NAB Behavioural & Industry Economics

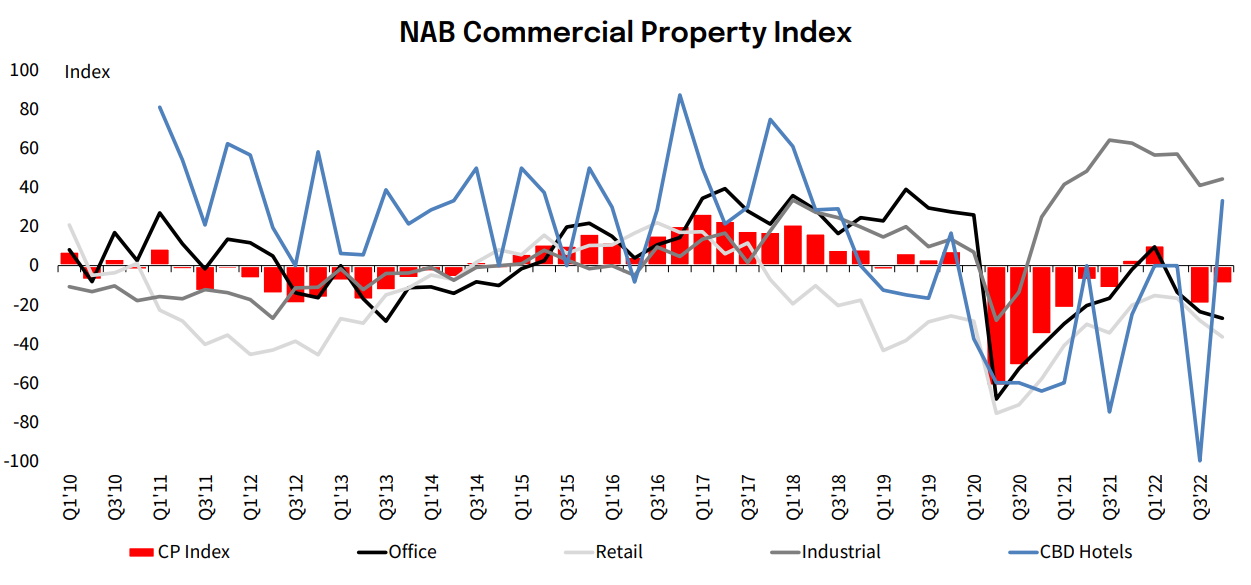

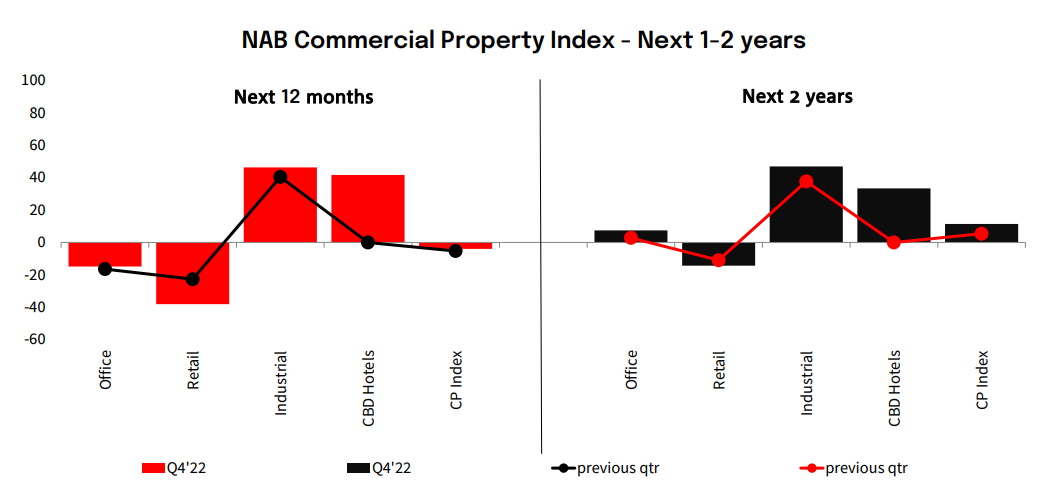

The NAB Commercial Property Index improved in Q4, but is still negative overall and trending well below the survey average.

The improvement largely reflected booming conditions in Industrial property markets, as conditions weakened for both Office and Retail property. With interest rates continuing to climb, funding conditions were also harder in Q4 and are expected to worsen in the next 3-6 months.

Key Messages

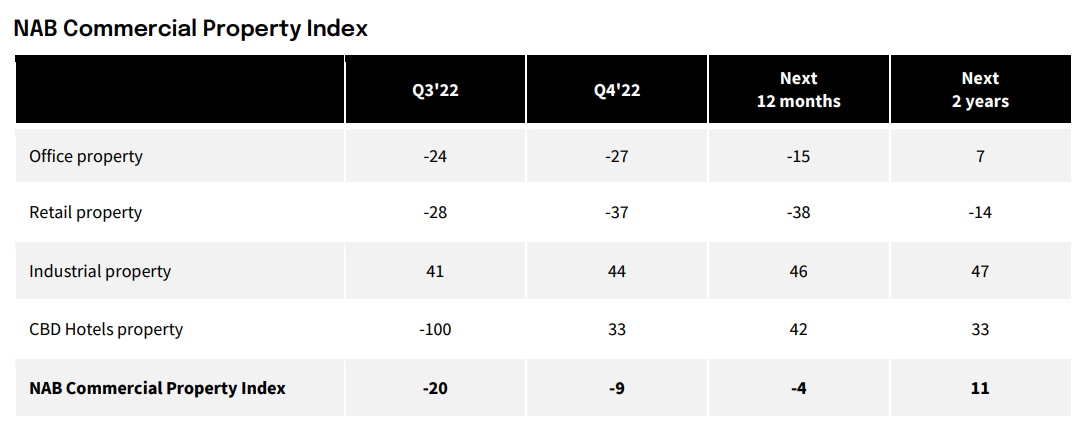

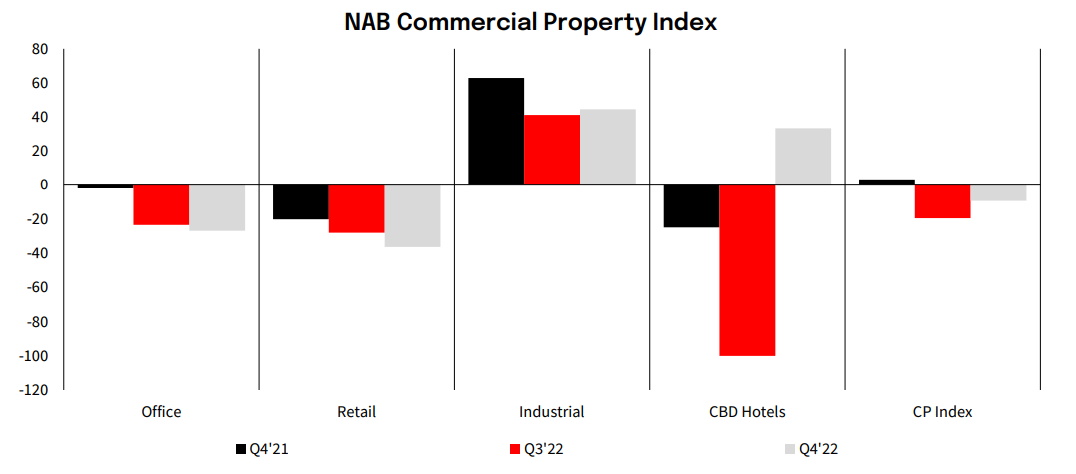

- NAB’s Commercial Property Index lifted to a still weak -9 pts in Q4 (-20 pts in Q3). But sectoral trends were mixed. It rose in the booming Industrial market (+44 pts), and in CBD Hotels (+33 pts) where value growth was reported for the first time since the pandemic. It slipped in Office (-27 pts) and Retail (-37 pts).

- With economic growth expected to slow in 2023, short-term confidence is very weak (-4 pts), but better in 2 years’ time (+11 pts). Confidence is highest (and rose) in the Industrial sector (+46 pts & +47 pts), and was broadly unchanged for Office property (-15 pts & +7 pts). It dipped sharply and remains negative in Retail (-38 & 14 pts). By state, overall confidence levels are weakest in VIC by a considerable margin, and highest in WA.

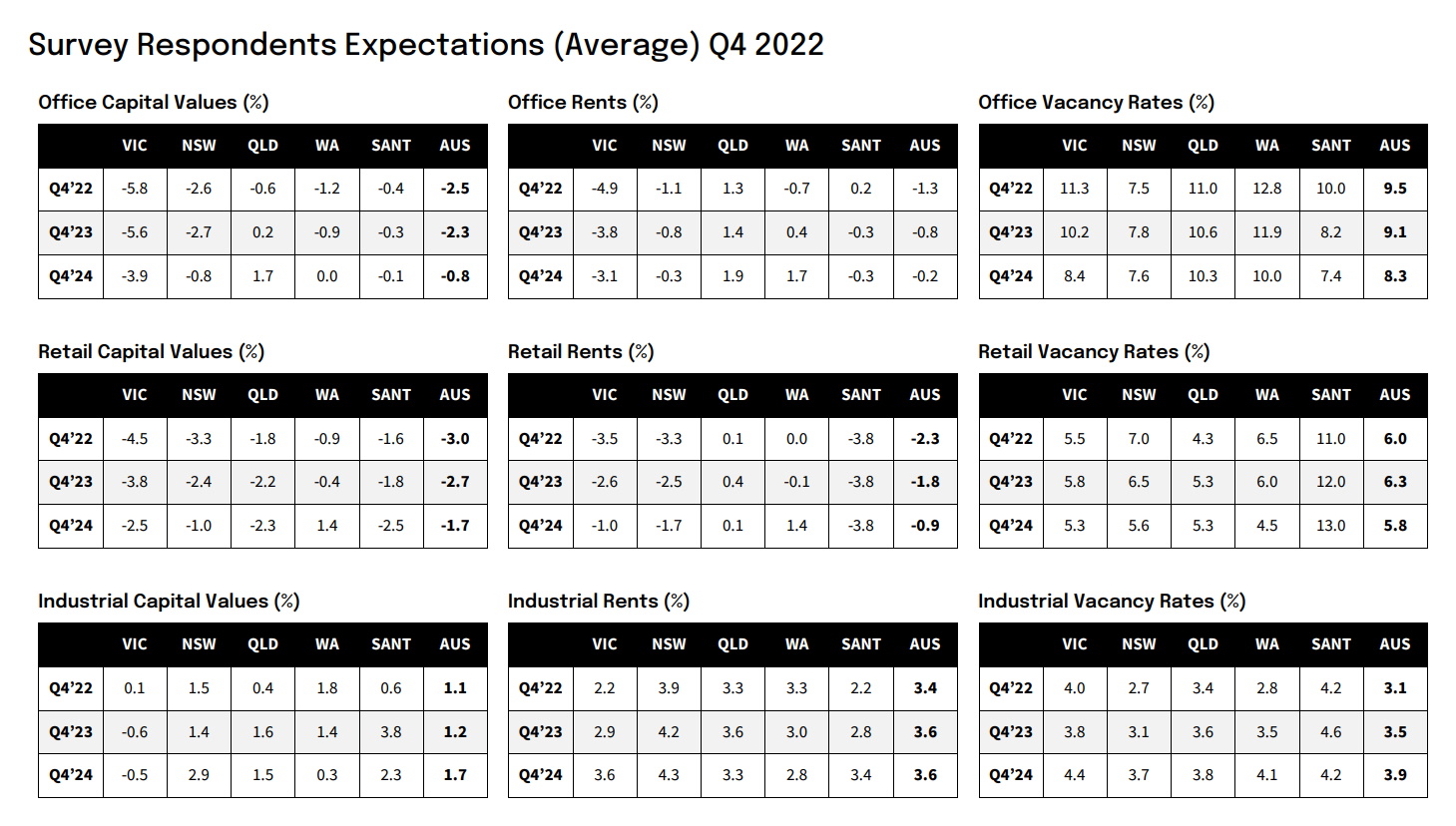

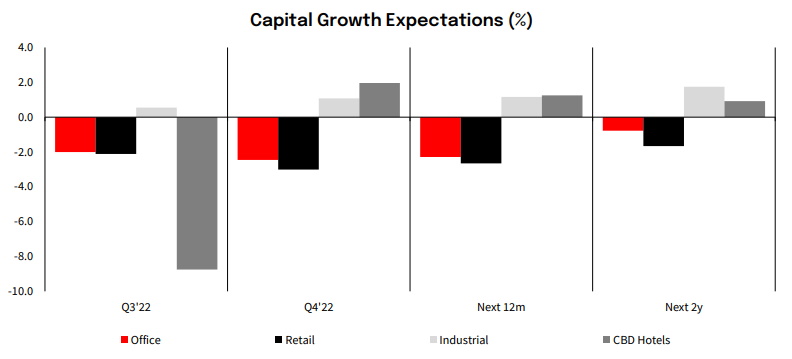

- Capital growth expectations for the next 1-2 years were revised up for Industrial (1.2% & 1.7%), and CBD Hotels (1.3% & 0.9%) property. They were cut back and negative for Office (-1.9% & -0.9%) and Retail (-2.7% & -1.7%).

- Office rents are now expected to fall in the next 1-2 years (-0.8% & -0.2%), with the outlook weakest in VIC (-3.8% & -3.1%) by some margin. Retail rents are also expected to fall more steeply (-1.8% & -0.9%). The outlook for Industrial rents was revised up (3.5% & 3.9%), and is predicted to grow in all states led by NSW (4.2% & 4.3%).

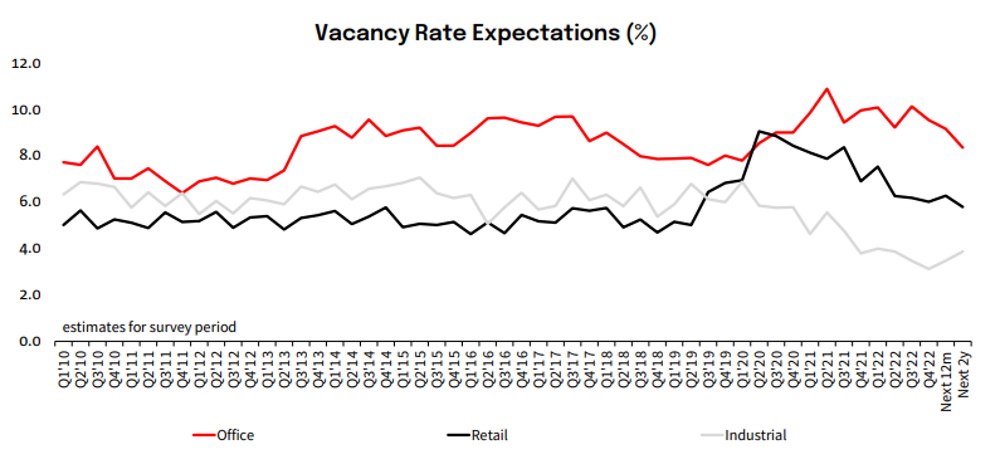

- Office vacancy rate eased to 9.5% in Q4 (10.5% in Q3) and is expected to fall further in the next 1-2 years (9.1% & 8.3%) – but remain above average levels in all states bar QLD. Retail vacancy was down a little in Q4 (6.0%), but expected to rise next year (6.3%) and fall in 2 years’ time (5.8%). Industrial vacancy fell to a survey low 3.1% in Q4, with the market tightest in NSW (2.7%). Industrial vacancy is expected remain very low over the next 1-2 years (3.5% & 3.9%), led by NSW & QLD.

- The number of property developers expecting to commence new works within the next 6 months fell for the fourth straight quarter to 33% – the lowest result since Q3’19 – and is now trending well below the survey average (48%).

- The number of developers planning to commence new works in the residential sector rose to 49% in Q4, but remains well below average. But an above average number of developers are planning plan to start new works in the Office and Industrial property sectors (15%), but amid perceptions of over-supply only 6% in Retail.

- With interest rates climbing further during Q4, intentions to source capital were somewhat weaker than at the same time last year, with over 6 in 10 (61%) now signalling no intention to source capital in the next 6 months.

- Funding conditions were also harder in Q4, and expected to worsen in the next 3-6 months. With interest rates still rising, the net number of property professionals who said it was harder to obtain debt rose for the 3rd straight quarter to a 4-year high -36%. Equity funding was also more difficult, with the net number who said it was harder also rising for the 4th straight quarter to -27%. Looking 3-6 months ahead, a net -39% expect debt funding to be harder and -30% equity.

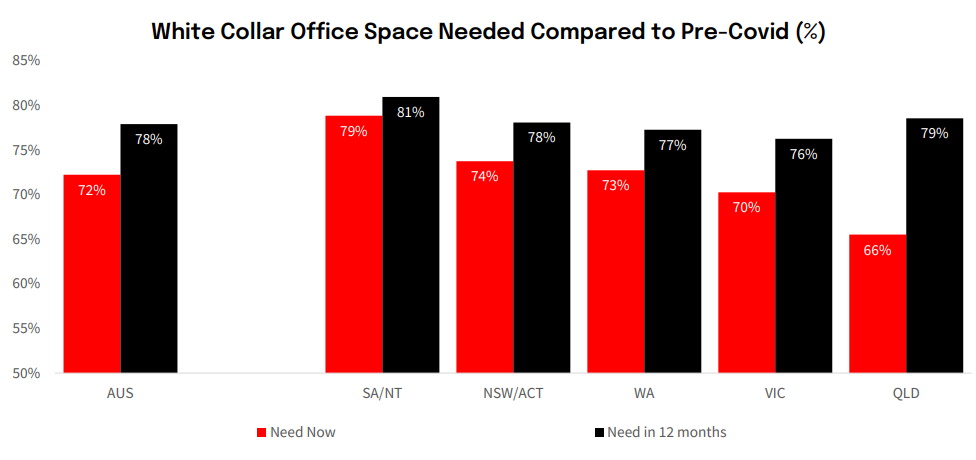

- In this survey, property professionals were also asked to estimate how much Office space do white collar workers need now compared to before COVID, and how much they will need in 12 months’ time. On average, they think they now need 72% of what they were using prior to COVID – ranging from 79% in SA/NT to 66% in QLD. Looking 12 months’ ahead, they expect requirements to climb slightly to 78% overall, led by SA/NT (81%) and QLD (79%). Requirements are expected to be broadly similar in all other states, ranging from 78% in NSW/ACT to 76% in VIC.

Market Overview – NAB Commercial Property Index

The NAB Commercial Property Index improved in Q4 but remained weak at -9 pts. Though the index lifted from -20 pts in Q3, it is still well

below the long-term survey average (-1 pts). Sectoral trends were however mixed Sentiment improved and was positive for Industrial

property (+44 pts up from +41pts in Q3), which continues to experience boom conditions. It also recovered in the bouncy CBD Hotels sector

(+33 pts up from -100 pts in Q3), where property professionals reported positive capital value growth for the first time since the pandemic.

Sentiment however slipped deeper negative for Office property (-27 pts down from -24 pts in Q3) in an environment of rising interest rates

and ongoing challenges associated with work from home. Sentiment in the Retail sector also fell (-37 pts down from -28% in Q3) as inflation

and higher rates continued to weigh on real household disposable income and spending.

With economic growth expected to slow in sharply in 2023 and level out in 2024, confidence in overall commercial property markets in the

next 12 months was broadly unchanged at a negative -4 pts (-5 pts in Q3). The 2-year measure however lifted to +11 pts (+5 pts in Q3), with

both measures printing well below average (+19 pts & +28 pts respectively). Confidence levels remain highest (and lifted) for Industrial

property at +46 pts in the next 12 months and +47 pts in 2 years’ time.(+40 pts & +38 pts respectively in Q3). Short and longer-term

confidence in the CBD Hotels sector also improved to +42 pts and +33 pts respectively (neutral in Q3). Office confidence was broadly

unchanged at -15 pts in the next 12 months (-16 pts in Q3), and +7 pts in the next 2 years (+3 pts in Q3). Retail confidence however fell to a 2

year low -38 pts in the next 12 months (-23 pts in Q3) and to a 15 month low -14 pts in 2 years’ time (-11 pts in Q3).

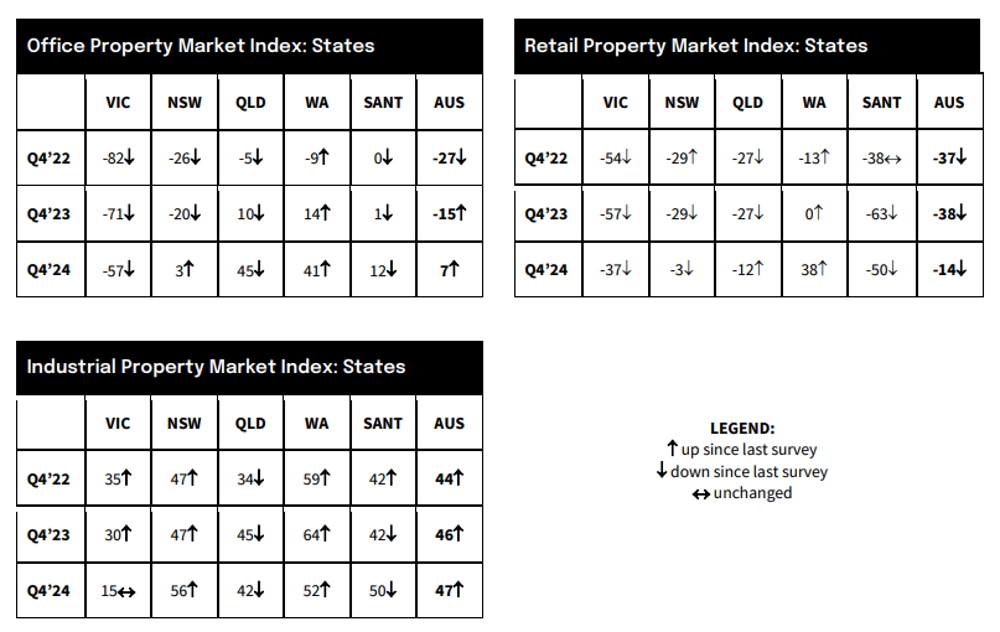

Market Overview – Commercial Property Index by State

Overall market sentiment was negative in all states in Q4 except WA (+14 pts) and SA/NT (neutral). It was lowest and fell in VIC (down 10 pts

to -37), but fell most in QLD (down 16 pts to -3). Short-term confidence moderated further in VIC (-35 pts), and was much lower than the

next worst state NSW (-5 pts). It was positive in all other states led by WA (+28 pts). VIC (-31 pts) is also the only state to print a negative

long-term confidence reading. Short-term confidence in Office and Retail markets for the next 12 months eased in all states bar WA where it

was also highest in both sectors (+14 pts and 0 pts). Office confidence was weakest in VIC (-71 pts), and Retail in SA/NT (-63 pts). Industrial

confidence levels remain positive and improved in all states (bar QLD and SA/NT). It was highest in WA in 12 months (+64 pts) and NSW in 2

years’ time (+56 pts).

Market Overview – Capital Growth & Vacancy Expectations

Capital growth for Industrial property is forecast to out-perform the broader market in the next 1-2 years (1.2% & 1.7%) and was revised up from 0.3% & 0.9% in Q3. Prospects are best in SA/NT (3.8% & 2.3%) and NSW (1.4% & 2.9%), and worst in VIC (-0.6% & -0.9%). The outlook for capital value growth for Office property was cut to -2.3% & -0.8% (-1.9% & -0.9% in Q3), with expectations weakest in VIC (-5.6% & -3.9%) and NSW (-2.7% & -0.8%), and strongest and mildly positive in QLD (0.2% & 1.7%). The outlook for capital growth for Retail property was revised down to -2.7% & -1.7% (-2.3% & -1.5% in Q3), with growth expected to fall in all states. The heaviest falls in the next 12 months are expected in VIC (-3.8%), and in VIC and SA/NT (-2.5%) in 2 years’ time. Expectations for CBD Hotels were positive for the time since before the COVID outbreak (1.3% & 0.9%)

The national Office vacancy rate eased to 9.5% in Q4 (10.5% in Q3). It fell in QLD (11.0%) and WA (12.8%), but rose in NSW (7.5%), VIC

(11.3%) and SA/NT (10.0%). Vacancy is expected to ease further to 9.1% & 8.3% in the next 1-2 years (9.6% & 8.8% in Q3), but remain above

survey average levels in all states bar QLD. Retail vacancy also fell a little to 6.0% in Q4 (6.2% in Q3). Vacancy was lowest in VIC (5.5%) and

highest in SA/NT (11.0%). Overall Retail vacancy is tipped to increase next year (6.3%) but fall in 2 years’ time (5.8%) – with vacancy lower in

all states bar SA/NT (13.0%). The national Industrial vacancy rate fell to a survey low 3.1% in Q4 (3.5% in Q3). It was lowest in NSW (2.7%)

and WA (2.8%) and highest in SA/NT (4.2%) and VIC (4.0%) – but below survey averages. Industrial vacancy is expected to remain very low

over the next 1-2 years (3.5% & 3.9%), led by NSW & QLD – see page 11.

Market Overview – Rental Growth & Supply

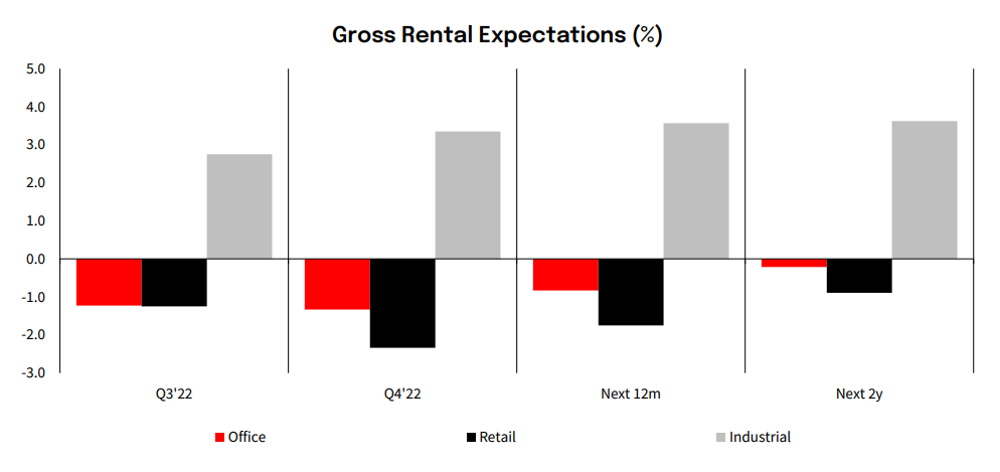

National Office rents in the next 1-2 years are now expected to fall -0.8% in the next year (-0.5% in Q3), and -0.2% in 2 years’ time (+0.2% in

Q3). The outlook is strongest in QLD (1.4% & 1.9%) and WA (0.4% & 1.4%), and still weakest by some margin in VIC (-3.8% & -3.1%). Retail

rents are now expected to fall by a larger -1.8% & -0.9% (-1.2% & -0.7% in Q3), and fall most in SA/NT (-3.8% in both years), followed by NSW

(-2.5% & -1.7%) and VIC (-2.6% & -1.0%). Modest growth is forecast in QLD (0.4% & 01%), with rents also expected to grow (and by most) in

WA in 2 years’ time (1.4%). The outlook for Industrial rents in the next 1-2 years was lifted to 3.5% & 3.9% (3.1% forecast for both years in

Q3). Rents are predicted to grow in all states led by NSW (4.2% & 4.3%), with rental growth slowest in SA/NT (2.8%) in the next year and WA

in 2 years’ time (2.8%) – see page 11.

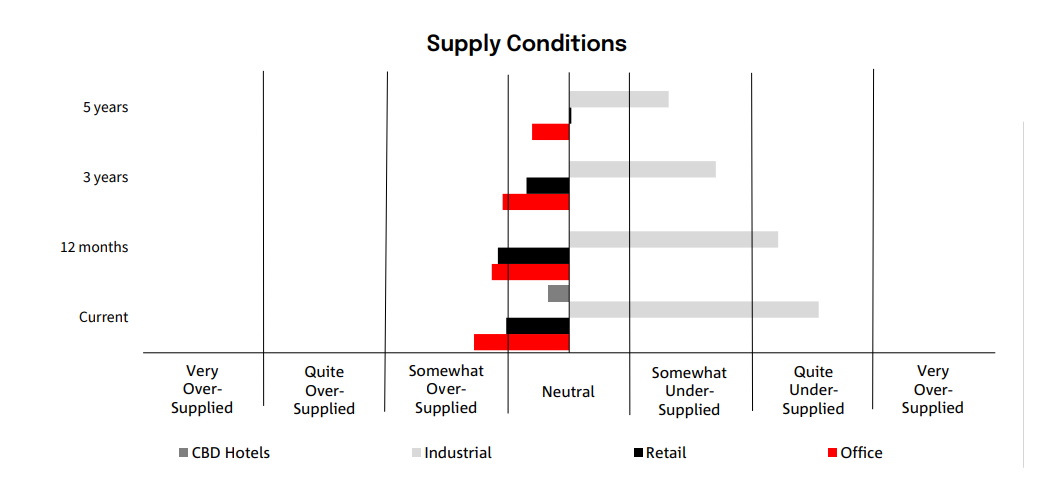

The national Office market is still currently “somewhat” over-supplied, and expected to remain that way in the next 1-3 years. All state

Office markets are expected to be over-supplied to some degree in the next 1-3 years, except in NSW where conditions are expected to be

“neutral”. Retail markets are also currently “somewhat” over-supplied, and expected to remain that way in the next 12 months. By state,

mild over-supply is expected to characterise Retail markets in SA/NT over the outlook horizon, and in VIC and NSW in the next 1-3 years.

Supply conditions in QLD are expected to be “neutral” over the outlook period. All states report an under-supply of Industrial property in

Q4, bar SA/NT. Conditions also are expected to be quite tight in next year, but moderate a little in 3-5 years’ time except VIC and SA/NT

(“neutral”). In the CBD Hotels sector, supply conditions are currently “neutral” and expected remain “neutral” over the next 1-5 years.

Market Overview – Development Intentions

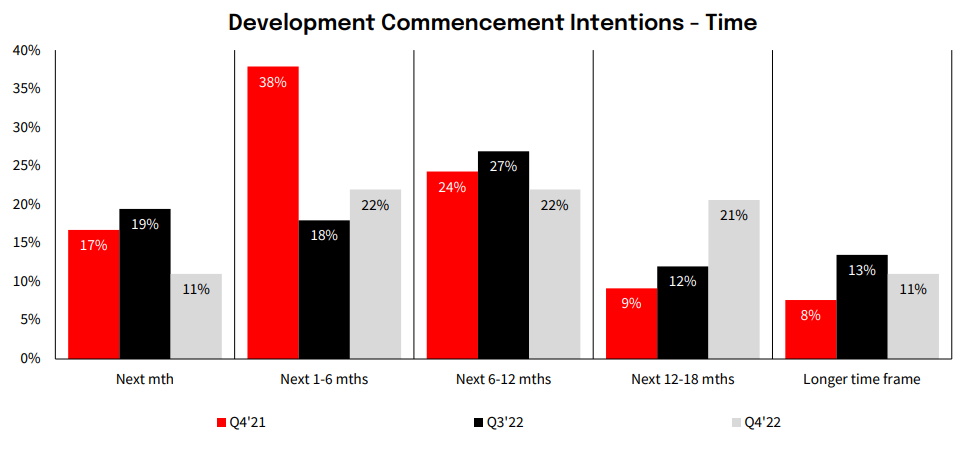

The number of property developers expecting to commence new works in the next 6 months fell for the fourth straight quarter to 33% (11%

in the next month & 22% in the next 1-6 months). This was the lowest result since Q3’19, and has now fallen well below the survey average

(48%). A below average 23% also intend to commence new works in the next 6-12 months (27% in Q3). A much higher number (21%) were

looking to start in the next 12-18 months (12% in Q3), and 11% were looking at a longer time frame (13% in Q3). In total, 3 in 4 (75%)

developers plan to commence new building works within the next 18 months – down from 88% at the same time last year, and also well

below the survey average level (84%).

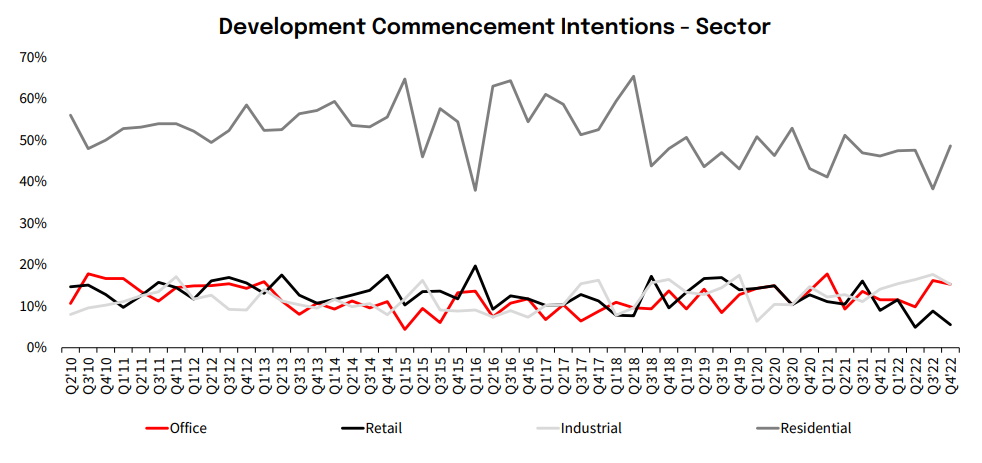

Around 1 in 2 (49%) property developers planning to commence new building works in Q4 were targeting residential property (up from a

survey low 38% in Q3). However, this is still below the survey average (52%), and appears consistent with a housing market that is

continuing to adjust to the impact of higher interest rates and falling building approvals during the quarter. An above average 15% of

developers however indicated plans to commence new works in the Office sector, and an above average 15% also in the Industrial sector.

But amid perceptions of persistent over-supply in the Retail property sector, the number of developers planning to commence new

building works in this sector fell to a near survey low 6% (9% in Q3) – less than half the survey average level (13%)

developers plan to commence new building works within the next 18 months – down from 88% at the same time last year, and also well

below the survey average level (84%).

Market Overview – Land Sources & Capital Intentions

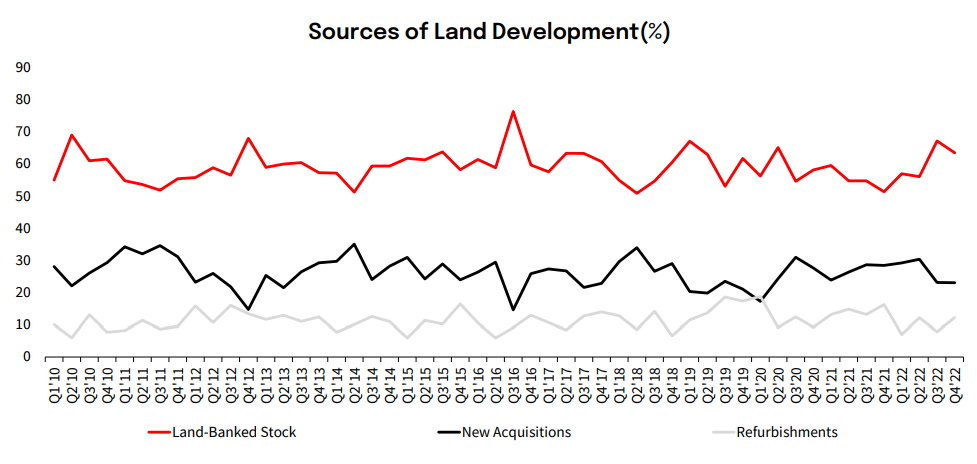

The number of surveyed property developers looking to use land-banked stock for their new projects fell slightly to 64% in Q4, after hitting

a 2½-year high 67% in Q3) – but remains above the survey average (59%). The number of developers seeking new acquisitions was

unchanged over the quarter at 23% – but down from 28% at the same time last year and below average (26%). The number of developers

looking at refurbishment opportunities in Q4 however kicked up to 12% (8% in Q3 but down from 16% at the same time last year), and

tracked slightly above the survey average (11%).

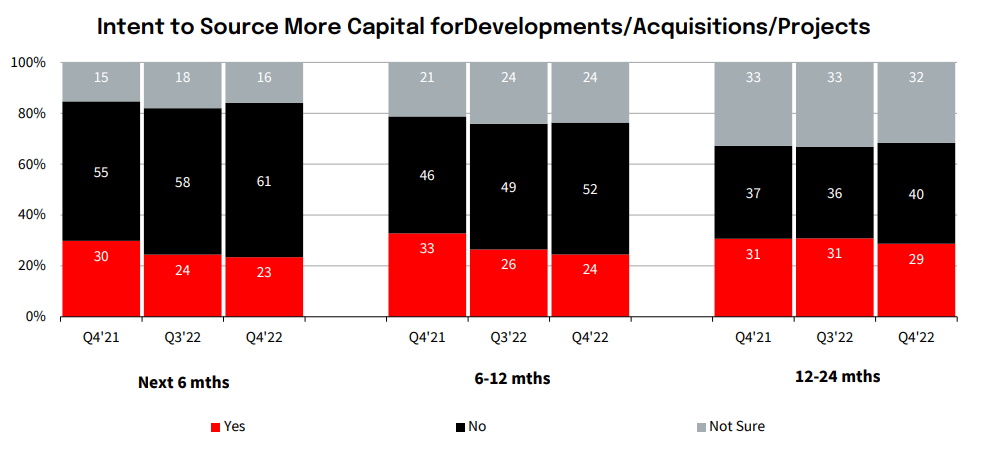

Intentions to source capital to fund new developments were little changed over the quarter, but somewhat weaker than at the same time

last year. The number planning to source more capital in the next 6 months eased to 23% (24% in Q3 and 30% in Q4’21), and in the next 6-

12 months to 24% (26% in Q3 and 33% in Q4’21). Around 61% had no intention to source capital in the next 6 months (58% in Q3), and 52%

had no intention to source capital in the next 6-12 months (49% in Q3). Around 16% were unsure of their intentions over the next 6 months

and 24% in the next 6-12 months. The number intending to source more capital in the next 12-24 months also fell a little to 29% (31% in

Q3), and 40% did not intend to source capital over this period (36% in Q3). Around 1 in 3 (32%) developers remained were unsure.

Market Overview – Ease of Funding & Pre-Commitments

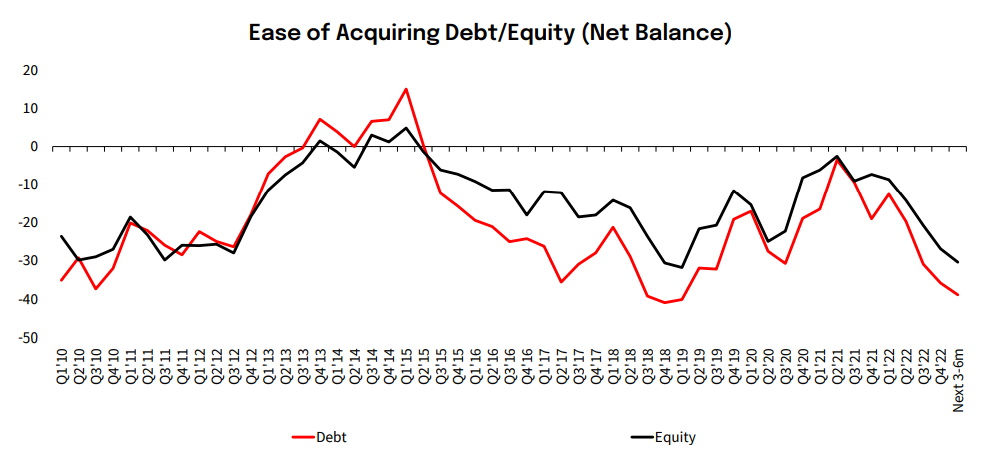

Property professionals said funding conditions worsened further in Q4, and expect them to continue worsening in the next 3-6 months.

With interest rates rising, the net number of property professionals who said it was harder to obtain borrowing or loans (debt) rose for the

third straight quarter to a near 4-year high -36% in Q4 (-31% in Q3 and -19% at the same time last year). Equity funding was also more

difficult in Q4, with the net number of property professionals who said it was harder to obtain equity rising for the fourth straight quarter to

-27% (-21% in Q3 and -7% at the same time last year). Looking ahead, more property professionals believe that funding conditions in the

next 3-6 months to be worse than now, with the net number for debt funding rising to -39% and equity -30%

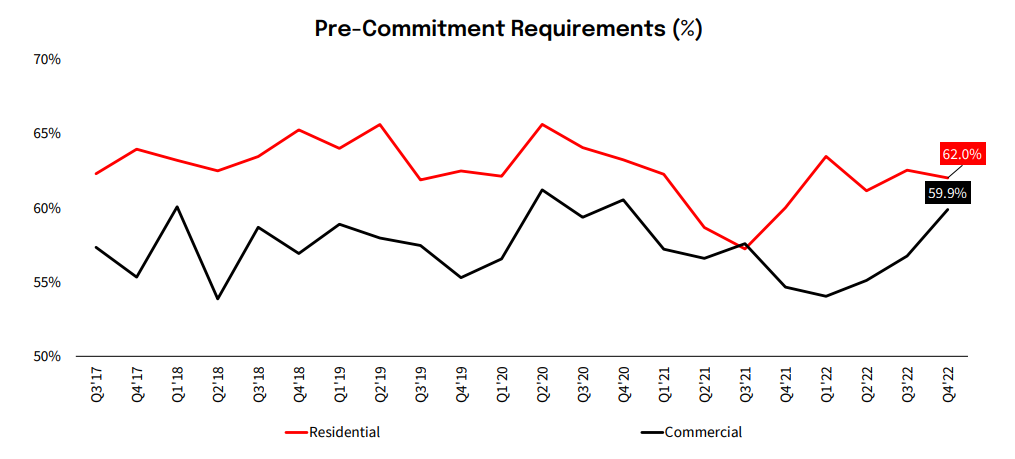

The average pre-commitment to meet funding requirements for new residential developments fell to a slightly below average 62.0% in Q4

(62.5% in Q3). The average pre-commitment for commercial property however climbed further to 59.9% (56.8% in Q3), and was somewhat

higher than average (57.3%). Residential requirements were broadly unchanged across states. It remained highest in WA (68.8%), followed

by VIC (64.4%) and NSW (61.7%). Requirements were lowest in QLD (56.9%). Commercial requirements were also highest in WA (66.7%) and

VIC (63.4%), and lowest in NSW (55.3%) and QLD (57.6%). But fewer property professionals see residential requirements worsening in the

next 6 months (-30% down from -40% in Q3) and 6-12 months (-27% down from -40%). Fewer also see commercial requirements worsening

in the next 6 months (-29% down from -40% in Q3) and 6-12 months (-24% down from -41%).

Special Survey Question – White Collar Office Space Needed

Compared to Pre-Covid

The COVID pandemic forced many Office-based businesses to transition to fully remote operations and let their employees work from

home. Though many have re-opened post the pandemic, hybrid working is still a reality for many white collar Office workers, with many

having returned to the Office in only a limited capacity.

As a result, maintaining building occupancy has become a major challenge. It has also forced building occupiers to re-calculate how much

space is needed for employees who do come into the Office.

In this survey, property professionals operating in the Office sector were asked to estimate how much Office space do white collar Office

workers need now compared to before to the pandemic, and how much space they will need in 12 months’ time.

On average, they believe that they now need only 72% of what they were using prior to the COVID outbreak. But this varied somewhat

across states. Property professionals in SA/NT estimate they need only 79%, followed by NSW/ACT (74%), WA (73%) and VIC (70%).

However, property professionals in QLD estimated they now only need around 66%.

Looking 12 months’ ahead, property professionals on average expect that number to climb slightly to 78%. They also expect white collar

Office workers will need more space than they do now in all states, led by SA/NT (81%), followed by QLD where requirements are expected

to rise sharply to 79% (from 66% now). Requirements are expected to be broadly similar in all other states, ranging from 78% in NSW/ACT

to 76% in VIC.

About the Survey

In April 2010, NAB launched the first NAB Quarterly Australian Commercial Property Survey with the aim of developing Australia’s preeminent survey of market conditions in the commercial property market.

The large external panel of respondents consists of Real Estate Agents/Managers, Property Developers, Asset/Fund Managers and

Owners/Investors.

Around 380 property professionals participated in the Q4 2022 Survey.