Key Points

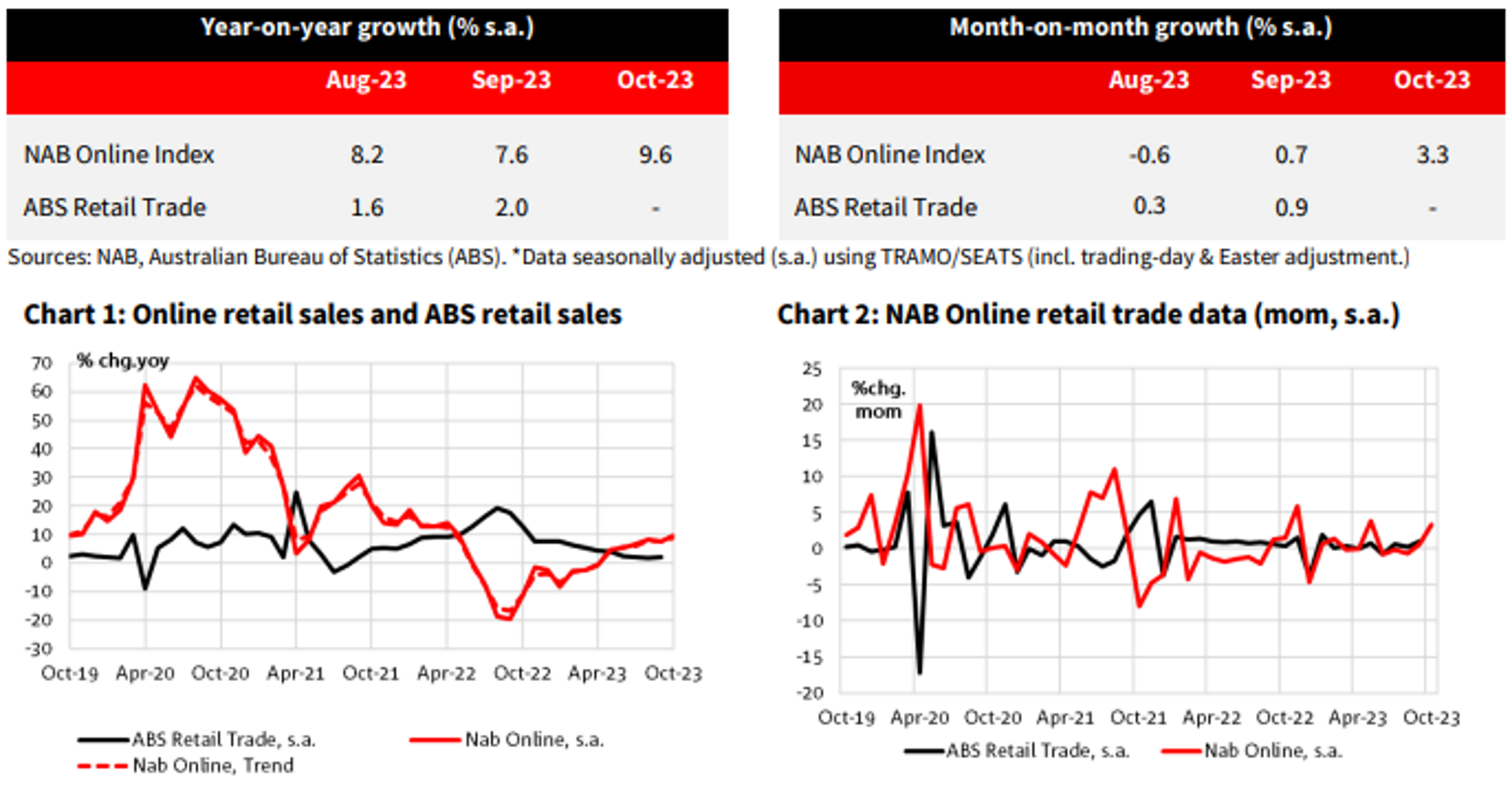

- On a month-on-month, seasonally adjusted basis, growth accelerated in October (3.3%), following on from a significantly revised September estimate (0.7%, was 2.9%).

- In year-on-year terms, growth accelerated again in October (9.6% y/y), albeit on a downward revision to the September estimate.

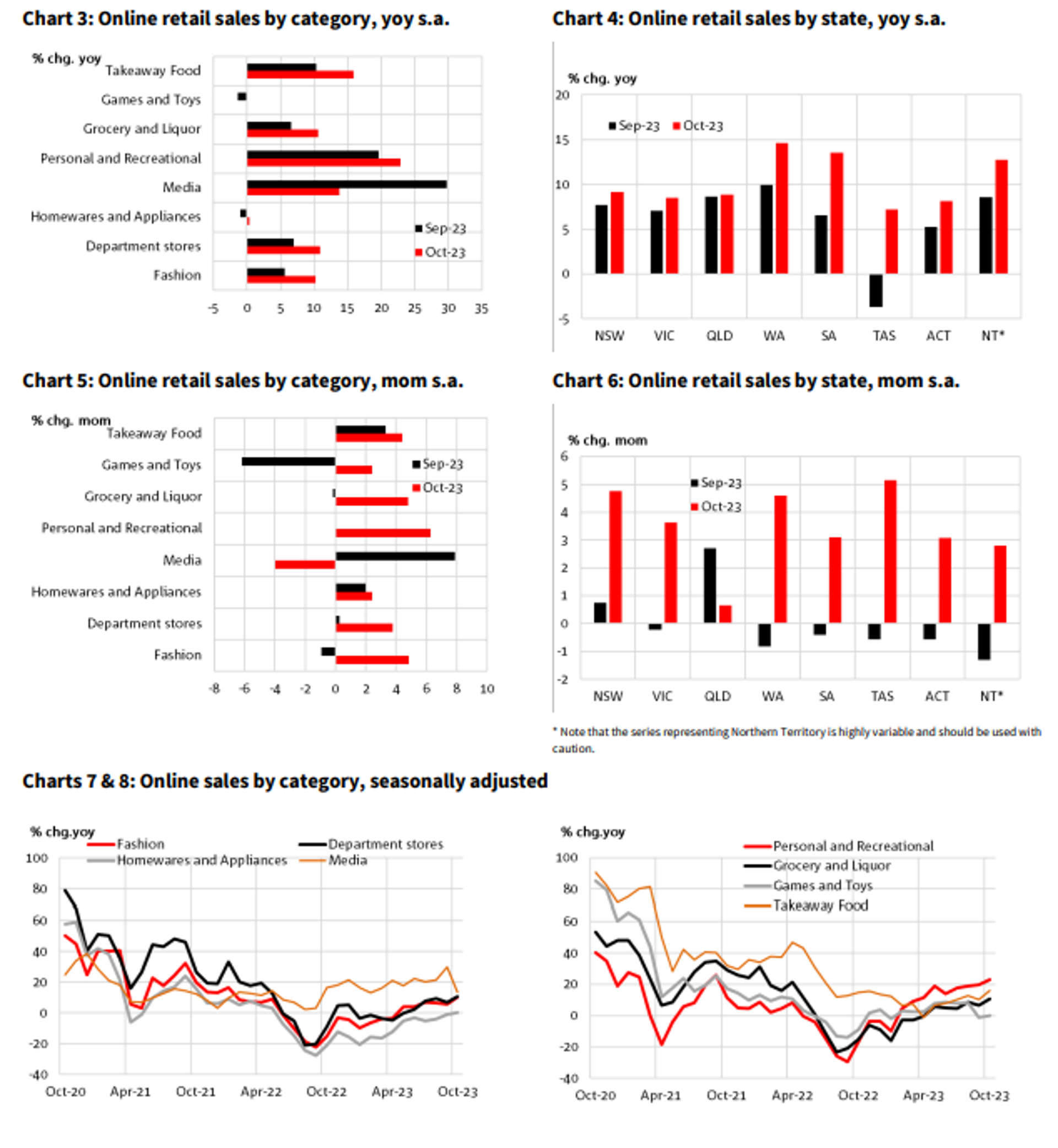

- Broad-based growth in October by category, with the exception of media, which contracted after rapid growth

a month prior. Growth was led by personal and recreational goods, along with a return to growth for fashion, and

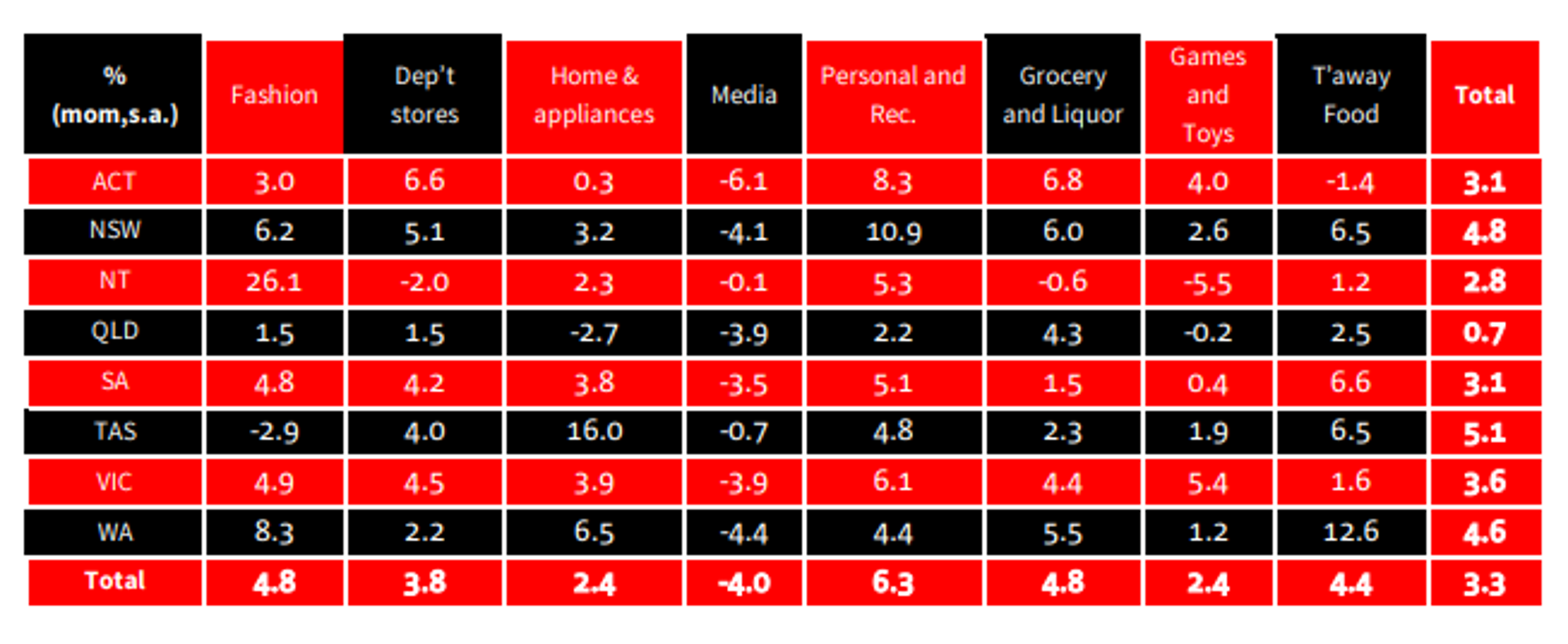

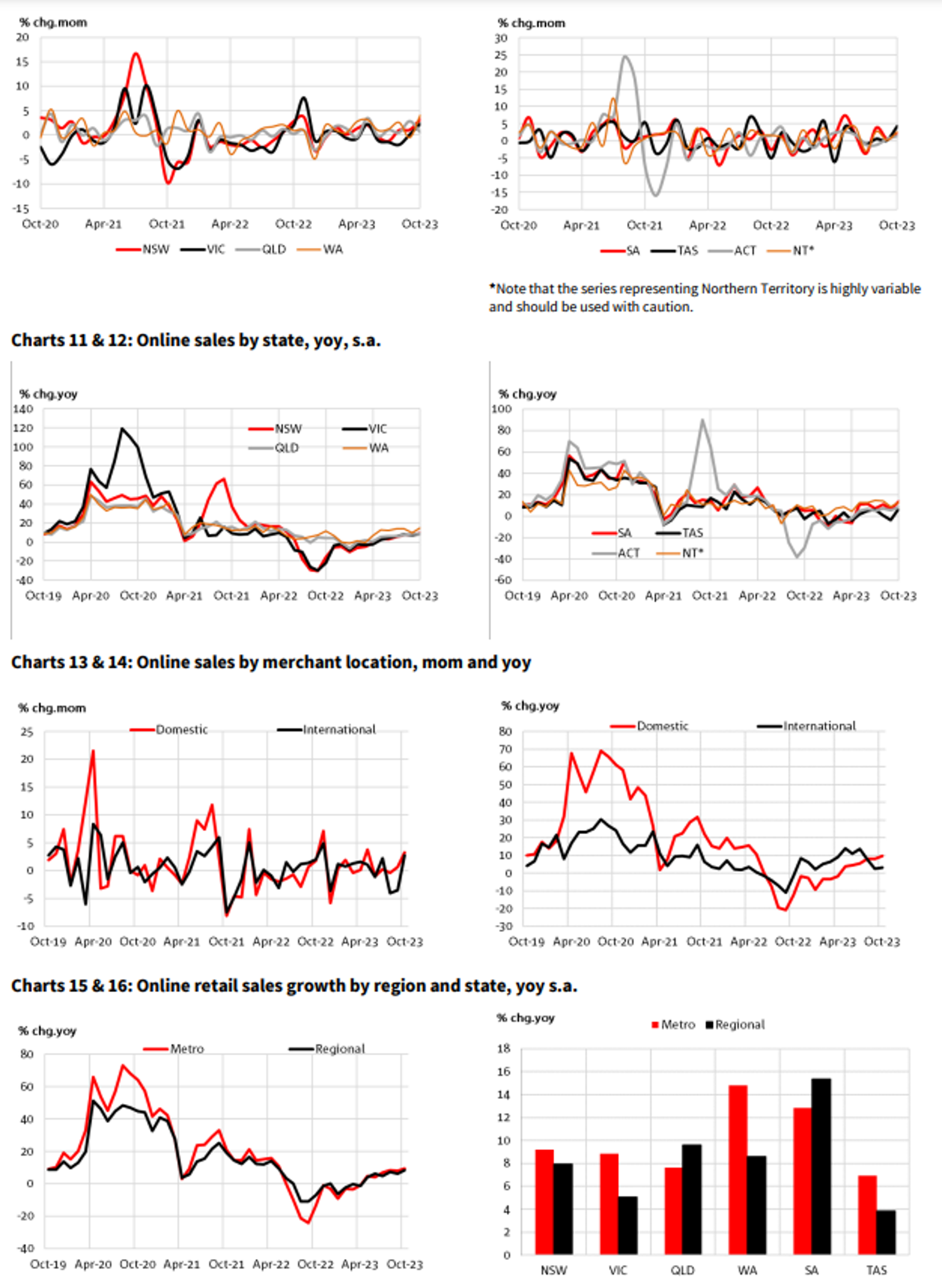

grocery and liquor. All other categories grew above the overall except for homewares and appliances, and games and toys. Personal and recreational goods also led in year-on-year terms. For more detail, see charts 3, 5, 7 & 8 and table 3 below. - Growth recorded for all states this month, with QLD slower after rapid growth the month prior. TAS recorded

rapid growth this month, after a contraction a month prior. This was the case for most categories, especially homewares and appliances, with fashion, and media the exceptions. In year-on-year terms, all states recorded growth, with WA and SA leading. See charts 4, 6, 9-14, and table 3 for more detail. - Metro areas outpaced regional areas this month. In year-on-year terms, while metro areas recorded stronger growth, the two have somewhat converged. A year prior, online sales for metro areas were experiencing a stronger post lockdown slump, relative to regional areas. So, with the two converging more recently indicates stronger

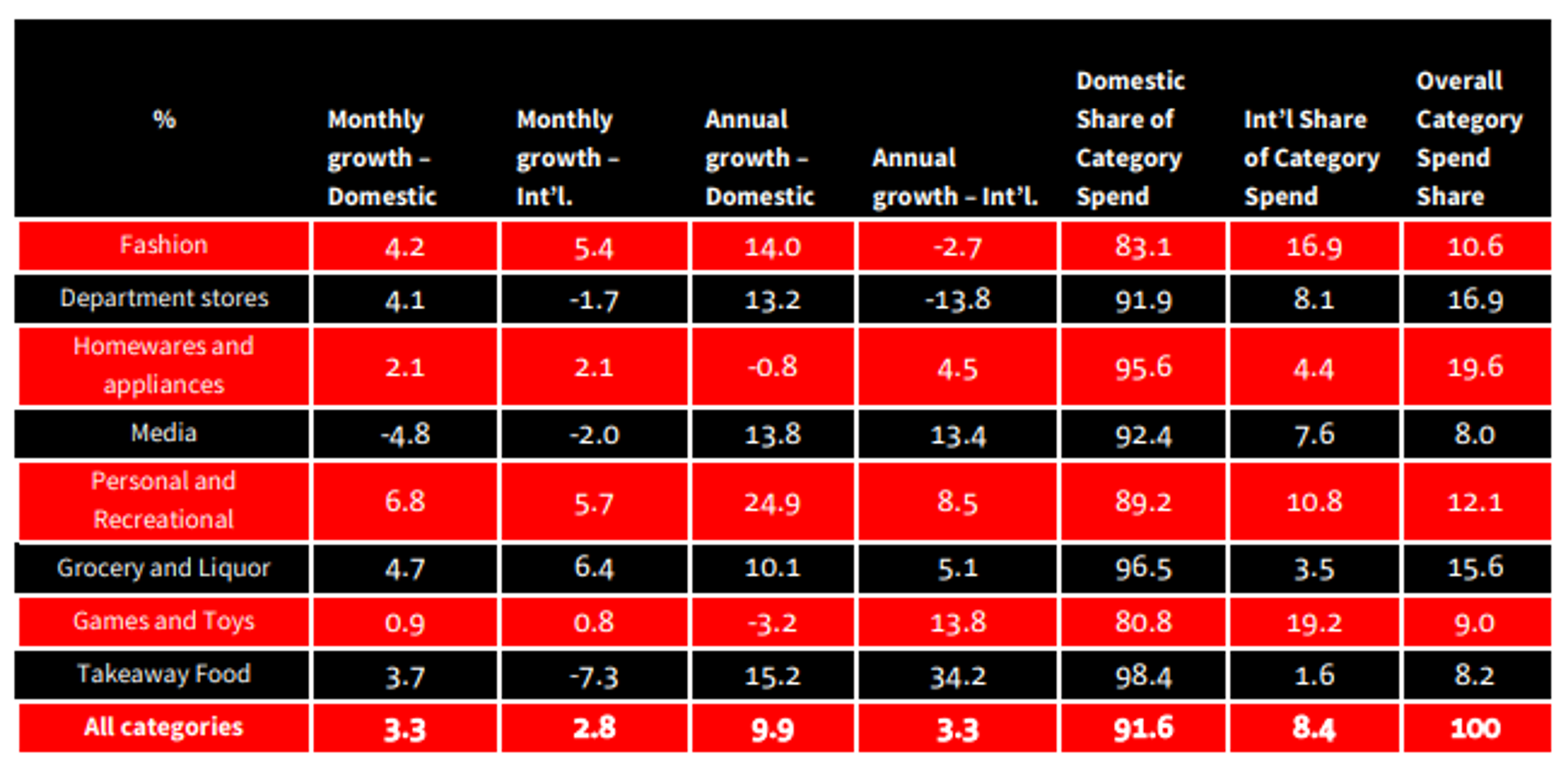

monthly performance in metro areas over the past couple of months. See Charts 15 and 16 for more detail. - Both domestic and international retailers recorded growth in the month, with the former performing better. In yearon-year terms, growth for international was much slower than the headline. See charts 13 and 14, and table 4 for category growth and share.

- NAB estimates that in the 12 months to October, Australians spent $54.36 billion on online retail, a level that is around 12.8% of the total retail trade estimate (September 2023, Series 8501, Australian Bureau of Statistics), and a return to growth (1.3%) relative to the 12 months to October 2022.

Comments from NAB Chief Economist Alan Oster

We observed strong growth in October, following on from a rebound in September. As mentioned in the above summary, our growth estimate for September was revised down significantly, with a particularly strong revision to our estimate for international retailers. The growth pattern of the online series is somewhat at odds with our broader measure of retail spending. For that series, growth for retail was revised up in September and contracted in October.

There was broad-based growth in online retail sales in October, observed at both the state and category level. Fashion, which had seen four consecutive monthly declines, recorded the second highest growth rate in October. Media was the only category to record a monthly contraction, and slow in year-on-year terms, but this is after a mid-year period of stronger than average growth.

Charts 9 & 10: Online sales by state, trend

Table 3: Online sales by category and state

Table 4: Online sales by category and merchant location- Domestic, International (Int’l

About this report

The NAB Online Retail Sales Index is now sourced in-house and is produced by Group Economics. We have made some significant changes to the NAB online series. Importantly, we have merged SME and Corporate Online into a single index, and provide more detail by region and industry on a monthly basis.

It is derived from NAB transactions data that have been assigned from particular merchant codes to retail industries by state. To keep the series reasonably consistent with past series, we have left these category descriptions broadly unchanged, albeit we now include new entrants to the Australian market. Against that, we have however removed the standalone previously reported category of ‘Daily Deals’, as this category was considerably volatile and caused statistical issues with indirect seasonal adjustment.

The NAB Online Retail Sales Index measures all Online Retail spending by consumers using various electronic payment methods such as credit cards, BPAY, and PayPal. We have made adjustments for where merchants appear to be wholesaling goods as opposed for final household consumption, and also incorporate new standards involving purchases using stored customer details. The index is derived from personal transaction data from NAB platforms and is scaled up to be representative of the economy by using scalars including ABS Estimated Resident Population, and RBA payments data.

NAB electronic transactions data for the compilation of this series is collected in real time at event record level, which allows significant flexibility to segment the data by age, time, location and merchant type. In future months, we plan to

expand the data provided from the series as we bed-in acceptable seasonal adjustment factors for the new series. Transactions included in these data may incorporate purchases by Card, BPAY, Bank Transfers, Direct Debits and PayPal services where available, and include transactions with Australian and international merchants. Spending represented here includes transactions we have identified as online. NAB’s estimate of the online retail market is larger than that of the official ABS measure of Online retail trade as it covers businesses that may not be within the remit of the ABS business register, such as overseas online retailers.

In the previously published series, we were using online retail sales by merchants with turnover greater than $2.5m (‘Corporate’) as a proxy for online sales growth of the whole online market. This was due to the shorter time series of the previous market estimate and associated seasonal adjustment issues. With the new extract, we now have sufficient time series, and the growth rates represented are for the total market – i.e. Corporate and SME combined in a single series.

The data captures electronic retail online transactions and is therefore subject to the changing nature and take-up rate of electronic payment methods. Hence, change in growth in the overall transaction value may be attributable to either an increased preference towards a payment type by consumers (such as buy now pay later schemes), or a change in the level of spending across the economy by consumers, i.e. a pick-up in nominal online sales. We continue to work to isolate these effects.

Customer spending is based on where the customer lives, which may or may not be where the actual spending activity occurs. Customers without an Australian residential address are excluded.

These estimates are developed from transaction micro level data are then aggregated to higher level categories based on transaction attributes. The data is made representative of national sales activity by applying both demographic attributes to customer location using the most recent ABS Estimated Resident Population, and comparing NAB transaction data to RBA payments system data. Changes in these data are reflected in the NORSI market size estimate timeseries.

The industry and state data have been seasonally adjusted using Tramo-SEATS with a trading day and Easter adjustment. Given the relatively short time frame for the data, this seasonal adjustment process should be regarded as provisional: estimates are likely to change as a longer run of data becomes available and can be revised from month-to-month given the concurrent process. The trends have been extracted from the same process.

Our aim is to have a data series that is as reflective as possible of online retail spend. As such, each month we will revise previous data to take into account changes in payment processing such as chargebacks and delayed payments. Given these attributes, typically, larger revisions occur to the most recent months, and diminish as the data ages, but the latter effect cannot be excluded.

Our data differs to that of the ABS series as the NAB series covers a broader spectrum of online retailers – overseas merchants selling to Australian residents for example, and categories that substitute for previously retail purchased goods. Categories such as music and book retailing, and electronic games form part of the current online estimate. These are now substitutes for what may have been purchased in-store, but are now provided by online media streaming companies. While these may not fit the strict retail trade definition, our data reveals that they are increasingly being used by customers who previously purchased media in-store. We incorporate these companies into our estimate of online retail sales.

As part of the continual improvement of the series, this month we have revised our total market estimates. We have identified and removed potential wholesale trade transactions made on personal accounts. We have also identified more transactions that are made using a ‘stored credentials’ technique of online purchases. This technique is increasing in popularity as consumers opt for convenience especially with purchases made using mobile apps. Finally, in March 2018 the RBA made changes to its Payments System Data which we use as an input into our estimate of online total market size.

These revisions are retrofitted to the series history.

We have also added a comparison based on metropolitan and regional areas. The definition of these geographical areas is based on the ABS geographical concordance tables, specifically the Greater Capital City Statistical Areas (GCCSAs).

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for

your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.