Keypoints

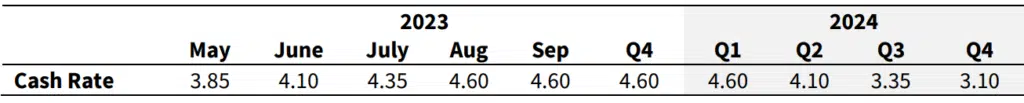

- Following the RBA’s decision to lift rates to 4.1% at the June meeting, we upped our rate call to 4.35% by August. We are now tentatively adding an additional 25bp increase, taking the cash rate to 4.6%. Timing is less certain, and we pencil in 25bp increases for July and August.

- While inflation has clearly peaked, and we (like the RBA) see inflation returning to the band by 2025, the extended period of inflation above target amidst a tight labour market poses the risk of stronger wage and price expectations becoming imbedded.

- Taking rates to 4.6% will weigh more heavily on growth and we have revised down our expectations for growth over 2023 to just 0.5% and pulled back expectations for 2024 to around 0.9%. That sees unemployment rise more quickly and reach 5.0% by end 2024. More details on the forecasts will be in our Forward View to be released Tuesday next week.

- We still see the RBA cutting interest rates back towards neutral in 2024 as a “forward-looking” central bank sees the slowing in growth and unemployment rising (negating the risk of ongoing strength in wage expectations) and it becomes clearer inflation is returning to target.

While the recent run of activity data including our business survey clearly show the economy is now slowing – as consumer spending begins to stall – inflation and wage data still show that price pressures remain elevated. This was highlighted by the Q1 national accounts which saw GDP growth of just 0.2% q/q and increasing signs of rates and inflation weighing on the consumer, while dwelling investment (typically very sensitive to rates, but also in this cycle cost pressures) continued to fall. The household income account showed a further moderation in the savings rate.

The nominal side of the accounts reflects what we already know in terms of passing the peak in inflationary pressure, but both the DFD and consumption deflators remain elevated. Interestingly, average earnings per hour (the broadest measure of labour costs, including bonuses and other payments) while accelerating continues to track below 4%. However, nominal unit labour costs which adjust labour cost growth for productivity, continue to track very strongly rising 2% q/q and tracking at near 8% y/y.

Domestic labour cost pressures will be important for how inflation moderates.

Global goods inflation pressures are waning as growth slows and freight costs have normalised pointing to a significant easing in upstream cost pressures for domestic consumer goods prices, albeit with some uncertainty about how quickly businesses will pass on any easing in prices to the consumer.

With the labour market remaining tight and wage growth accelerating the key risks to inflation remaining higher for longer come from the services side – as they have globally. While measured wage growth, according to the WPI, at 3.7% y/y is considerably below some other advanced economies, the average wage increase of those people (in the private sector) receiving a pay rise in recent quarters is above 4% pointing to the risk that overall WPI will continue to strengthen in coming quarters, with the most recent National Wage Case providing for even faster rates of wage growth for a significant proportion of the labour force, albeit the lower paid.

With weak cyclical productivity growth this is unlikely to see inflation track quickly towards the middle of the 2- 3% target band and indeed the RBA has noted that at present wage growth is consistent with inflation returning to the target band with the proviso that “productivity growth picks up”. Ultimately, recent tightening actions have been about inflation expectations – while previously well anchored there is a growing risk that ongoing price rises continue to feed back into price setting behaviour in the economy.

Alan Oster (Group Chief Economist), M: +(61 0) 414 444 652

Alt: Gareth Spence (Senior Economist); Brody Viney (Senior Economist)

Rates will increasingly weigh on growth, as the RBA seeks to drive a more sustainable balance between supply and demand.

Alongside the upgrade to our interest rate forecasts, we have pulled back our expectations for growth this year and next. We now see GDP growth of just 0.5% over 2023 and 0.9% over 2024. While the economy remained resilient through 2022, there are increasing signs that interest rates are beginning to flow through with nominal (and real) spending growth slowing, an ongoing impact on housing construction and softening capex expectations.

The labour market remains tight, but unemployment seems to be beginning to edge up (and we see it lagging activity by around 6 months). We now see unemployment of 4.3% by year’s end, 4.6% by mid-2024 and 5% by the end of 2024.

It should also be noted that there is still some outstanding pass-through of previous interest rate rises to occur, with around 75bps of hikes yet to be passed onto mortgage holders. On top of this, financial conditions will see a further marginal tightening as the TFF rolls off and RBA bond holdings begin to roll off the balance sheet. The bulk of fixed rate loans will also begin to reset in Q2 and follow on in Q3, though there are some lags in that pass-through as well.

Rates to return to more neutral level in 2024

On our expectation that the economy will slow noticeably in the second half of 2023 and into 2024, seeing annual GDP growth of around 0.5% this year (its slowest rate since the 1990s recession) and the unemployment rate rising above the NAIRU the RBA will need to return to forward-looking metrics when setting policy. At present the bank continues to focus on lagging indicators – prices and the labour market – while calibrating its stance of policy. However, by mid-2024 we expect slower growth to have had a significant impact on the labour market and see some easing in inflation pressure. Therefore, we continue to expect the cash rate to normalise to a more neutral rate of around 3% with rate cuts likely to commence in Q2 2024.

Table 1: Updated cash rate profile

Authors

Alan Oster, Group Chief Economist

Ivan Colhoun, Chief Economist, C&IB

Gareth Spence, Senior Economist

Tapas Strickland, Markets Economist

Taylor Nugent, Markets Economist

Brody Viney, Senior Economist

Group Economics

Alan Oster

Group Chief Economist

+(61 0) 414 444 652

Jacqui Brand

Executive Assistant

+(61 0) 477 716 540

Dean Pearson

Head of Behavioural & Industry Economics

+(61 0) 457 517 342

Australian Economics and Commodities

Gareth Spence

Senior Economist

+(61 0) 422 081 046

Brody Viney

Senior Economist

+(61 0) 452 673 400

Phin Ziebell

Senior Economist

+(61 0) 475 940 662

Behavioural & Industry Economics

Robert De Iure

Senior Economist – Behavioural & Industry Economics

+(61 0) 477 723 769

Brien McDonald

Senior Economist – Behavioural & Industry Economics

+(61 0) 455 052 520

Steven Wu

Senior Economist – Behavioural & Industry Economics

+(61 0) 472 808 952

International Economics

Tony Kelly

Senior Economist

+(61 0) 477 746 237

Gerard Burg

Senior Economist – International

+(61 0) 477 723 768

Global Markets Research

Ivan Colhoun

Chief Economist Corporate & Institutional Banking

+(61 2) 9293 7168

Skye Masters

Head of Markets Strategy Markets, Corporate & Institutional Banking

+(61 2) 9295 1196

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.

Please click here to view our disclaimer and terms of use.