vacancy rate remains low at just 0.8% and rents continue to grow at a rapid rate at ~10% y/y. Dwelling prices also continue to rise at a solid pace and are up 16.5% over the year and around 60% since mid-2019. The pressure will likely persist in the near term with population growth remaining strong and the supply side still challenged. Rolling annual dwelling completions remain relatively low at around 33k despite an elevated pipeline (42k) of dwellings under construction.

With support from population growth, exports and public demand continuing, we see Queensland’s GSP growth remaining relatively resilient in 2024. As inflation eases further over the year, household consumption should also begin to pick up, though the outlook for commodities demand and prices remains a key risk.

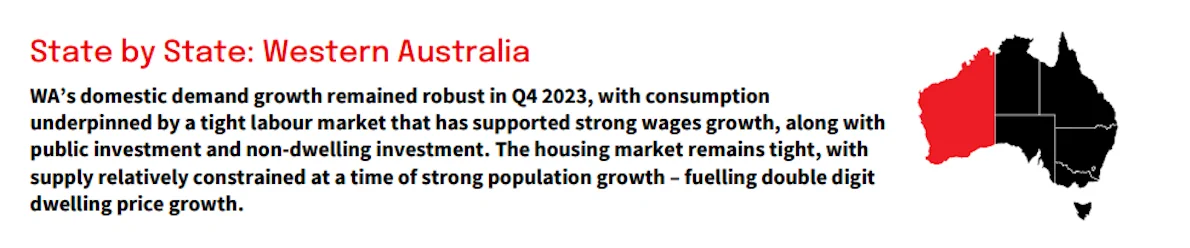

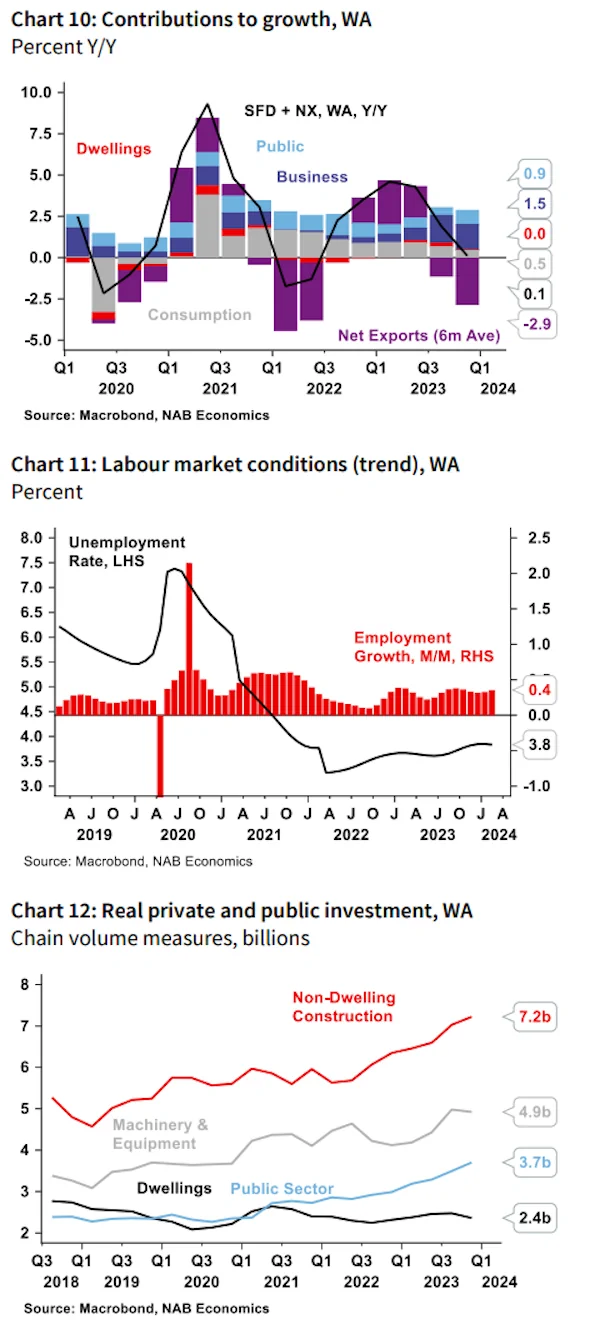

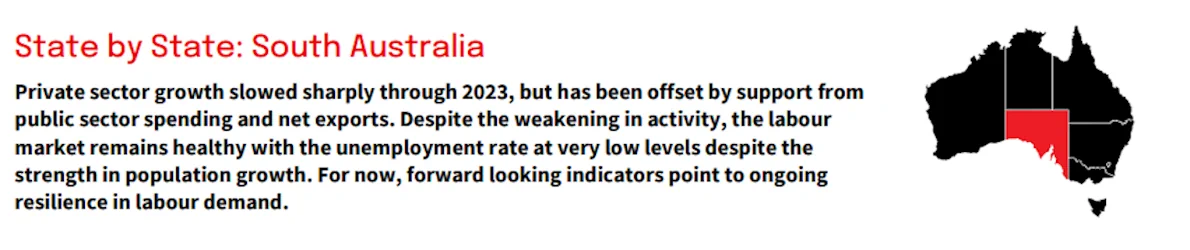

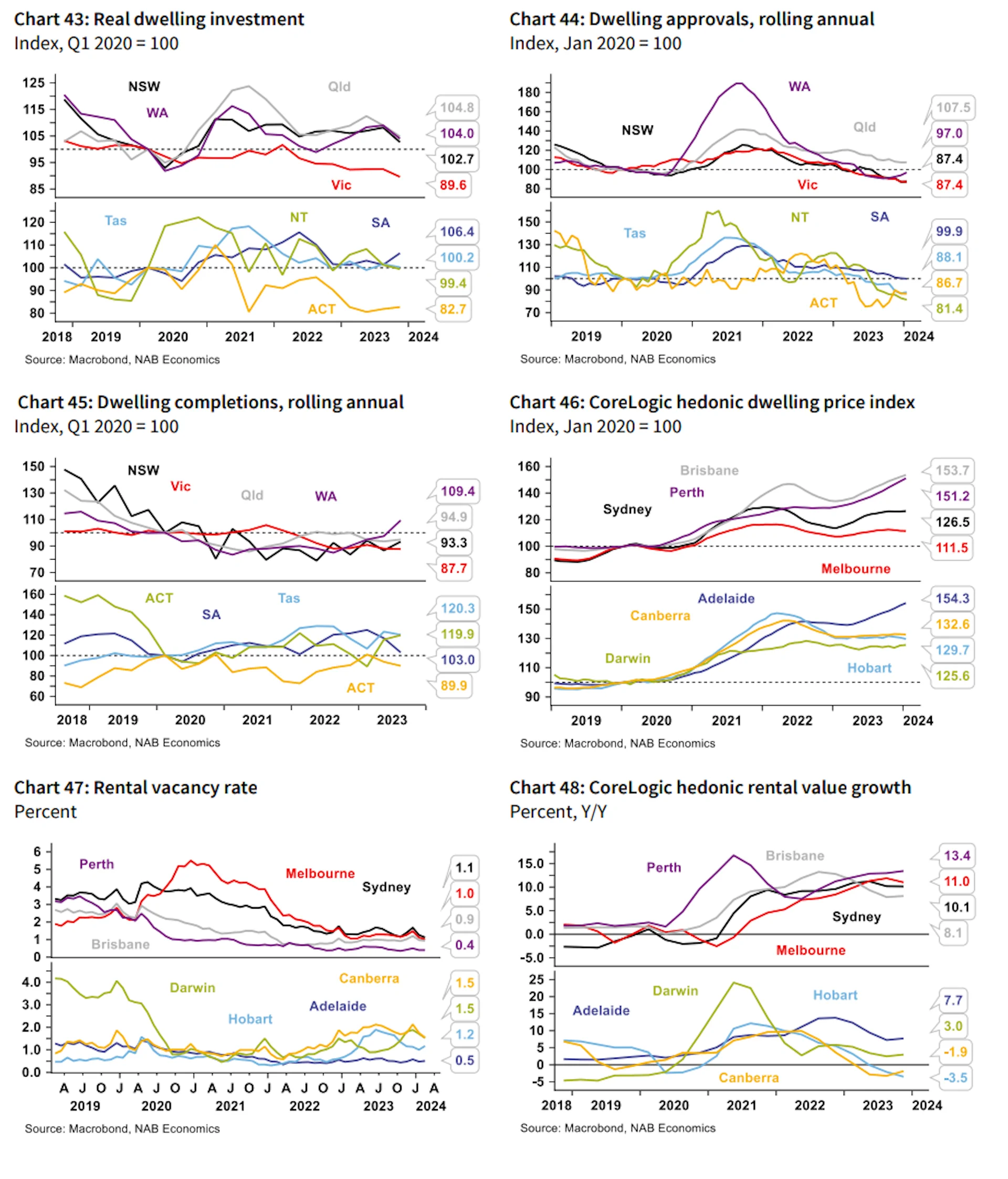

WA continued to outperform the other states in terms of SFD growth in Q4 2023 – a trend observed across the full year – increasing by 5.5% y/y (unchanged from Q3). That said, growth slowed in quarterly terms, increasing by 0.8% q/q (from a remarkably strong 2.5% q/q in Q3) – a rate only exceeded by the NT and ACT.

The increase in state final demand in Q4 was driven primarily by household consumption (which rose by 0.9% q/q), public investment (which surged by 6.0% q/q) and private non-dwelling construction (up 2.8% q/q). WA remains a strong performer in NAB’s Monthly Business Survey, overtaking QLD to record the highest reading for business conditions (on a three-month moving average basis) in February 2024. Offsetting this strength has been a steep decline in the state’s real net exports, driven by lower export volumes in Q3 and increased import volumes in Q4.

Employment growth remains robust in WA but has not kept pace with population growth, leading to a gradual easing in the trend unemployment rate to 3.8%. This was compared with a trend of around 3.6% across 2023, however by historical standards, labour market condtions remain tight. This has supported strong wages growth which rose by 4.7% y/y in Q4 2023 (the second strongest rate of increase in the country).

Perth’s residential property market remains extremely tight, with limited supply of rental properties – the vacancy rate was 0.4% in February 2024 and has been below 1% since mid-2021 – and for purchase by owner-occupiers, at the same time that the population has rapidly increased. WA has accounted for a sizeable share of interstate migration since late 2020. Corelogic data showed dwelling prices rose by 16.7% y/y in January.

Dwelling investment rose substantially between Q3 2022 and Q3 2023, but declined signifciantly quarter-on-quarter in Q4, in line with most other states – with the impact of higher interest rates and building material costs a factor. WA’s residential pipeline remains elevated when compared with other states, but has been trending lower since its peak in Q3 2022.

Looking ahead, pospects for trade support are constrained going forward by the prolonged downturn in China’s property sector, which could negatively impact demand for iron ore (the state’s largest export) in coming years, with prices retreating at the time of writing. On balance, we see subdued GSP growth through the near term despite the strength in domestic demand components.

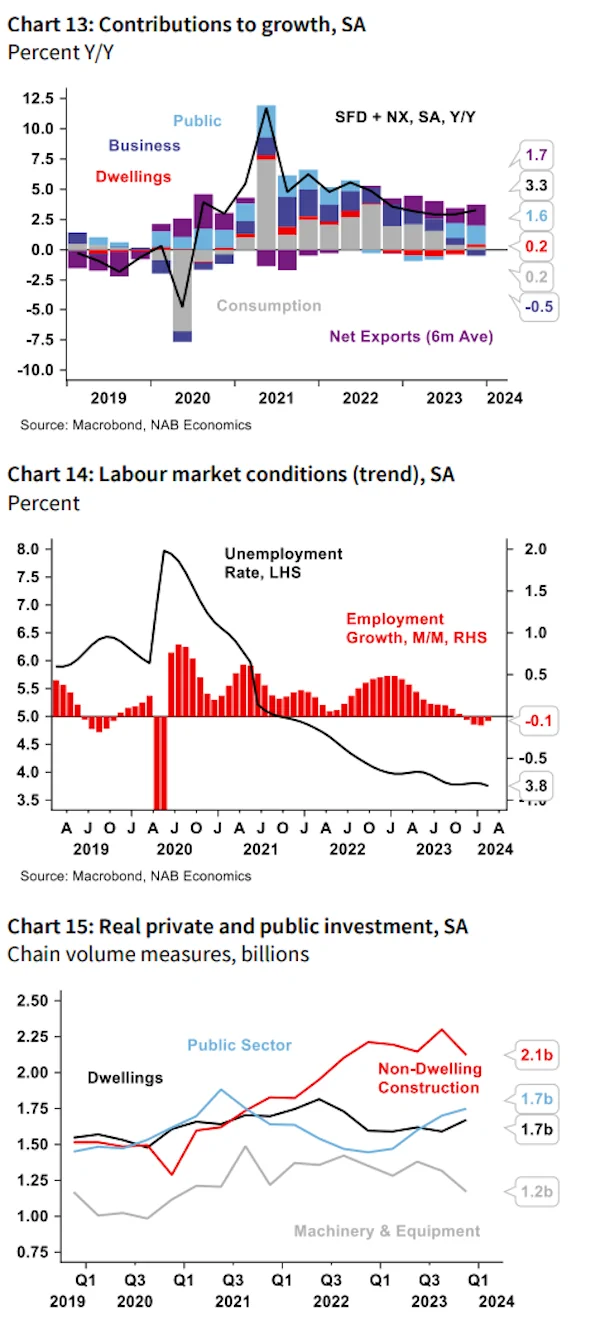

SFD grew by 1.6% y/y in in Q4 2023, and has broadly tracked sideways since early 2023. However, private sector activity fell over the past three quarters reflecting weakness across consumption, business investment as well as dwelling investment.

Public sector spending has been an important offset to the weakness in the private sector. Public sector investment rose 21% over 2023, supported by spending on road infrastructure, health and education buildings as well as utilities and public housing.

The NAB business survey points to some ongoing resilience in activity in early 2024 with business conditions rising in February and tracking well into positive territory in trend terms, despite ongoing weakness in business confidence.

Employment growth also slowed in H2 2023 and declined in both December and January. However, the trend unemployment rate remains very low at 3.8% in February. Still, forward indicators of labour demand remain healthy with job vacancies in the state around double the pre pandemic level at 24k openings.

Population growth appears to have levelled off at a relatively high 1.7%. Over the year, population growth has been supported by the rebound in net migration as well as a lower-than-normal drag from outflows to other states.

Like the other mainland states, the housing market remains tight, the rental vacancy rate in February just 0.5%. Rents growth has eased from the very high rates seen in early 2023 of well over 10% y/y but remain strong at around 8% y/y. House price growth remains very strong with prices up around 12% over the past year and around 50% since February 2020.

The pressure in the housing market will likely persist for some time, with completions weakening through 2023 amid very strong demand from the rebound in population growth. Over the year to Q3 2023, 10k new dwellings were completed broadly in line with rate of completions over past decade. The pipeline of work remains elevated at around 19k dwellings either underway or about to be commenced in Q3.

As in other states, the recovery in international students has been an additional source of support – in fact enrolments are now well ahead of their pre-pandemic level – but this should ease over time while household consumption is expected to pick up only gradually. On balance we see GSP growth remaining subdued through 2024.

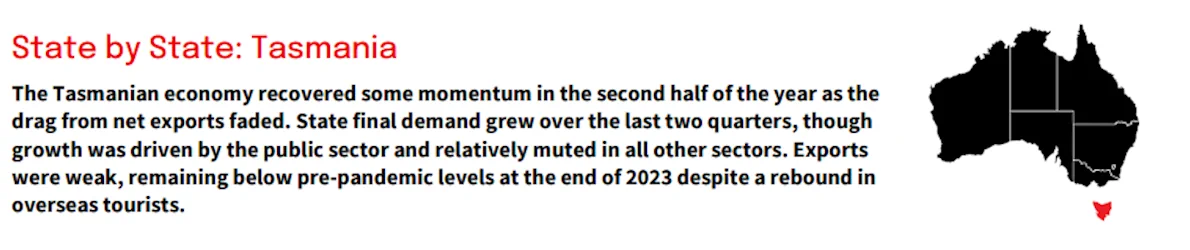

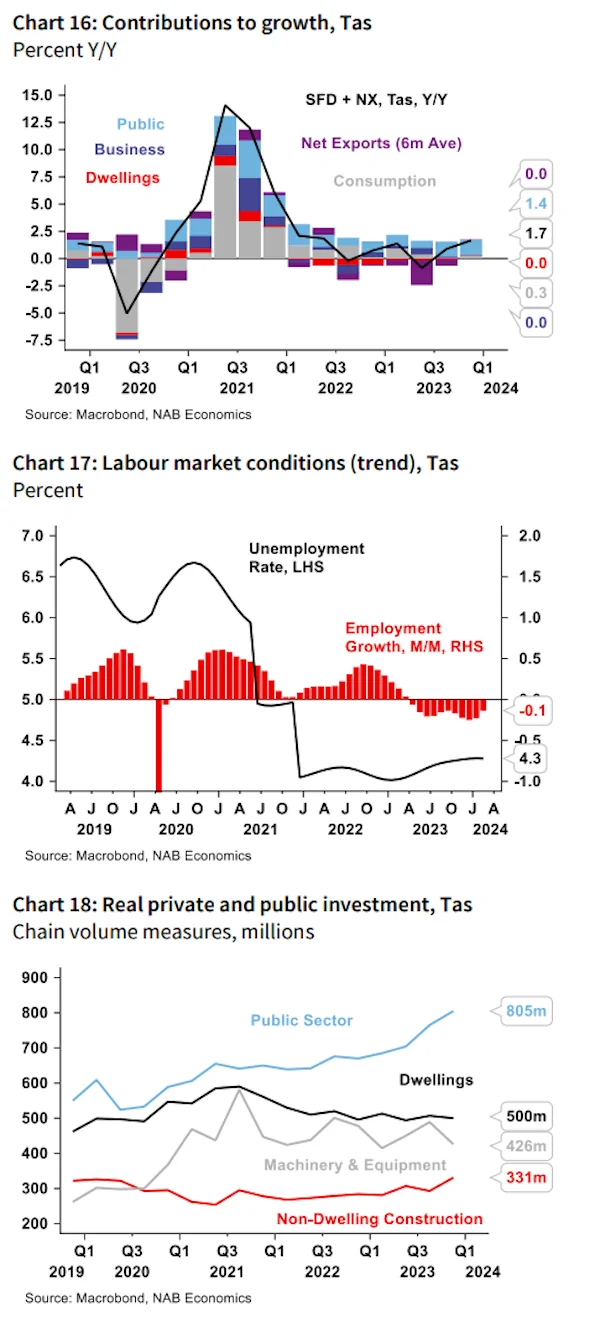

SFD in Tasmania grew 1.8% over the year to Q4 2023. In the second half of 2023 government spending, and to a smaller extent household consumption, drove growth while contributions from other sectors were largely flat.

The household sector continued to struggle: household consumption was little-changed over the year, and made only a small positive contribution to SFD in the second half of 2023. High inflation and interest payments have weighed on household spending power. Relative to other states, consumption in Tasmania has not grown as much since the pandemic.

Dwelling investment was little changed over the second half of 2023, though the level is still strong by historical standards and is slightly above the ten-year average. The pipeline of work is elevated but will likely ease in the future due to the continued decline in building approvals. The secondary market is weak: dwelling prices in Hobart have been relatively steady since the start of 2023.

Business investment was relatively unchanged over 2023. NAB’s monthly Business Survey report shows that business conditions have deteriorated in Tasmania since October, and the forward-looking confidence indicator has also declined further into negative territory and is at the lowest level of all the states.

Government consumption and investment has increased in recent quarters, in line with the Tasmanian 2023-24 Budget, and have been the primary driver of the economy over the past year.

Overseas exports improved a little over the second half of 2023. Goods exports remain above pre-pandemic levels, while services exports continue to improve with the ongoing recovery in overseas tourist arrivals. Short-term arrivals to Tasmania increased over the latter half of 2023, while overseas student enrolments continued to drift down.

Labour market pressures have eased in Tasmania: employment has fallen and vacancies per head have drifted down since the start of 2023. As a result, the trend unemployment rate has drifted higher, to 4.3% in February. Our forecasts imply growth will remain subdued in Tasmania over 2024 and into 2025. Much will depend on the extent to which tourism exports can recover further, as well as the outlook for the public sector and the extent to which household consumption improves as inflation eases.

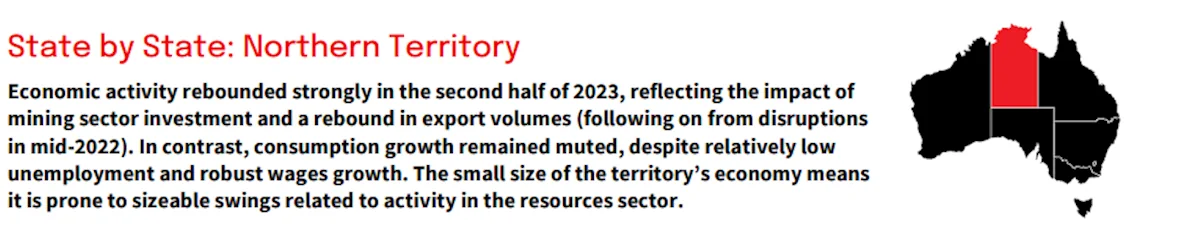

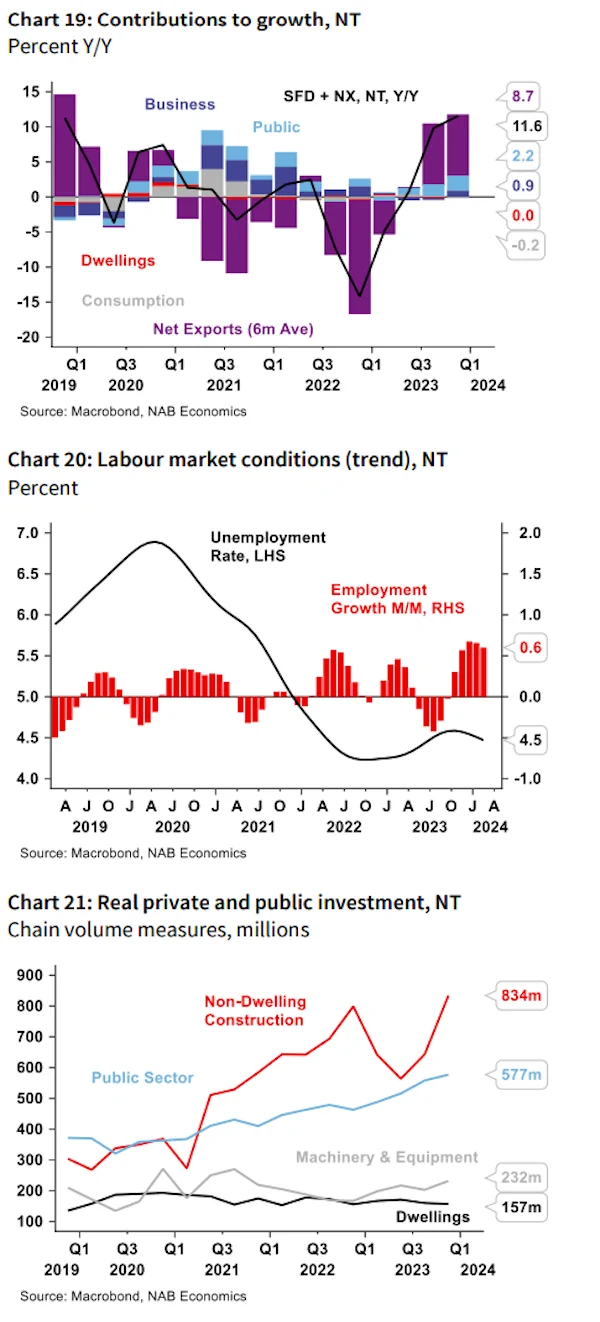

After quarterly growth contracted in the first half of 2023, SFD for the NT expanded rapidly across the second half, increasing by 3.0% q/q in Q4 – by far the largest rate of growth across the country in the quarter.

This increase was almost entirely driven by private investment, which increased by 15.0% q/q, reflecting engineering construction activity associated with mining sector projects. Machinery and equipment investment also grew strongly, albeit its contribution was relatively modest.

Given the small size of the territory’s economy, large scale resources projects can have an outsized influence on economic activity – with a high likelihood of further volatility in coming years as projects are started or completed.

In contrast, household consumption was marginally weaker in Q4 2023, following on from an essentially unchanged level in Q3. This was despite relatively modest rates of unemployment (below its average so far this century) and strong wages growth (up by 4.3% y/y in Q4).

In fact, the NT labour market has tightened slightly in recent months after easing through the second half of 2023, reflecting a rapid increase in employment between December 2023 and February 2024. Trend unemployment drifted slightly lower to 4.5% in February, compared with a recent peak of 4.6% in late 2023. Darwin’s residential property market is something of an outlier, when compared with other mainland capitals.

CoreLogic data shows that dwelling prices fell marginally in January 2024 – down 0.1% y/y – and declined for much of 2023 as well. Unsurprisingly, dwelling investment and the residential pipeline of work to be done is fairly modest. The vacancy rate is the equal highest in the country at present – at 1.5% (the same as the ACT), meaning that rental growth has been comparatively weaker than most major capitals – at 4.5% in Q4 2023 – albeit it was stronger than in Canberra and Hobart.

The NT economy has been substantially boosted by exports in recent quarters. NT’s export volumes rose by 17% in 2023, as LNG production ramped up after earlier disruptions, although the flow through from production to the local economy is likely somewhat limited.

The recovery in LNG volumes underpins an expected strong rate of GSP growth for 2023-24, before growth should stabilise somewhat into 2025. Another pickup is projected further out as additional projects come online.

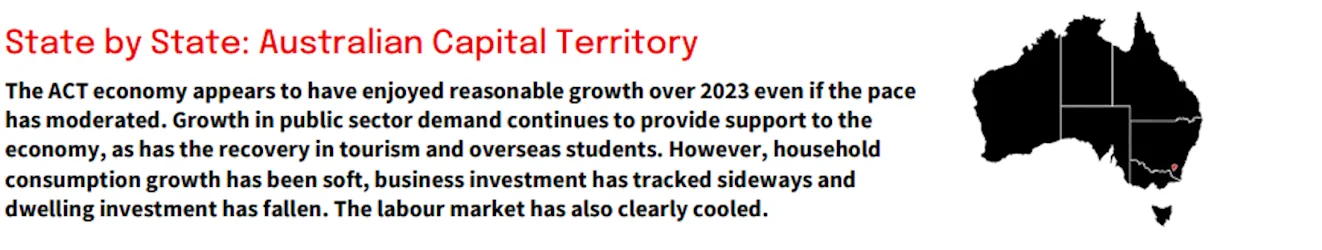

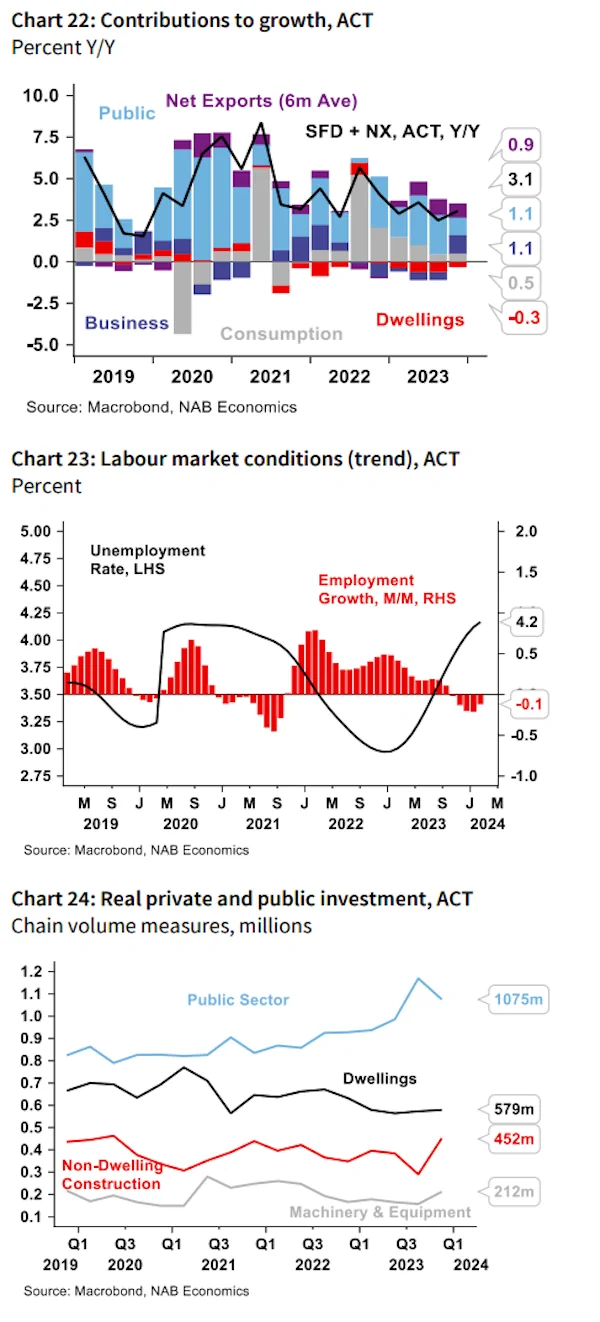

After a soft patch of growth in mid-2023, SFD in the ACT grew by 1.1% q/q in Q4 to be up a solid 2.2% over the year. Export growth was also very strong over 2023 (32% y/y) reflecting the rebound in tourism and overseas student numbers, although the quarterly growth rate is slowing as the recovery in these sectors is now well-advanced.

Over 2023, there was solid growth in private demand, up 2.5% y/y, albeit flattered by a spike in business investment in Q4. Public final demand also continued to make a substantial contribution, up 1.9% y/y.

Household consumption growth in recent quarters has been soft, although it strengthened a little in Q4 (to 0.3% q/q from 0.1% in Q3), likely reflecting the Australia-wide pressure on household budgets including from high inflation and mortgage servicing costs. There was a large increase in private business investment in Q4 (30% q/q) leaving it well up on its year ago level.

However, the average level of business investment in 2023 was slightly below that of 2022. Given the quarter-to-quarter volatility, this suggests that the underlying trend is flat. In contrast, dwelling investment has declined by 14% since mid-2022. It has shown signs of stabilising in the last two quarters and, with a large pipeline of work remaining and a recent lift in dwelling approvals, the near-term outlook looks reasonable.

Population growth is robust but appears to have stopped accelerating, rising 2.1% y/y in Q3 of 2023 with net migration to other states dampening the impact of overseas arrivals. Notably, this is flowing through to the housing market.

Unlike the other states, the rental vacancy rate is not historically low (at 1.5% on the SQM measure, it is the equal highest), and house prices have seen only small gains since April 2023 (and remain 6% below their 2022 peak).

Employment growth has weakened appreciably in recent months and the trend unemployment rate has been rising from 3% in early 2023 to 4.2% in February. While still a reasonably low level by past standards, traditionally the ACT has enjoyed a lower unemployment rate than other states, but it is now a little above the national average. Highlighting the extent to which the ACT labour market has cooled, the job vacancy to unemployment ratio is now back around its pre-COVID level.

Still, we see growth holding up in the ACT through the forecast period with easing inflation supporting a recovery in household consumption later in 2024 and into 2025.

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice

contained in this document has been prepared without taking into account your objectives, financial situation or needs.

Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for

your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document,

before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.