Key points

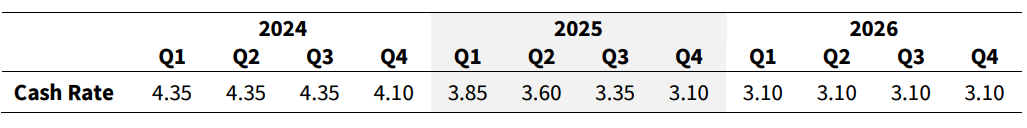

- We now expect the RBA to remain on hold at the February meeting, with the current cash rate of 4.35% now expected to be the peak.

- The RBA is then expected to remain on hold until November, before gradually cutting rates by 125bps bythe end of 2025 taking the cash rate to 3.1% by end 2025.

- We had previously expected the RBA to take rates to 4.6% to take some further insurance that inflation would reach the target band over the next two years. However, with the RBA having been reluctant to move higher and the Q4 CPI print providing some breathing room, the data will not push the Board in the same manner as November.

- It is possible underlying inflation will accelerate in Q1 2024 with the impact of rent subsidies dropping out, but there are increasing signs that goods disinflation may occur more rapidly than expected. In the near term this will be a key offset to still strong services inflation.

- Further out, our forecasts for growth and the labour market are consistent with inflation continuing to ease with growth remaining below trend in 2024 and the unemployment rate drifting higher. By late 2024 the RBA’s focus will shift more to the labour market.

Softer Q4 CPI to ease pressure on the RBA in the near term.

We had previously expected the RBA to take the cash rate to 4.6% in February, further squaring up the risks around the forecast profile for inflation. Over recent months we believe the risks around the inflation profile have become more balanced with inflation data coming in slightly below the November SMP forecasts and growth remaining below trend.

On inflation, the monthly prints in both the October and November CPI indicator point to a larger than expected easing in inflation than we (and the RBA) had expected. We now see a trimmed mean print of 0.8% q/q (4.2% y/y) and for headline inflation to come in at 0.7% q/q (4.2% y/y) (For more detail please see:Q4 CPI Preview)

While the Q1 2024 CPI release is likely to see a tick-up in underlying inflation on a quarterly basis with the impact of rent subsidies dropping out, the easing trend in inflation will remain clear. Encouragingly, goods inflation appears to be easing more quickly than expected with outright price falls in a number of categories. How long this can be sustained remains uncertain but provides an important offset to services prices which are currently tracking at a higher rate.

Services inflation appears to have peaked but remains high. A concern remains that services inflation could persist at a high level given labour costs typically reflect a larger share of input costs in these sectors and the current rate of wage growth as measured by the WPI is likely right at the cusp of comfort for the RBA. However, wage growth has been supported by large minimum wage decisions over recent years which will not continue in a lower inflation environment, and as pressure in the labour market eases, we expect wider wage growth to

slow. The recent strength in services inflation also reflects a confluence of factors that have driven cost pressures including overheads such as electricity prices and commercial rents (often linked to CPI). These factors will likely continue to pressure margins in the near term but will also ease.

Further, consumer demand which grew strongly through 2022 and early 2023 has now clearly slowed. Our read is that businesses were able to pass through significant cost pressures due to the sheer strength in consumer demand, supported by stronger nominal wage growth, aggregate population growth and accumulated savings buffers. The impact of each of these appears to now be fading. Therefore, it is reasonable to expect that demand-pull inflation for both services and goods will ease and while some cost-push inflation will persist in the near term, margins will likely come under more pressure.

Our outlook warrants a period of stability in rates.

The impact of higher rates is becoming clear in the data and even if they are kept on hold will continue to slow demand growth as the full impact of rates is still flowing through the economy. Eventually, the RBA will need to become more forward looking as it gains confidence inflation is moderating and many of the factors which have driven inflation over recent years are fading. With rates in restrictive territory they will need to be cut at some point. But despite the ongoing easing in inflation the task is not complete and we do not see the RBA easing rates in the first half of 2024.

Our forecasts continue to suggest that the RBA can sit back and watch given the significant uncertainty about the ongoing passthrough and risks to global demand growth. Domestically we continue to expect below trend growth in GDP of around 1.4% over 2024 and broadly at-trend growth of 2.25% in 2025.

The unemployment rate is expected to continue rising gradually, reaching 4.5% by the end of 2025. While the unemployment rate reached a very low trough in mid 2023, an increase of 1% would be a significant adjustment. Higher unemployment by later this year should see the RBA putting more focus on the economic outlook and the labour market.

Risks

We see the risks around the inflation profile as having become more balanced after remaining firmly to the high side over much of 2023.Cost pressures have eased significantly for goods distribution sectors and we will likely see a period of discounting. However, it remains uncertain how long this will persist and the ultimate degree to which price rises over recent years are unwound. The recent spike in global shipping freight rates could add some upwards pressure on prices if it persists. Further, services sector inflation remains high and while it should moderate as demand growth slows there is little evidence to date and some components of services inflation such as rents growth will likely remain strong for an extended period.

To the downside we may well see a larger than expected slowing, or even fall, in household consumption with cost of living pressures remaining high. To date a large degree of adjustment has come through a decline in the savings rate. However, as these pressures persist households may begin to pull back further, particularly as confidence in labour market conditions deteriorates.

Table 1: Updated cash rate profile

Authors

Alan Oster, Group Chief Economist

Gareth Spence, Head of Australian Economics

Brody Viney, Senior Economist

Tapas Strickland, Head of Markets Economics

Taylor Nugent, Senior Markets Economist