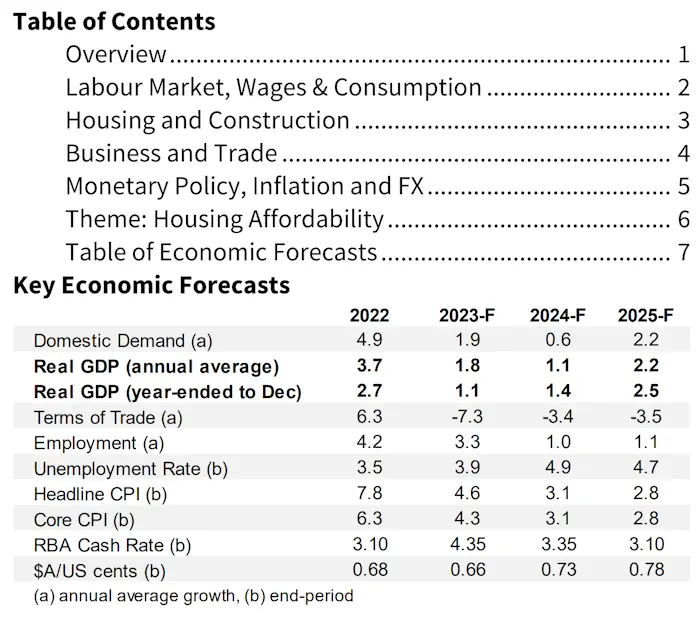

Overview

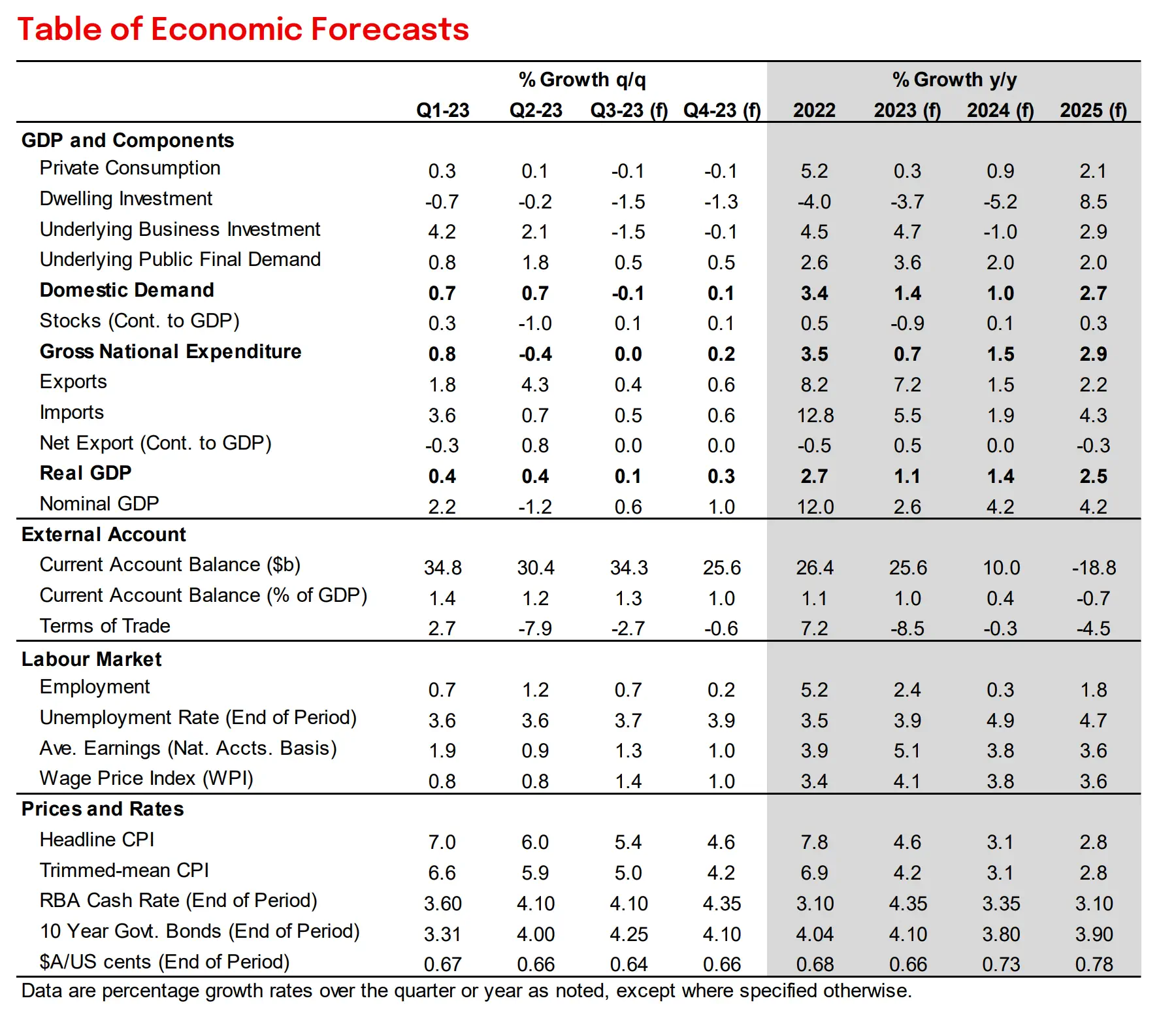

Our forecasts are unchanged this month with official

data, the NAB business survey and our internal

transactions data all pointing to ongoing resilience in

aggregate.

• That said, with the ongoing pass through of higher rates

and inflation still high we see consumption growth

remaining soft in H2 2023 and expect below trend GDP

growth of 1-1.5% in 2023 and 2024.

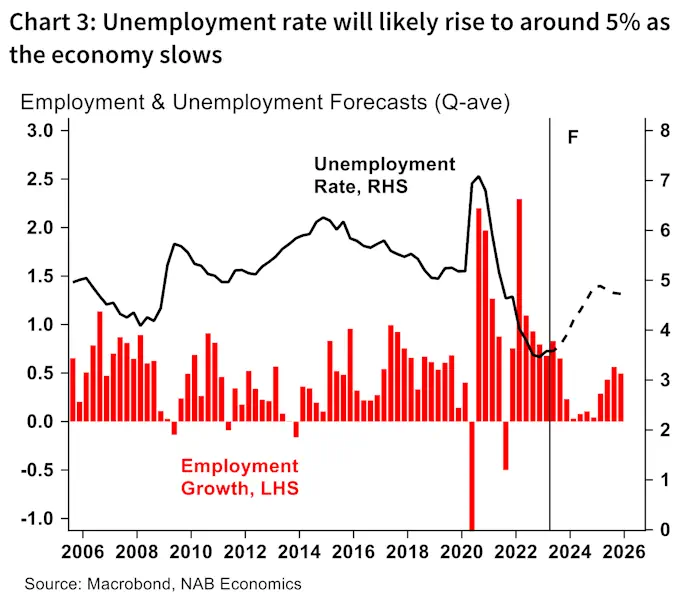

• We continue to expect the unemployment rate to rise to

around 4.9% through 2024 with slower labour demand

growth unable to absorb the full impact of high

population growth. However, forward-looking

indicators of the labour market remain healthy. More

broadly, despite the slowing in growth to date, the

labour market has remained resilient.

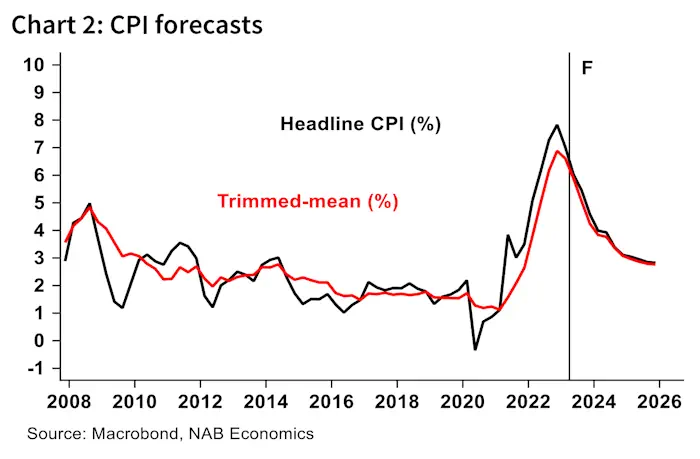

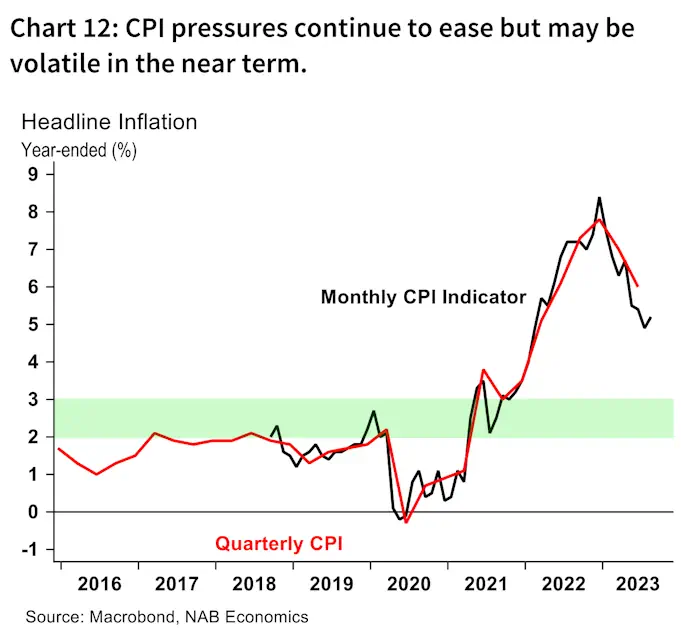

• The Q3 CPI released next week will provide a key marker

of the ongoing moderation in inflation. In quarterly

terms, we see a 1.1% increase in the quarter for both the

headline and trimmed mean measures. While this would

mark a small reversal in the trend easing in quarterly

terms, year-ended inflation will continue to moderate.

• For monetary policy the pace of this ongoing

moderation in inflation remains crucial. The

improvement in the year-ended rate will be driven

partly by base effects as large outturns in Q3 and Q4 of

2022 fade. The moderation from 4% to 3% will be more

difficult. Domestic factors will continue to grow in

importance as global factors continue to fade (although

the war in the Middle East highlights that geopolitical

and other risks can materialise rapidly).

• For now, domestically wage growth has not accelerated

to a pace inconsistent with inflation returning to target

and expectations in the medium- and long-term remain

anchored.

• The depreciation in the exchange rate over recent

months presents some upside risk though typically

exchange rate passthrough is gradual and global price

inflation is easing. How firms pricing decisions respond

to slower consumer demand will also be important

• In terms of housing, prices continue to rise and, as

explored in this month’s theme, this has continued to

challenge affordability.

Labour Market, Wages & Consumption

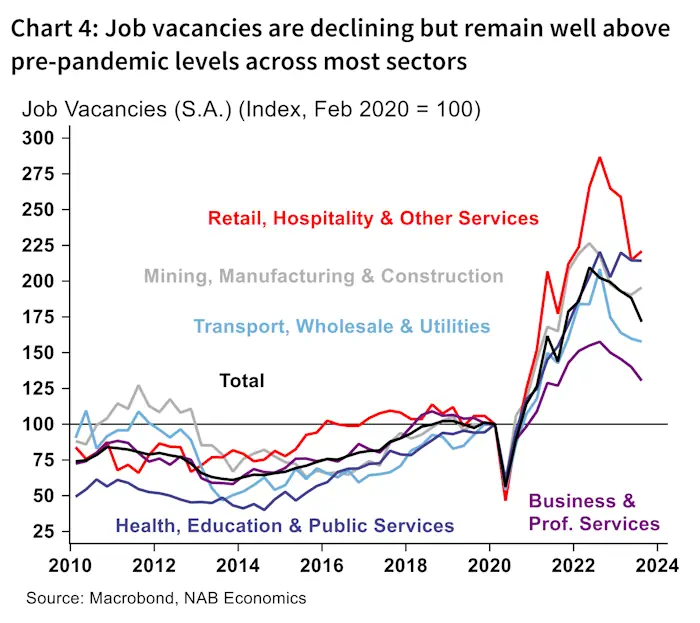

The labour market remains tight with unemployment

at 3.7% and job vacancies remaining elevated despite

falling in Q3. Still, we continue to expect

unemployment to start to rise as the economy slows.

Data on job vacancies for August (Q3) showed an 8.9%

decline since May. Vacancies are now down around 18%

from their peak in early 2022 but at 390k, the number of

vacancies remains very elevated relative to pre-pandemic

levels. Vacancies have fallen most in frontline services

sectors like retail and hospitality, but these remain the

most elevated, alongside public services like health and

education.

Employment growth has remained strong as vacancies

have declined, keeping unemployment at low levels even

as the population has grown rapidly. As the economy

slows, however, employment growth should also slow and

some vacancies may be ‘extinguished’ rather than filled.

As a result, we see the unemployment rate rising to

around 4% by end-2023 and approaching 5% by end-2024.

On wages, we continue to expect to see a material pickup

in hourly wage growth in Q3 when the Wage Price Index

(WPI) is released in November. This should see year-ended

wage growth surpass 4% by the end of 2023, before the

softening labour market begins to ease wage pressures

later in 2024.

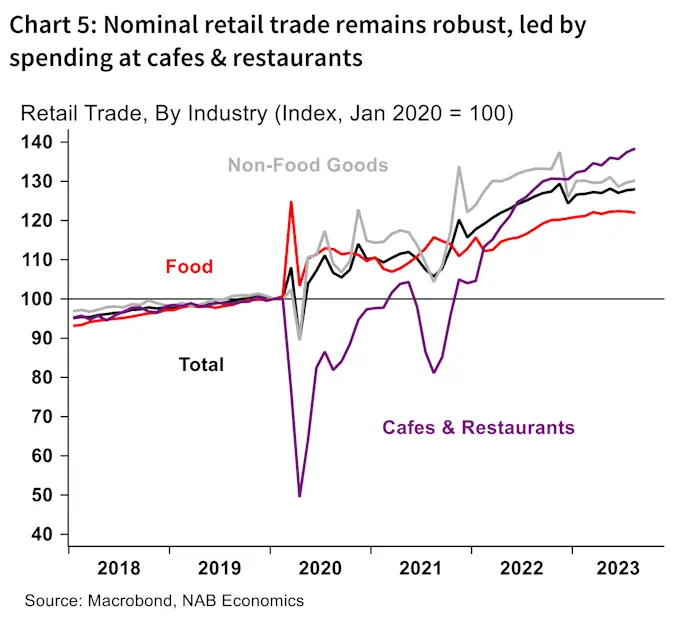

Retail trade growth was soft in August though price

movements may have played a role in the result. The

level of spending is high but households’ discretionary

spending is under pressure.

Nominal retail trade data from the ABS showed sales rose

0.2% in August, softening from a more solid 0.5% in July.

Spending on food fell 0.3% in August (though falls in fruit

and vegetable prices may have contributed) and

household goods spending fell 0.4%. On the other hand,

spending on clothing, department stores and other

retailing all rose in the month, as did cafes & restaurants

(up 0.7%).

More recently, transaction data analysis in NAB’s Monthly

Data Insights suggested retail spending grew 0.4% in

September. More broadly, the transaction data suggests

overall consumer spending grew around 3% in nominal

terms for Q3 as a whole. Fuel price increases contributed

to spending growth in August and September, but overall

spending still rose with fuel excluded.

This suggests consumption growth likely remained

positive in real terms for the quarter, although the result is

still expected to be subdued in a continuation of the slow

consumption growth seen in Q2. Population growth

remains a key factor supporting consumption with percapita consumption expected to continue declining for the

time being as households continue to adjust to higher

interest rates.

Housing and Construction

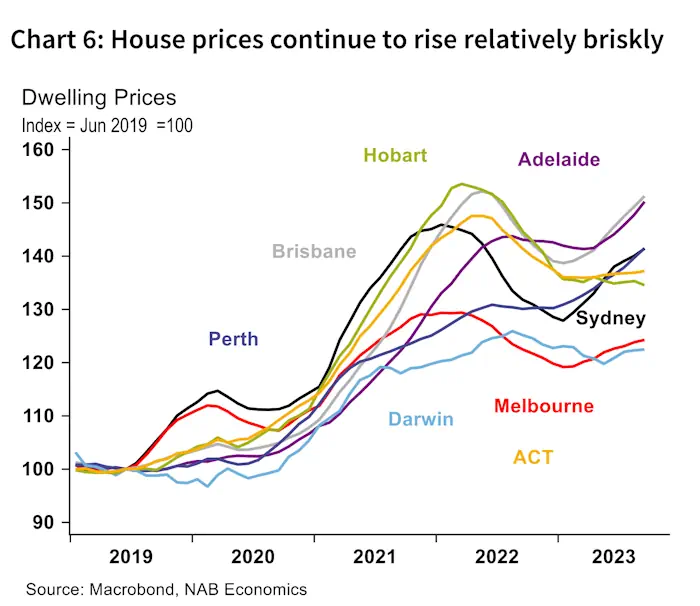

Despite the rapid rise in interest rates over the past

year house prices continue to rise at a brisk pace and

the very low rental vacancy rate continues to support

strong rents growth.

The CoreLogic 8-capital city dwelling price index rose by

0.9% in September while the combined regional index

continues to track at a lower rate, rising by 0.4% m/m.

Overall, capital city house prices rose 2.5% over the past 3

months and are now up 5.1% over the past year.

Price growth in Sydney has slowed over recent months,

but remains robust at 1% m/m. However, the smaller

capitals have accelerated with Adelaide leading the rise at

1.7% m/m, followed by Brisbane and Perth at 1.3%.

Melbourne continues to track at a slower pace rising 0.4%

in the month and 1.3% over the past quarter.

With the trend in house prices unlikely to change

significantly over the next 3 months, prices are likely to

end the year 8-10% higher and we continue to see gains of

around 5% over 2024 (with rate cuts in H2 to provide some

support). The ongoing increase in prices, from a high level,

amidst the sharp increase in interest rates has led to a very

sharp deterioration in housing affordability over the past

year (discussed on Page 6). While higher house prices

provide some support via the “wealth effect,” the cost-ofliving impact of more expensive housing could be a factor

weighing on consumer spending.

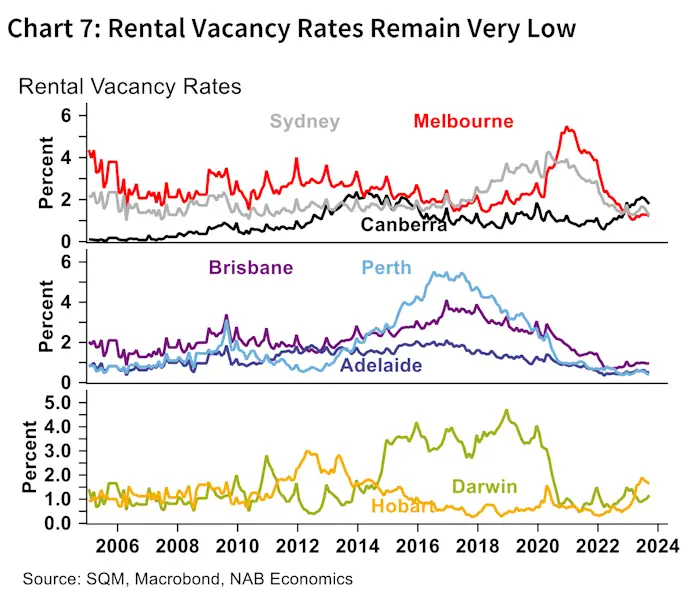

Indeed, the picture in the rental market points to similar

stress. Rents growth has slowed in annual terms over

recent months but has shown some mixed trends across

the capitals on a monthly basis. Growth in Perth rents is

now strongest at 13% y/y followed by Melbourne at 12%

and Sydney at 11%. Brisbane and Adelaide have tracked at

a slightly slower, though still very strong pace of 7% and

8%, respectively, over the past year. While there had been

some tentative sign of an easing in rental vacancy rates for

Sydney and Melbourne over recent months, they again

declined in September and remain very low across the

remaining capitals.

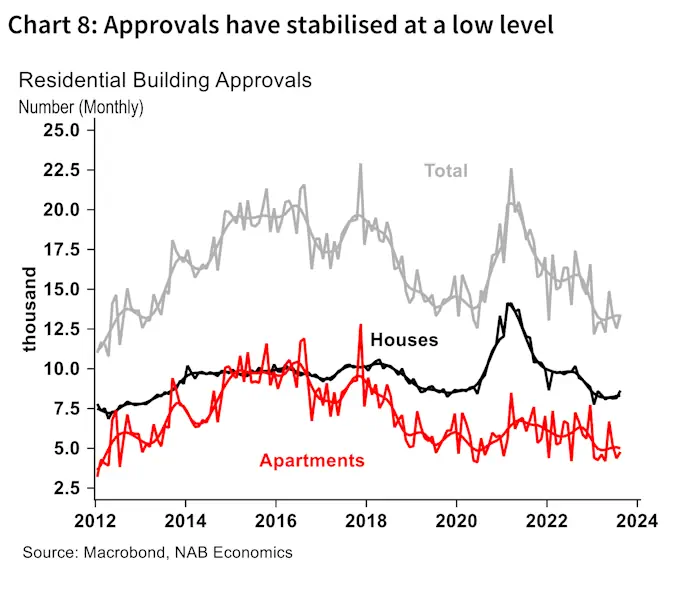

Amidst strong demand, the supply side remains

challenged. While, building approvals rose 7% in August

(with both houses, up 6.8%) and higher-density (up 9.4%)

rising in the month), total building approvals remain 23%

lower over the past year and appear to have stabilised at a

decade low rate of around 13.5k monthly.

Our Residential Property Survey for Q3 (released later this

week) continues to suggest that rising rates and

construction costs remain large barriers to new

construction despite a slight easing in the quarter.

Business and Trade

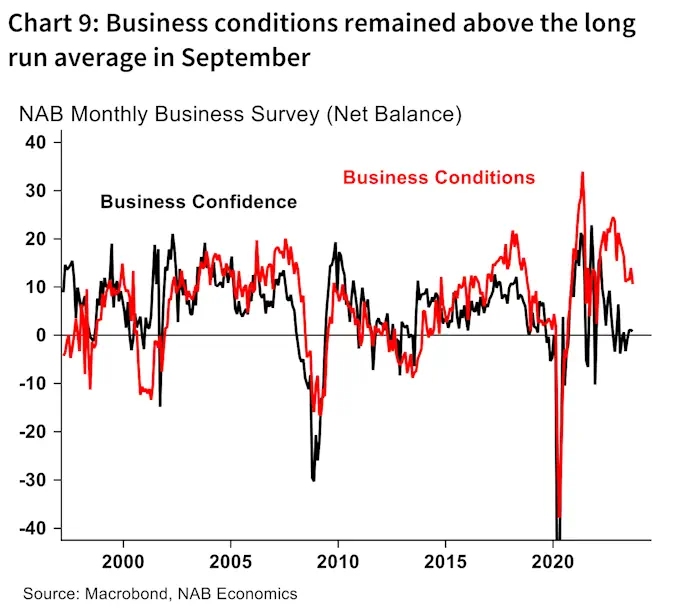

Business conditions eased in September but remained

above the long run average, while cost growth

measures also stepped down.

Conditions in the NAB Business Survey were down slightly

in September but remain above average at +11 index

points, where the index has hovered since May.

Importantly, capacity utilisation remains high and there

has been gradual improvement in forward orders.

Confidence was steady and while still sitting well below

average, has been around zero in net balance terms for

several months.

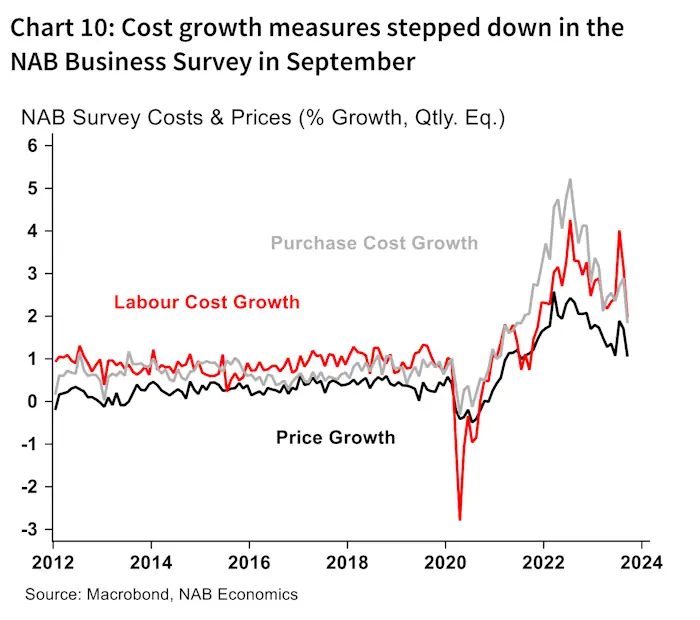

The survey also showed some positive signs for inflation

with cost pressures and price growth easing. Labour cost

growth – which spiked to 4.0% in quarterly terms in July –

fell to 2.0% in September, and purchase cost growth also

eased materially, though both remain elevated. Output

price growth eased, driven by an easing in rec & personal

(0.8%), while retail price growth remained elevated (1.8%).

Business credit growth picked back up in August, rising

0.6% m/m after a softer 0.2% rise in July. In year-ended

terms, business credit is up 7.4%, continuing a gradual

moderation. Below-trend economic growth should

continue to weigh on business credit and investment but

so far investment has shown resilience in line with the

broader economy and pressures generated by a very tight

labour market.

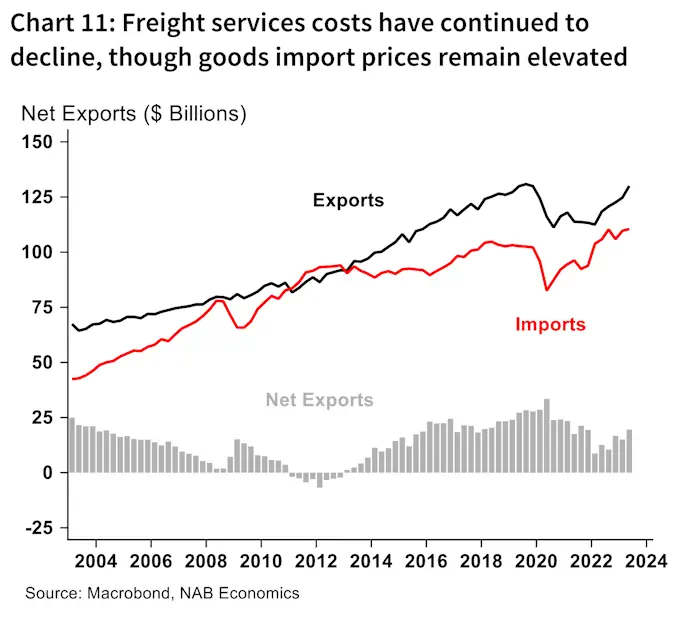

The trade balance rose in August, driven by a rise in

non-monetary gold exports. Trade remains a key

source of volatility for the forecasts.

The trade surplus rose by $2.3 billion in the month, to

$9.6 billion. Exports rose 4%, almost entirely driven by a

$2 billion increase in the volatile non-monetary gold

component. Rural and coal export values fell, offset by a

gain in iron ore. Imports were little changed with fuel and

travel services imports up but aircraft and industrial

transport equipment down.

Freight services costs continued to moderate, falling to

3.8% of good imports from a peak of 6.6% in August 2022.

This is an important disinflationary force for goods prices

that is expected to continue flowing through to consumers

over the months ahead. More broadly, Q2 balance of

payments data showed goods import prices have

continued to gradually decline albeit the level of prices

remains very elevated.

Looking ahead, trade volumes remain a key source of

volatility for the forecasts. On the imports side, supply

chains continue to improve but demand is also softening,

while on the exports side the outlook for China remains

uncertain, and the recovery in services trade is also

ongoing. At the same time, recent quarters have seen

significant movements in inventories alongside trade. On

balance we see a fairly stable profile for net exports.

Monetary Policy, Inflation and FX

We expect the Q3 CPI to show a quarterly print of 1.1%

for both headline and underlying inflation, seeing the

year-ended rates fall to 5.2% and 5.0% respectively.

The key drivers of the headline are a large rise in fuel

prices which were up sharply in the quarter, offset by

declines in fruit & veg and childcare. Of some concern is

our expectation for services inflation (ex telco and travel)

to continue to strengthen in annual terms. Rents growth,

in particular, is expected to remain strong.

The moderation in inflation from its peak has been

reasonably sharp, helped significantly by global goods

disinflation. While there is always some variation across

CPI components, at around 1.0% q/q it appears as if most

of the easy gains have been eroded – i.e. inflation will

likely moderate quickly to around 4% but bringing it back

into the RBA’s target band from there could be more

challenging.

Indeed, as the common global inflation shock wanes,

leading to disinflation (or even deflation) in goods prices,

domestic factors will become increasingly important.

Wage growth will be key – though not the only factor – but

to date has not accelerated to a rate that is clearly

inconsistent with inflation returning to the target band.

The depreciation of the exchange rate presents some

upside risk, though the passthrough is typically slow while

the disinflation in global goods is likely a larger driving

force.

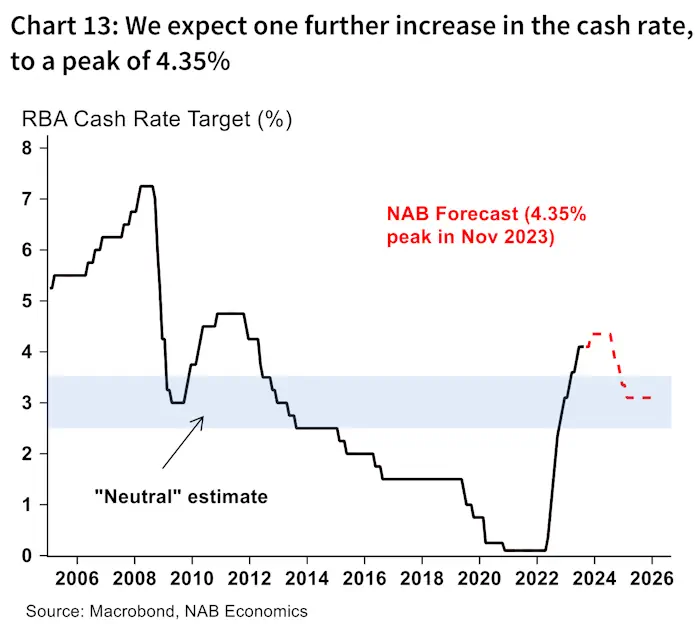

For rates, we continue to see the RBA hiking a further

25bps in November, before staying on hold until the

second half of 2024.

The RBA remained on hold in October for the fourth

consecutive month and made very few changes to the

post meeting statement.

The RBA reiterated that rates continue to slow the

economy (“working to establish a better balance of supply

and demand”) and that “they will continue to do so”.

Therefore, while inflation remains high, the RBA sees rates

in restrictive territory and that it is on track to return to the

target band by 2025. That said, the risk remains that a

prolonged period of above-target inflation poses the risk

of high inflation expectations becoming ingrained and a

larger cost of even slower growth and higher

unemployment to bring it back to target.

Ultimately, we see the Q3 CPI pushing the RBA –

particularly with services inflation remaining strong – to

provide some further insurance in balancing the risks.

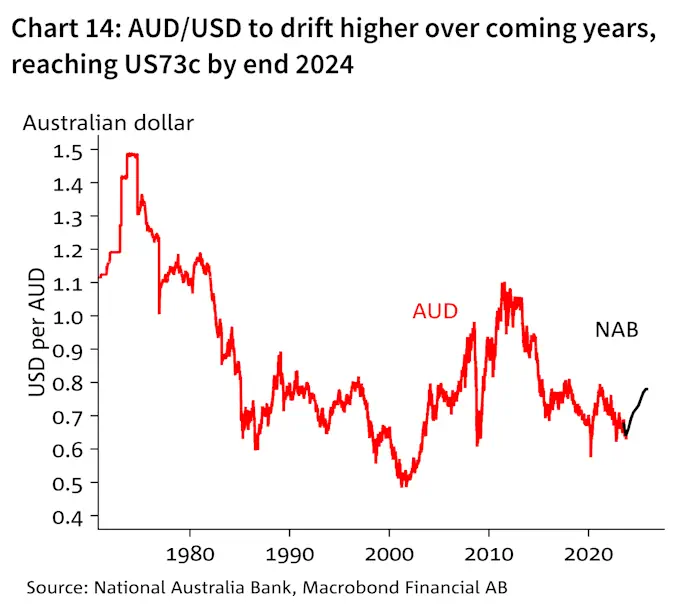

The AUD/USD weakened further over the month,

currently trading around US63c and at times lower.

We continue to see the Aussie ending the year at around

US66c before tracking higher over 2024 – ending 2024 at

around US73c.

Theme of the Month: The Stark Deterioration in Housing Affordability

Despite the rapid rise in interest rates over the past

year, which has seen a reduction in borrowing power of

over 30%, house prices have remained resilient – and

indeed they have already reversed a large proportion

of the initial ~10% fall.

This combination of higher prices and higher mortgage

servicing costs (which typically move in opposite

directions) has led to a sharp deterioration in housing

affordability.

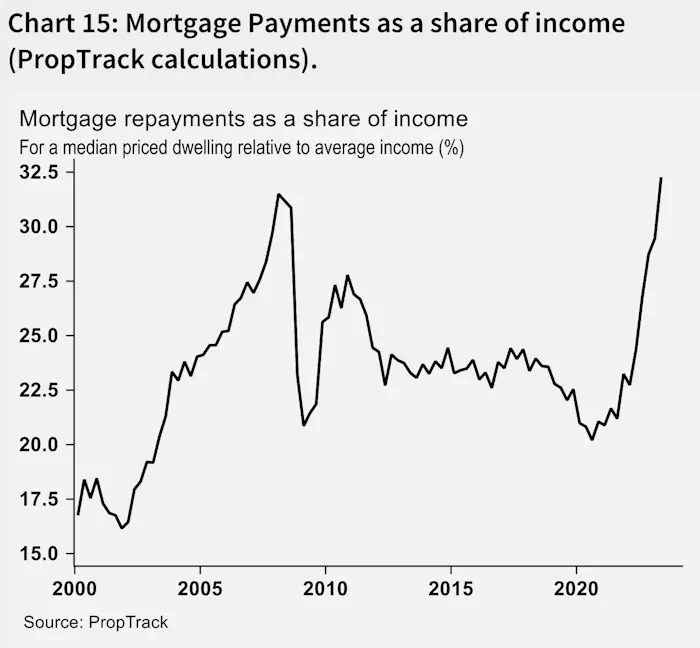

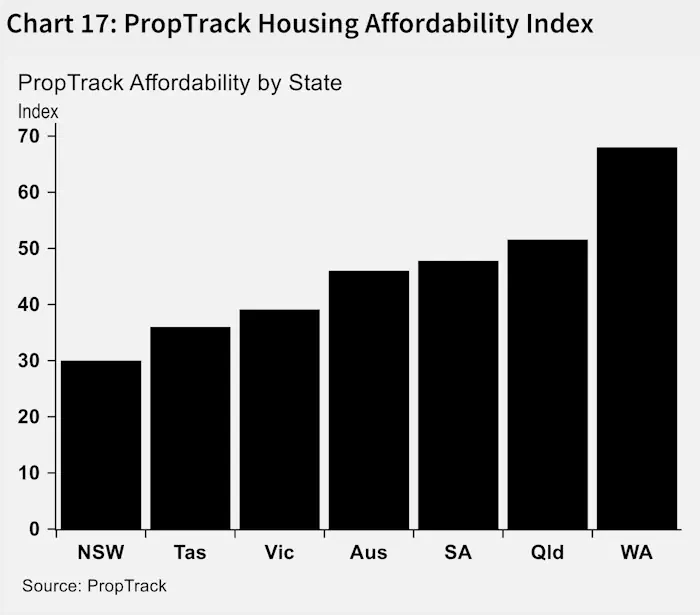

Most housing affordability measures summarise this

impact at aggregate level by calculating the share of

income spent by a household earning an average income

on the median priced property. According to PropTrack

calculations this measure has risen to around 33% of

income from a 20-year low in 2020 of around 20%. This

figure is closer to around 40% in NSW where Sydney house

prices remain a step above the other capitals. It is around

35% in Victoria and South Australia and around 30% in

Queensland.

However, the typical household (i.e. the average) is far

from common and there is a large distribution of both

incomes and property prices, with the analysis sensitive to

both binding assumptions.

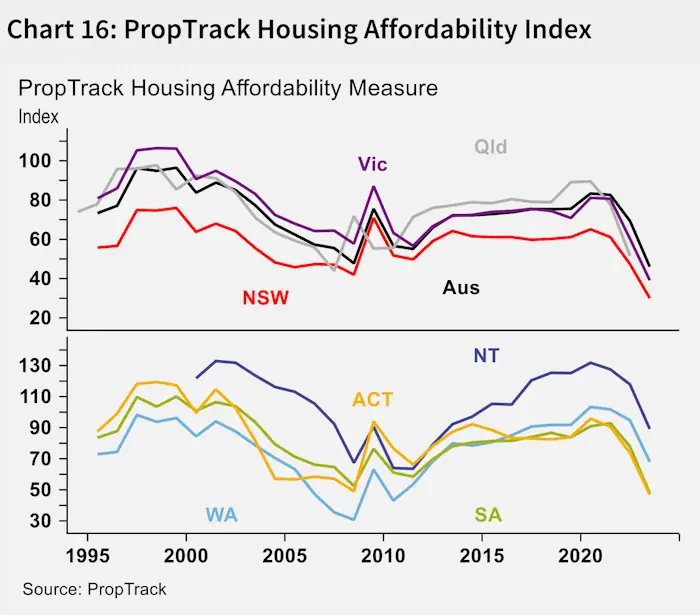

PropTrack’s new affordability index captures a broader set

of market dynamics, framing affordability as the share of

recent house sales that a median income household could

afford to buy (assuming a long run preference of 25% of

gross income is spent on housing).

This measure has deteriorated sharply over the past year

or so, falling to its lowest level since the mid-1990s (based

on available data). This pattern is common across the

states though there is some variation in the level of

affordability. Affordability is below the national average in

NSW, Tas and Vic. Above the national average in SA and

Qld – and highest in WA.

The deterioration in housing affordability is one factor

adding to the cost-of-living pressures faced by households

at the current juncture. Rents growth has also been high

and the time to save a deposit metrics also points to a

weakening in accessibility – with the time to save for a

deposit rising to very high levels.

While higher interest rates have driven a large proportion

of the deterioration in affordability over the past year,

housing supply over the long term will remain a critical

factor amidst a relatively fast-growing population, while

the impact rates will continue to be cyclical.

Group Economics

Alan Oster

Group Chief Economist

+(61 0) 414 444 652

Jacqui Brand

Executive Assistant

+(61 0) 477 716 540

Dean Pearson

Head of Behavioural &

Industry Economics

+(61 0) 457 517 342

Australian Economics

and Commodities

Gareth Spence

Senior Economist

+(61 0) 422 081 046

Brody Viney

Senior Economist

+(61 0) 452 673 400

Behavioural &

Industry Economics

Robert De Iure

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 477 723 769

Brien McDonald

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 455 052 520

International

Economics

Tony Kelly

Senior Economist

+(61 0) 477 746 237

Gerard Burg

Senior Economist –

International

+(61 0) 477 723 768

Global Markets

Research

Ivan Colhoun

Chief Economist

Corporate & Institutional

Banking

+(61 2) 9293 7168

Skye Masters

Head of Markets Strategy

Markets, Corporate &

Institutional Banking

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice

contained in this document has been prepared without taking into account your objectives, financial situation or needs.

Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for

your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document,

before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use