Overview

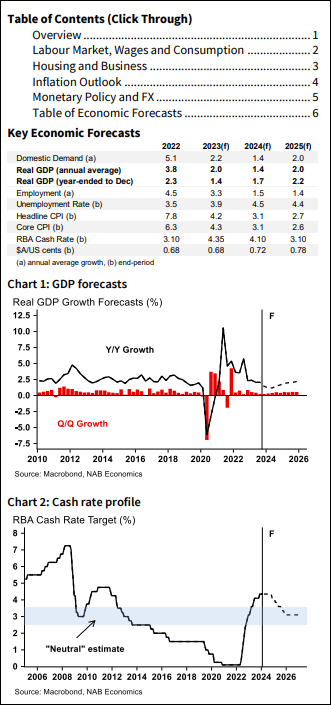

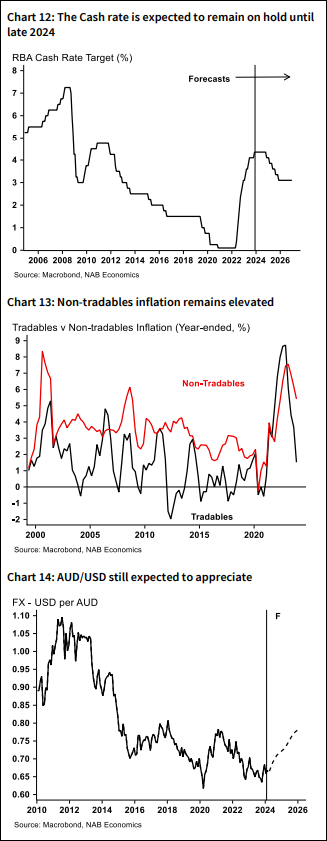

- We continue to see an environment of subdued activity in the near term with the RBA set to keep the cash rate on hold at 4.35% until November 2024.

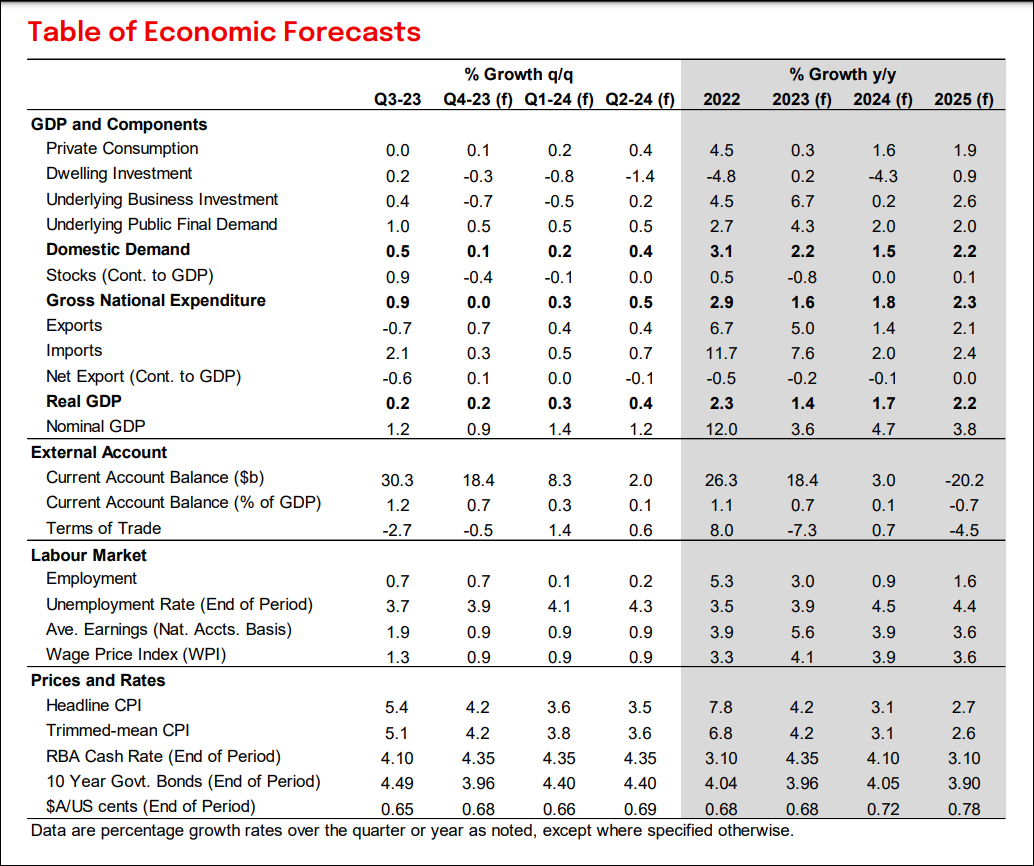

- We expect the upcoming National Accounts release to show GDP growth of 1.4% y/y for 2023 – materially below trend but avoiding the worst-case outcomes that might have been expected to accompany a rapid tightening of monetary policy. Strong population growth has been a key support, with per capita GDP contracting materially over the year.

- Growth is expected to improve slightly in 2024 but remain below trend, before improving to over 2% in 2025. Household consumption will remain the key dynamic but housing and business investment are also likely to be subdued, weighing on growth.

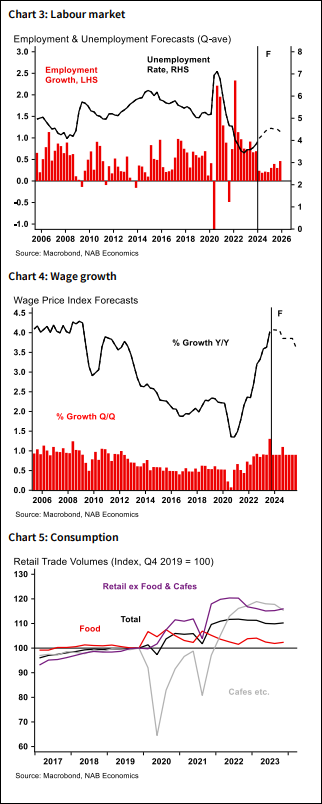

- The unemployment rate rose to 4.1% in January, though shifting seasonality may have overstated the rise. Nonetheless, the labour market has softened since mid2023 reflecting a mix of population recovery and slowing labour demand. We expect a further gradual easing, taking the unemployment rate to 4.5% by end 2024 – notably, still below the pre-pandemic rate.

- Inflation moderated to 4.2% y/y for 2023 (trimmed mean), marking a very significant improvement from the prior year as global supply improvements have seen goods price pressures rapidly abating. The extent to which this continues remains a key uncertainty but our central case sees inflation returning to just over 3% by end-2024 and near the middle of the RBA’s target band by end-2025.

- This trajectory for inflation and the wider signs that tighter monetary policy is working to dampen economic activity are likely to be enough to prevent the RBA pursuing further rate rises, but we expect the Board to take a cautious approach to easing policy settings. By November, the combination of higher unemployment and inflation nearing the target range should be enough for the RBA to begin to move, with the cash rate gradually cut back to around 3% by end-2025.

Labour Market, Wages and Consumption

The unemployment rate rose to 4.1% in January, thoughshifting seasonality may have overstated the rise. Nonetheless, the labour market has softened.

The January data showed a soft 0.5k rise in employment and a sharp 2.5% fall in hours worked. However, the ABS stated that a larger-than-usual number of workers reported they were not employed but starting or returning to work in the future, likely reflecting an emerging trend of workers delaying starting new roles until after the summer holidays.

An extra 23.4k workers were ‘attached but unemployed’ in the month than the pre-COVID average, enough to have kept the unemployment rate at 3.9% had they been counted as employed. A further 86.8k extra were attached but not in the labour force. We will need to wait for the February data for a clearer picture.

Nonetheless, the labour market has clearly softened since mid-2023 when the unemployment rate was anchored around 3.5%. With population growth still strong and labour demand easing, we expect further softening throughout 2024, taking the unemployment rate to 4.5% – notably, still below the pre-pandemic rate.

On wages, we see a 0.9% q/q (4.1% y/y) print for the Q4 WPI, marking a step down in the quarterly run rate after the minimum and award wage affected Q3 result. With the most acute labour market pressures easing and progress being made on inflation, we see wage growth stabilising rather than accelerating further from here, likely running around 3.7% by end-2024.

There were mixed signals from retail trade volumes in Q4 but consumption growth is likely to remain subdued until later in the year.

Overall retail trade volumes rose 0.3% q/q in Q4, ending a run of four consecutive quarters of decline. In the detail, the pickup was driven by non-food goods categories, which rose 0.7% q/q, alongside food (up 0.5%). Outright falls in some goods prices were evident in the Q4 CPI, likely helping to bolster activity.

Offsetting the rise in goods was a sharp decline in cafes & restaurants, where volumes fell 2.1% q/q. In level terms, hospitality consumption is still elevated but the downturn suggests some normalisation may be underway.

On net, we expect the broader National Accounts data to show consumption remained subdued in Q4 and for this to continue in the near term with households still managing the tail end of the pass through of higher rates.

However, the progress on inflation and still-tight labour market should see real wages begin to stabilise over the year. Additional support for household incomes will also come as tax cuts take effect mid-year (equivalent to around 1% of gross household incomes), before monetary policy begins to ease at the end of the year. This should see consumption growth begin to pick back up in H2 2024.

Housing and Business

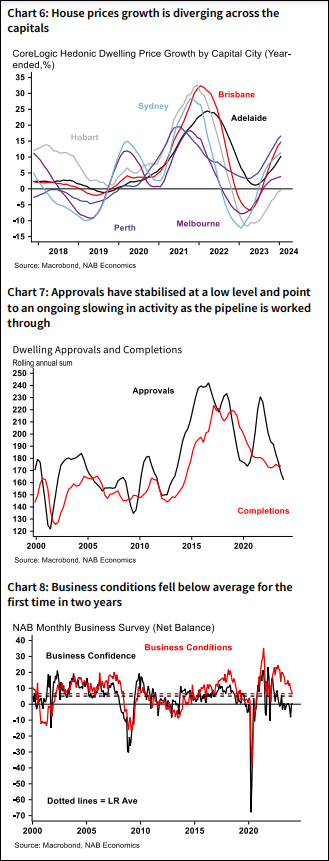

Recent housing data show a continuation of the key trends seen through late last year – with rental markets still tight and rents still growing strongly while prices also continue to rise.

The CoreLogic 8-capital city dwelling price index rose by 0.4% in January to be 10% up over the year. Price growth in Sydney continued to edge lower in the month, printing at 0.2% while Melbourne prices declined by 0.1%. Growth also slowed across the other mainland capitals but remains much stronger with Perth up 1.6% m/m, Adelaide up 1.1% and Brisbane up 1%. Weekly data suggest these trends have broadly continued through February. Dwelling prices are now 28% above their Feb-20 levels and around 10% above their recent trough in January 2023. Our forecast for house prices is unchanged, expecting a 5% rise over both 2023 and 2024.

The rental market remains exceptionally tight, with the capital city vacancy rate falling back to around 1% in January. Perth remains tightest at just 0.4%, followed closely by Adelaide at 0.5%. The other mainland capitals are clustered around 1% or just above. New rents growth remains strong at 0.8% m/m (8.3% y/y).

With housing demand growth still strong, and underlying shortage and challenges on the supply side, we expect rents growth to remain high (consistent with our forecast for house prices).

On the supply side, dwelling approvals have stabilised at a low level and are consistent with an ongoing fall in the annual completion rate. That said, the pipeline of work remains elevated at over 260k dwellings.

Both PPI and CPI data, as well as our business survey, point to ongoing cost pressures in the construction sector from both input materials and labour costs. While there are some encouraging signs of an easing in materials inflation, costs remain around 30% higher than pre-pandemic.

For dwelling investment in the national accounts, we expect ongoing weakness in the near term, declining by around 3.5% over the next few quarters.

Business conditions eased further in January, falling below the long-run average for the first time in two years, while confidence and forward orders remained below long run averages.

Conditions in the NAB Monthly Business Survey fell to +6 index points (vs. a long-run average of +7) while confidence ticked up 1pt to +1 index points. Nonetheless, capacity utilisation remains elevated at 83.6% and there was a small pickup in cost and price growth measures. Underlying business investment likely fell in Q4 with the effects of vehicle imports in Q3 set to unwind, and investment is set to remain subdued in 2024 with the economy growing below trend.

Inflation Outlook

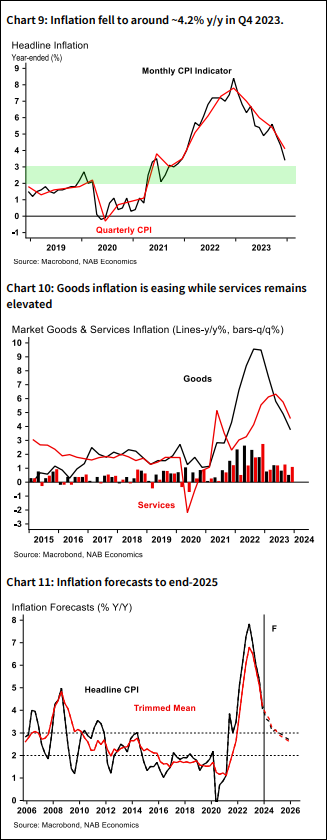

We see inflation continuing to moderate through 2024, falling to 3.1% y/y by Q4 and then easing to around 2.6% by end 2025. That said, we expect a small uptick in the q/q rate in Q1 as the impact of rental subsidies unwinds.

The Q4 2023 CPI data released in late January showed a further easing both the headline (0.6% q/q) and trimmed mean (0.8% q/q) measures following the spike in Q3. In annual terms, trimmed mean inflation eased to 4.2%.

Goods with a large import component continue to be key offset to still solid services inflation with household goods, furniture and garments continuing to show a significant easing in annual terms. However, new dwelling prices (5% weight) continue to rise strongly, offsetting some of the moderation in the goods category.

Many services categories continue to rise at a brisk pace – in particular rents, which rose 2.2% q/q ex-subsidies and insurance (1.7% q/q, 16.2% y/y). The partial monthly CPI indicator for November and December confirmed a rebound in rents growth (0.7% m/m) as the impact of the rental subsidy increase passed.

Going forward, a more significant easing in services prices inflation will be required to ensure that inflation settles within the RBA’s 2-3% target range. Goods prices will likely continue to aid the moderation in inflation in the near-term but this impact will eventually wane as prices level off.

For services inflation we do see labour costs as an important factor, and the current growth in labour costs (when adjusted for productivity) appear inconsistent with inflation returning to target, we expect these pressures to ease as the labour market cools.

Further, while wage costs are typically a sizeable component of input costs for services, other overhead costs including rents, utilities and insurance have also pressured margins. As these factors eventually normalise alongside the slowing in demand we expect services price inflation to also ease.

The housing component (both rents and new dwelling construction) will likely continue to put upward pressure in the CPI for an extended period. The rental vacancy rate remains very low, and advertised rents growth (and the current gap between new and existing rents) will drive ongoing rises in CPI rents. For new construction, price pressures will likely also persist, with strong demand for housing and ongoing labour cost pressures. The degree of any price level correction in other material inputs also remains highly uncertain.

Monetary Policy and FX

We continue to see the RBA on hold at 4.35% until November before easing rates towards 3% through 2025.

Taken together with our forecasts for growth and the labour market, that implies a relatively soft landing with inflation returning to target but GDP growth remaining positive and the labour market avoiding a major downturn. This implies that inflation is brought back under control by the easing in global pressures and growth in aggregate supply.

The latest set of RBA staff forecasts released in the February SoMP saw a small downward revision to the outlook for inflation as well as slightly slower GDP growth over 2024 and 2025, now 1.8% and 2.4% respectively. The unemployment rate is also now expected to peak at a slightly higher 4.5%.

The new set of forecasts are very similar to our own, though we see some upside risk to unemployment in the near-term and some downside risk to inflation and growth in 2025.

Indeed, the SoMP highlighted the risk that “demand is weaker than expected” with an ongoing weakness in consumer demand, or larger than expected slowing in global demand. Both scenarios would see a faster than expected easing in inflation.

On the other hand, with uncertainty elevated (and noise in the CPI data), a read of the true underlying inflation trend remains difficult. Therefore, the second key risk highlighted by the RBA is that inflation stays more persistent with a further risk that inflation expectations begin to drift higher.

Consequently, the Governor (via the post-meeting press conference and appearances before the parliament) noted that the risks remain “balanced”. Ultimately, the RBA remains data dependent while uncertainty remains elevated.

Importantly, the SoMP now contains a clearer assessment of capacity pressures in the economy. While growth has slowed sharply, the RBA continues to see the economy operating at above potential (and the level of the unemployment rate below its long-run sustainable level).

While this remains the case, monetary policy settings are likely to need to remain at least somewhat restrictive, underscoring that substantial cuts to the cash rate remain some time away.

We have pushed out our forecasts for AUD/USD by a quarter, now expecting the Aussie to end 2024 around US72c.

We continue to see a further appreciation through 2025 with the AUD/USD reaching US78c by Q4.

Group Economics

Alan Oster

Group Chief Economist

+(61 0) 414 444 652

Jacqui Brand

Executive Assistant

+(61 0) 477 716 540

Dean Pearson

Head of Behavioural &

Industry Economics

+(61 0) 457 517 342

Australian Economics

and Commodities

Gareth Spence

Head of Australian

Economics

+(61 0) 422 081 046

Brody Viney

Senior Economist

+(61 0) 452 673 400

Behavioural &

Industry Economics

Robert De Iure

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 477 723 769

Brien McDonald

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 455 052 520

International

Economics

Tony Kelly

Senior Economist

+(61 0) 477 746 237

Gerard Burg

Senior Economist –

International

+(61 0) 477 723 768

Global Markets

Research

Skye Masters

Head of Research

Corporate & Institutional

Banking

+(61 2) 9295 1196

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.