Overview

- Fears around the US banking sector have eased since

mid-May, with central banks’ focus returning to

inflation (around 6.3% yoy in April) that remains well

above target ranges. The ECB hiked in June, and while

the US Fed paused, both banks are likely to increase

rates in July. - While market expectations suggest both central banks

are near the peak (fully pricing in one additional

increase for both), persistent inflation could drive

policy rates higher, adding downside risk to our

forecasts. - Economic growth across the major advanced

economies has been mixed, highlighted by the

contraction in the Euro-zone over Q4 2022 and Q1

2023, while Japan saw growth recover over this

period. While the fall in energy prices will help some

economies (notably in Europe and Japan) the

tightening in monetary policy is likely to keep growth

generally subdued. - Stronger readings for emerging market surveys in May

were largely driven by China. The strength of China’s

services PMI is somewhat at odds with ongoing signs

of weakness in the country’s domestic demand. Softer

goods demand in advanced economies will impact

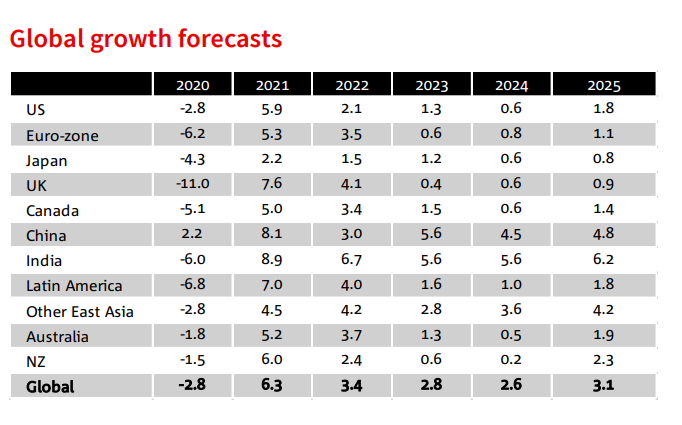

trade activity going forward – hitting EM growth. - Overall, our forecast for global economic growth in

2023 is slightly higher this month – reflecting the

impact of stronger than anticipated activity in India, a

pushing back of the expected slowdown in US growth

to H2 2023 (which negatively impacts the global

outlook in 2024) and a pickup in Latin America. We

expect the global economy to expand by 2.8% in 2023

(from 2.7% previously), before slowing to 2.6% in 2024

(2.7% previously). Excluding the outliers of the Global

Financial Crisis and initial wave of COVID-19, this

would be the slowest rate of growth since 2001. We

expect a modest upturn in 2025 (to 3.1%).

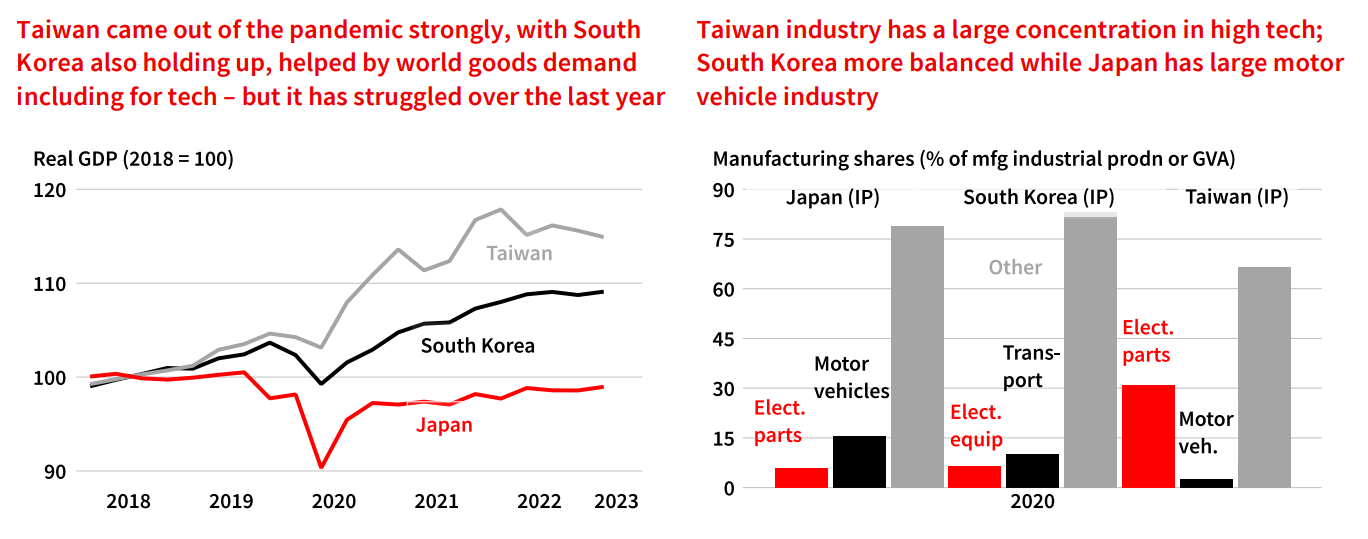

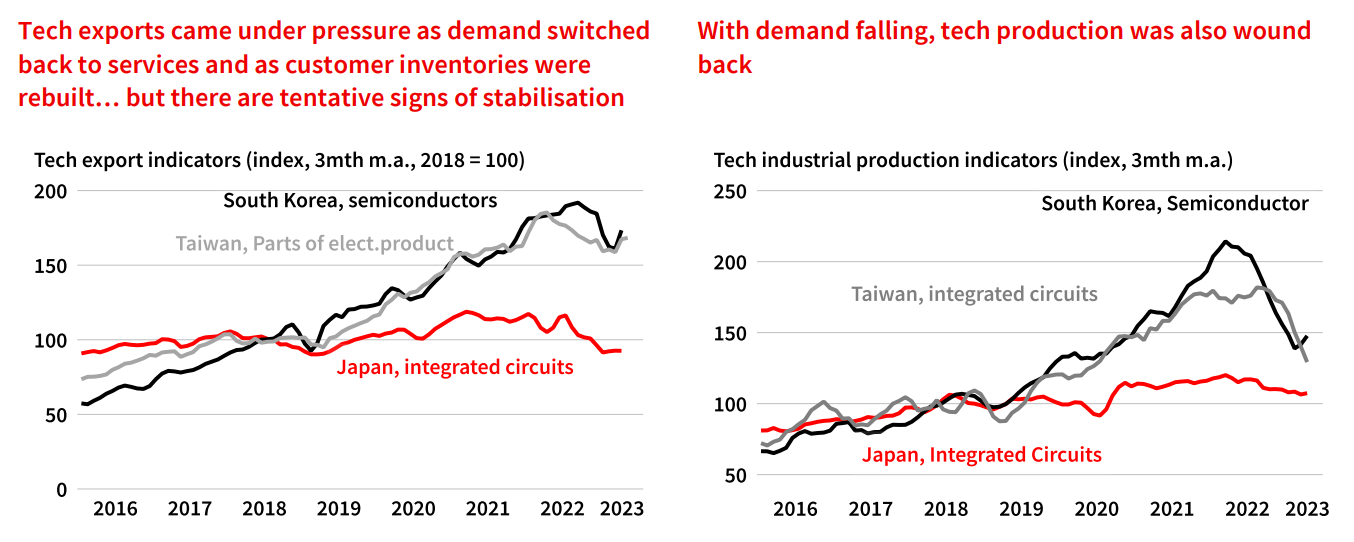

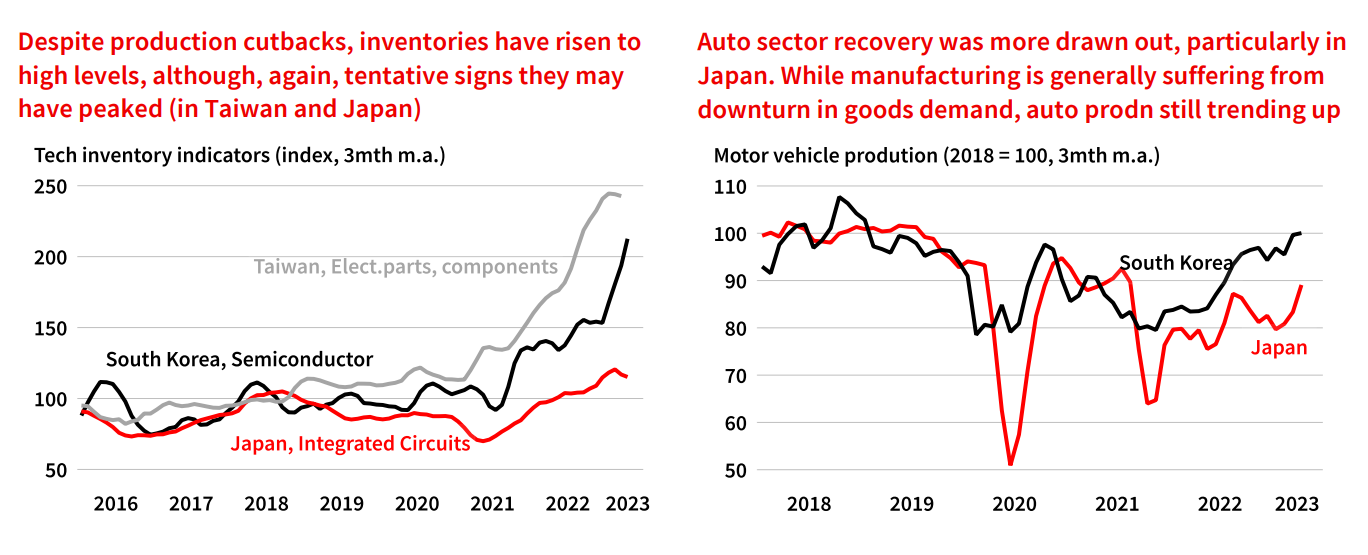

Charts of the month: Taiwan’s economy – which performed strongly in the aftermath of the pandemic – has contracted over the last year as global demand for high tech exports such as semi-conductors has fallen. This has also been a drag for Japan and South Korea, but they are less exposed to the tech cycle and the ongoing recovery in auto production has partially offset the

broader manufacturing downturn

Financial and commodity markets: banking fears subside, central banks still targeting inflation

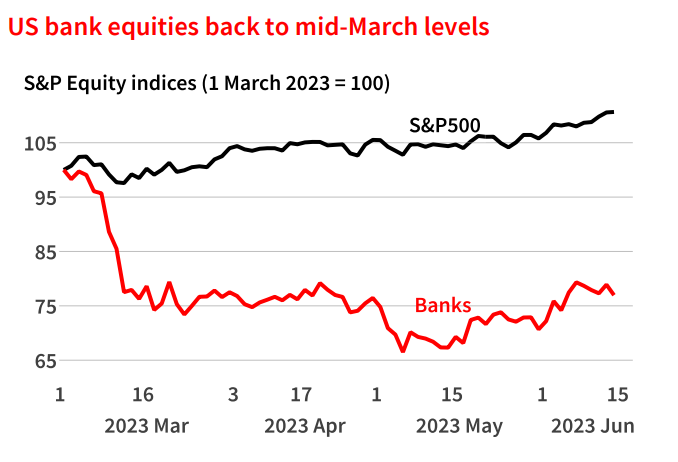

Fears around the US banking sector appear to have eased

once again – following the failure of First Republic Bank in

early May. Excluding the COVID-19 related plunge in early

2020, the US banking equities index fell in early May to its

lowest levels since August 2016, before subsequently

recovering to mid-March levels (post the initial fears).

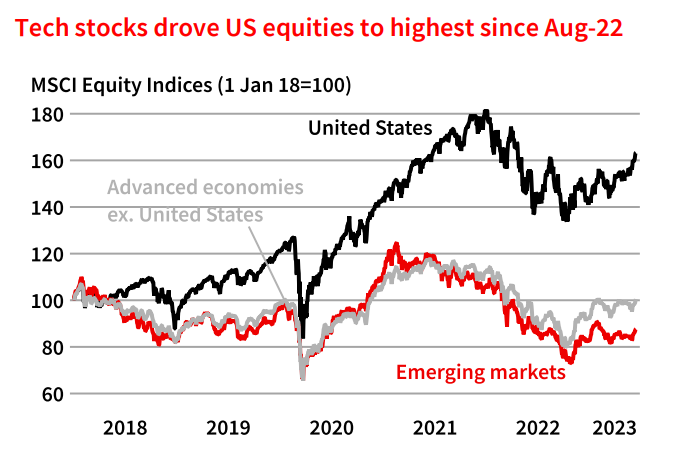

More generally, US equity markets (as measured by the

MSCI index) have trended higher since late May (up to their

highest levels since August 2022, but still well below their

peaks of early 2022). It is worth noting that these gains

were concentrated among the eight largest tech firms

(with the rest of the S&P 500 trending lower since late

May). In contrast to the stronger trend in the US, other

advanced economies and emerging markets have

essentially tracked sideways since the start of the year.

Despite the fears around stability in the banking sector,

volatility in equity markets (as measured by the VIX index)

has generally eased in recent months – trending down

from a recent cycle peak in October 2022 (despite a

modest upturn in early March). In contrast, volatility in

bond markets has been remained relatively high – the

MOVE index is above trends observed post the Global

Financial Crisis until 2022.

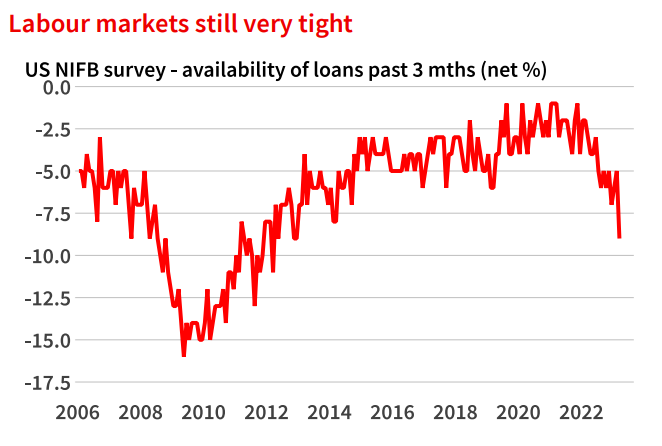

Government bond yields for most major advanced

economies remain below their early March peaks – in part

reflecting a downward shift in market expectations around

central bank policy rates (with stricter lending standards

among financial institutions following the bank fears seen

as effectively providing additional monetary tightening).

The key exception is the UK, where the 10-year bond yield

rose rapidly above 4% following a higher-than-anticipated

inflation print (particularly an uptick in core inflation).

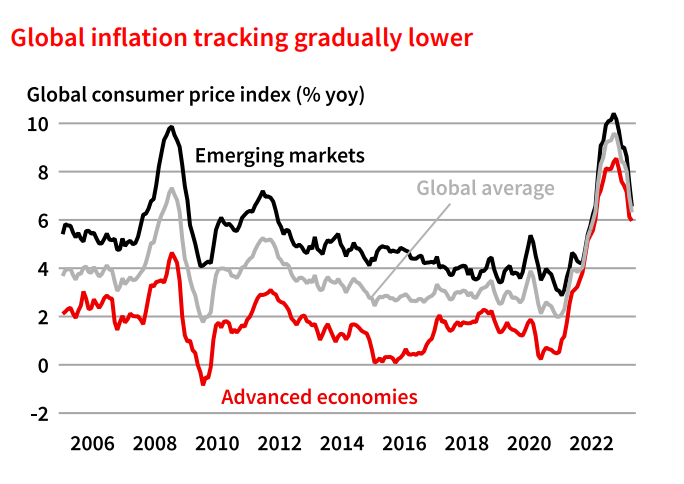

Overall, global inflation has continued to trend lower –

down to around 6.3% yoy in April 2023. While this has

slowed from a peak of around 9.6% yoy in September

2022, inflation has proved to be sticky – persisting at high

rates for longer than major central banks had anticipated.

Among the advanced economies, the US is leading the

way lower, with the CPI up 4.1% in May (despite core

inflation remaining relatively strong).

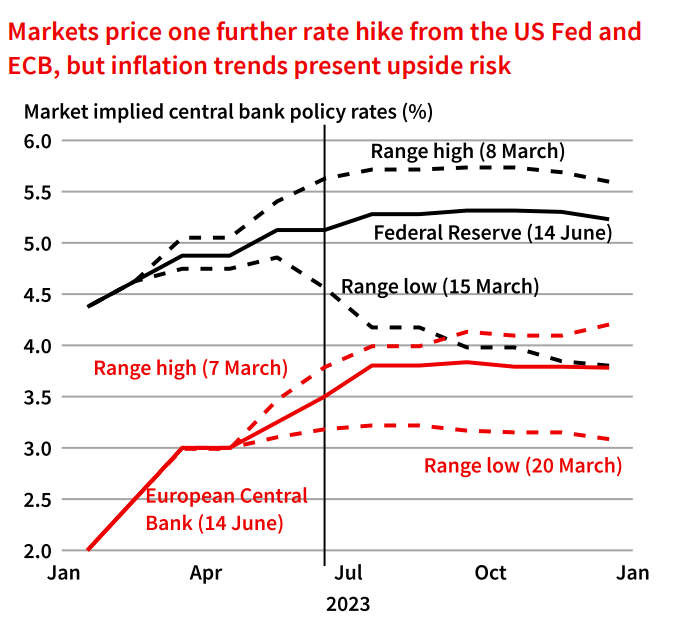

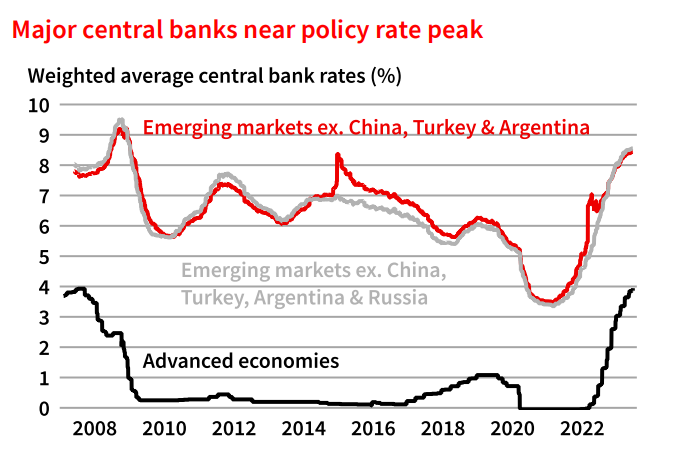

With inflation still above target in most economies, major

central banks remain on a tightening bias. The European

Central Bank (ECB) raised rates by 25 basis points in June,

while the US Federal Reserve (Fed) paused, albeit noting

that a hike in July remains in play. Market expectations

continue to suggest that both the Fed and ECB are near

the peak of the current hiking cycle (with one further hike

priced in for both institutions).

Commodity prices – as measured by the S&P GSCI – have

largely tracked sideways since early May, with lower

energy prices offset by an upturn in non-energy

commodities (on speculation of Chinese stimulus).

Advanced economies: As policy continues to tighten, the growth outlook remains weak

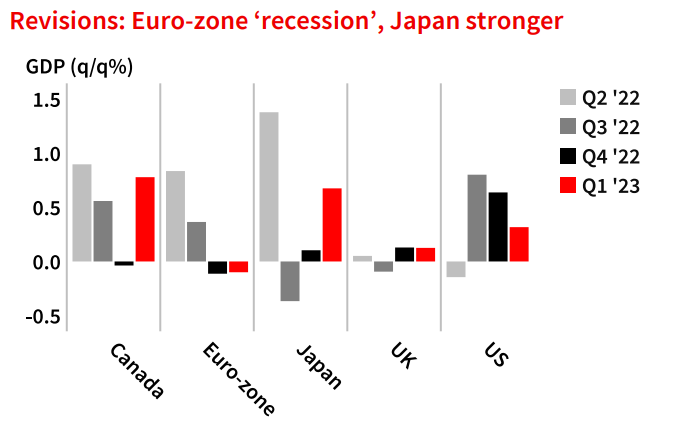

Euro-zone GDP growth in Q1 was revised down from +0.1%

to -0.1% q/q. With GDP also having fallen in Q4 2022

(also -0.1%), the ‘technical recession’ marker of two

consecutive quarterly declines has been met. These data

are still subject to revision, so conceivably it could move

out of recession again. Regardless, it is clear that the Eurozone economy came to a standstill at end 2022/early 2023

principally due to the impact of last year’s energy price

shock. This shock also weighed on the UK economy which

only grew by 0.2% over the year to Q1 2023.

In contrast, Q1 GDP growth in Japan was revised up to

0.7% q/q from 0.4%. Japan struggled in H2 2022, but is

now enjoying a bounce in growth, helped along by the

removal of remaining COVID restrictions (including on

overseas tourists this quarter). Japan’s auto sector has

also continued its drawn out recovery (see p2) and, while

weak global growth may constrain exports, the continued

rise in the PMIs suggests momentum remains positive.

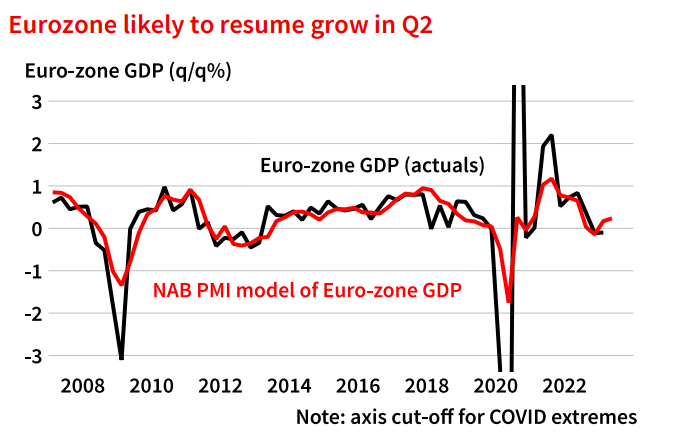

We expect the Euro-zone economy will grow in Q2, helped

by the fall in energy prices. However, the continued

tightening of monetary policy is a growing headwind. The

ECB raised rates again this month and signalled another

hike in July. The net result will likely be subdued growth.

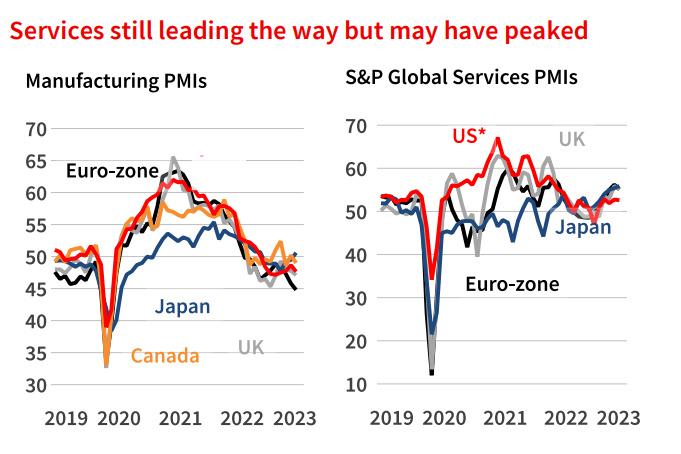

The Euro-zone PMIs are consistent with moderate growth

in Q2, even with the manufacturing sector PMI continuing

to slide. However, while still solid, the services PMI in the

Euro-zone recorded its first fall since late 2022, and the UK

services indicator fell (but both are still at a solid level).

The average of the US S&P Global and ISM services PMIs

also inched down but the two indicators moved in

opposite direction, making interpretation difficult. The

ISM measure is now at levels seen during recessions (or

their aftermath) but the S&P Global measure has been

recovering. Partial data early in the quarter point to

continued growth and so we recently moved out our

expectation of when the US economy might contract to H2

2023. We also now expect that the Fed will raise rates

again in July and pushed out the date at which we expect

the Fed to start cutting rates (to Q1 2024). This means

interest rates will be higher over the forecast horizon,

leading us to shave our 2024/25 forecasts.

While growth may have generally slowed, labour markets

remain tight, maintaining pressure on wages. Similarly,

while headline inflation is coming down, core measures

remain elevated (although there are some positive signs in

recent US and Euro-zone data). Because of this, there

continues to be upwards pressure on major central bank

policy rates. A clear, sustained shift down in inflation will

be needed to break this cycle. Accordingly, the main risk

to the outlook remains that persistent high inflation forces

central banks to raise rates to the point that there are

significant corrections in advanced economies.

Emerging markets: service sector outperforming; manufacturing hit by weaker global demand

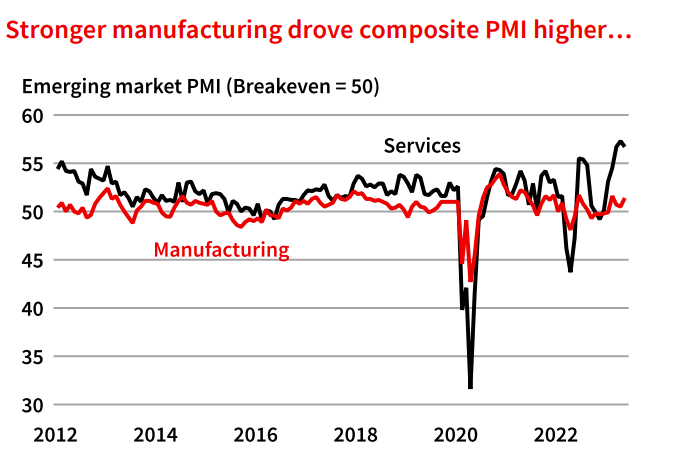

Business surveys in emerging markets remained

comparatively strong in May. Overall, the EM composite

PMI pushed higher to 55.6 points (from 54.9 points

previously), despite an easing in the services measure that

had been the key driver in recent months.

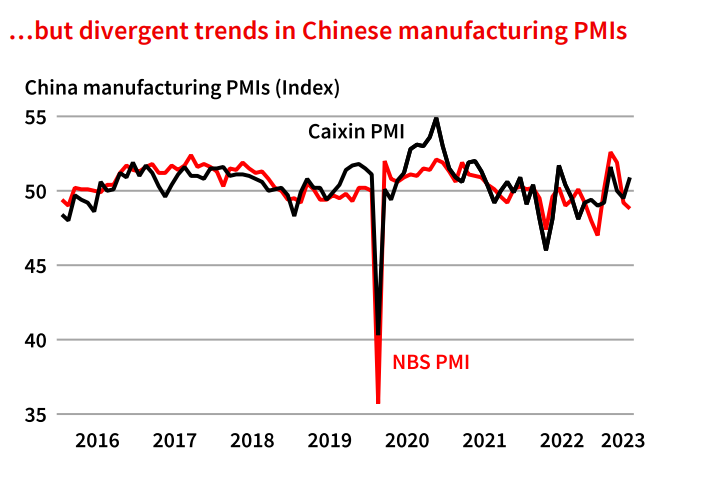

The EM manufacturing PMI moved up to 51.4 points (from

50.5 points in April). The key driver of this upturn was

China – where the Caixin manufacturing PMI switched

from a negative reading in April to a positive one in May –

supported by an upturn in India’s measure as well.

It is worth noting that China’s official manufacturing PMI

dropped further into negative territory in May.

Substituting this outcome for the Caixin measure would

result in the overall EM composite PMI pushing lower this

month – highlighting the importance of China to the

overall measure.

The EM services PMI drifted slightly lower – albeit

remaining at strongly expansionary levels – to 56.7 points

in May (from 57.3 points previously). Trends diverged

between major economies – with a stronger reading in

China offset by weaker results for both India (albeit

remaining very positive) and Russia.

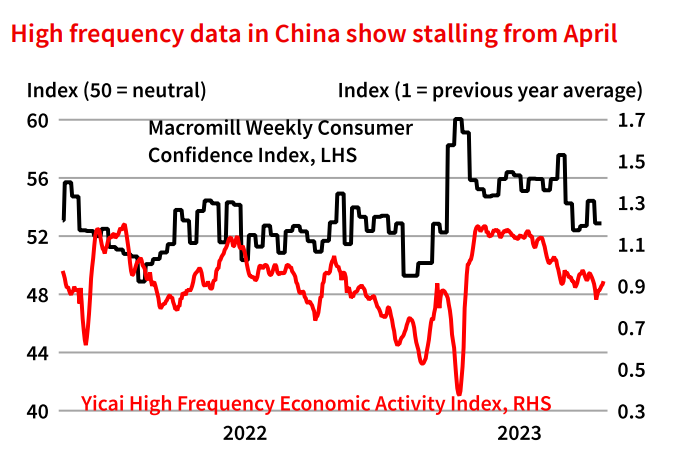

The strength of China’s services PMI is somewhat at odds

with ongoing signs of weakness in the country’s domestic

demand. While not encompassing the complete range of

services, China’s retail sales growth has been relatively

weak (when accounting for the impact of base effects).

Similarly, consumer prices have barely increased in recent

months, and policy makers are mulling further stimulus –

including further monetary easing and support for the

beleaguered property sector. Given weakness in consumer

confidence, it is not clear that such measures would have

a material impact on China’s growth in the near-term.

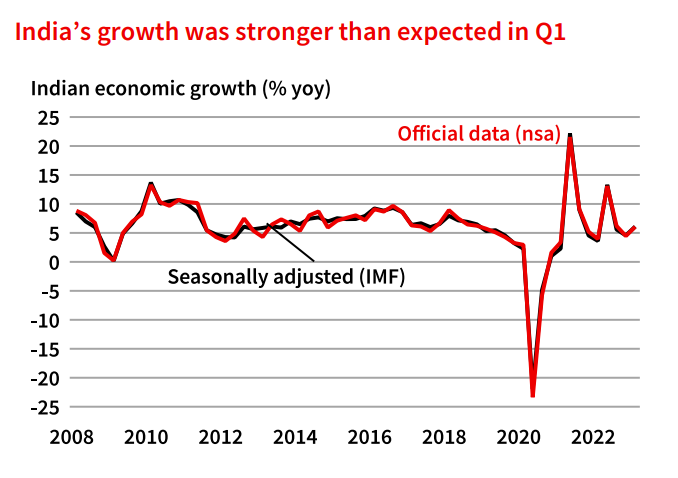

India’s first quarter economic growth was stronger than

anticipated – increasing by 6.1% yoy (compared with

consensus forecasts around 5.0% yoy). While domestic

consumption was relatively subdued, strong growth in

capital investment and exports were key drivers of this

increase.

Growth in emerging markets is typically more trade

dependent than for advanced economies. The impact of

tightening financial conditions and the rebalancing of

consumption towards services is set to negatively impact

emerging markets in the near-term.

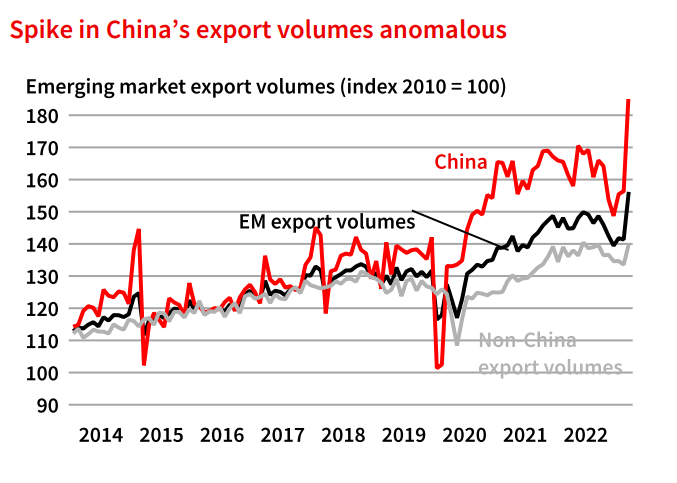

Global trade data are available to March and show a

surprise spike in EM export volumes in the final month.

This increase was driven by a 16.2% yoy increase in

exports from China – albeit this appears somewhat

anomalous. When a three-month moving average is

applied, the increase falls to just 1.3% yoy (highlighting

the weakness in both January and February), while

subsequent Chinese trade data has softened considerably.

Global forecasts and risks: stronger near-term growth negatively impacts outlook for 2024

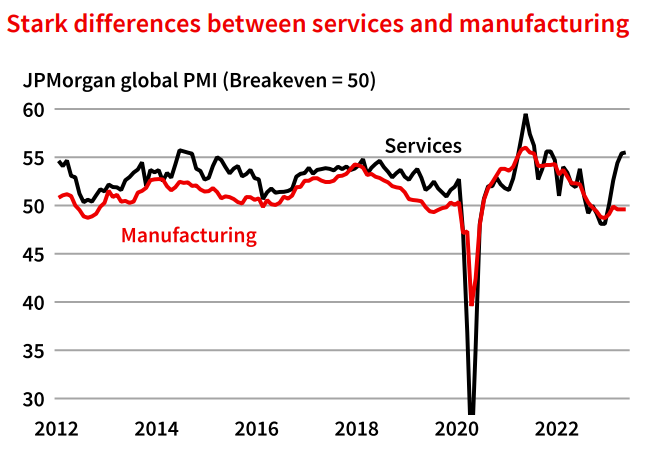

Global business surveys edged marginally higher in May,

with the JPMorgan global composite PMI at 54.4 points

(up from 54.2 points in April). The upturn in this measure

since December 2022 has been driven by the services

sector – with readings in both advanced economies and

emerging markets strengthening since late last year

(albeit EM services eased marginally from high levels in

May).

In contrast, the global manufacturing PMI has remained in

negative territory since September 2022. Modest gains in

the EM measure have been offset by declines in the

advanced economies.

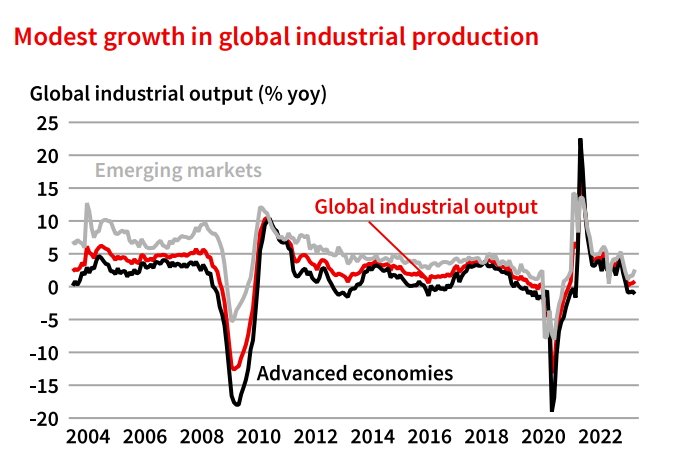

This trend is broadly consistent with data on global

industrial production – where historically modest year-onyear growth in global output reflects aggregate gains in

EMs that were partially offset by lower production in

advanced economies.

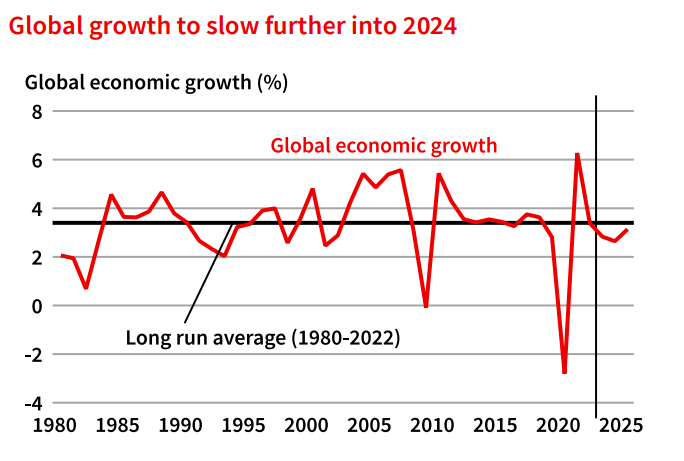

Overall, our forecast for global economic growth in 2023 is

slightly higher this month – reflecting the impact of

stronger than anticipated activity in India, a pushing back

of the expected slowdown in US growth to H2 2023 (which

negatively impacts the global outlook in 2024) and a

pickup in Latin America. We expect the global economy to

expand by 2.8% in 2023 (from 2.7% previously), before

slowing to 2.6% in 2024 (2.7% previously). Excluding the

outliers of the Global Financial Crisis and initial wave of

COVID-19, this would be the slowest rate of growth since

2001. We expect a modest upturn in 2025 (to 3.1%).

There remain a range of risks to this outlook. This includes

uncertainty around monetary policy (given the persistence

of inflation above central bank targets) – with the risk that

various major central banks could hike policy rates above

our current expectations, leading to deeper than

anticipated slowing in activity (including the risk of

recession in many regions). Similarly, there is uncertainty

as to when the easing of monetary policy will commence.

In contrast, China’s economic recovery from its zeroCOVID policies appears close to stalling – with the

anticipated rebound in consumption yet to eventuate.

While policy makers have been considering stimulus,

proposals have largely been supply side measures, with

little indication that these will revive flagging demand.

While fears around financial stability in the US have cooled

again since early May, there remains risk of further strains

in the financial markets emerging. Further policy rate rises

could reveal previously unidentified vulnerabilities.

Similarly, there remain geopolitical risks to the outlook.

The Russia-Ukraine conflict has persisted for over a year,

with little prospect of a near-term resolution, while

tensions between China and the United States remain –

albeit with an opportunity for improvement with US

Secretary of State Blinken currently visiting China.

Group Economics

Alan Oster

Group Chief Economist

+(61 0) 414 444 652

Jacqui Brand

Executive Assistant

+(61 0) 477 716 540

Dean Pearson

Head of Behavioural &

Industry Economics

+(61 0) 457 517 342

Australian Economics

and Commodities

Gareth Spence

Senior Economist

+(61 0) 422 081 046

Brody Viney

Senior Economist

+(61 0) 452 673 400

Phin Ziebell

Senior Economist

+(61 0) 475 940 662

Behavioural &

Industry Economics

Robert De Iure

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 477 723 769

Brien McDonald

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 455 052 520

International

Economics

Tony Kelly

Senior Economist

+(61 0) 477 746 237

Gerard Burg

Senior Economist –

International

+(61 0) 477 723 768

Global Markets

Research

Ivan Colhoun

Chief Economist

Corporate & Institutional

Banking

+(61 2) 9293 7168

Skye Masters

Head of Markets Strategy

Markets, Corporate &

Institutional Banking

+(61 2) 9295 1196

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice

contained in this document has been prepared without taking into account your objectives, financial situation or needs.

Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for

your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document,

before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.