Overview

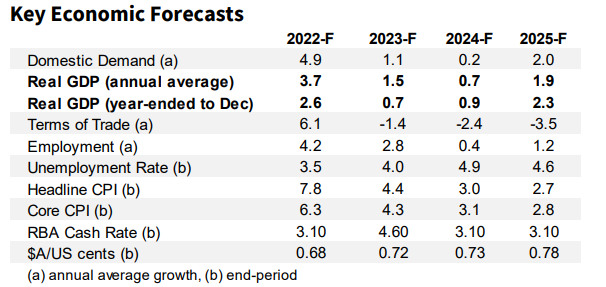

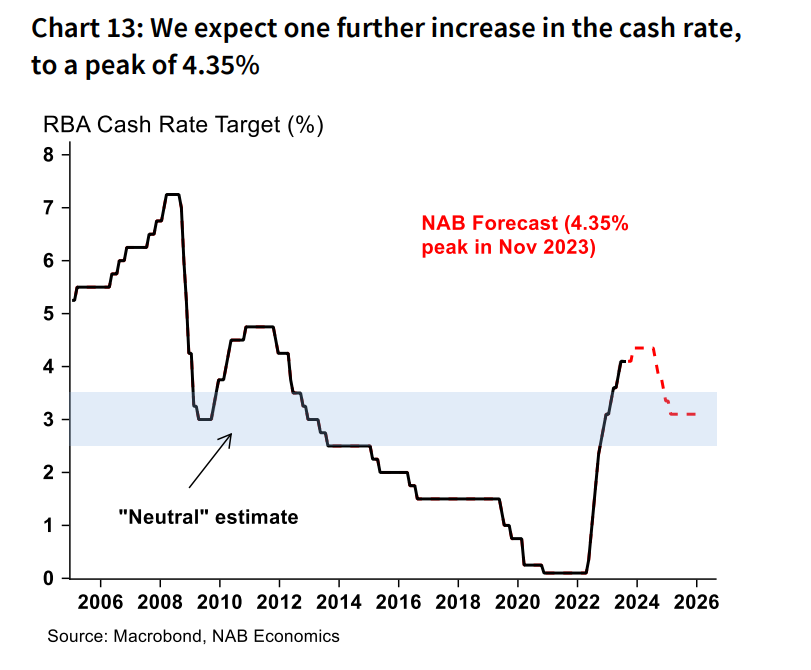

- With inflation moderating more than expected in Q2 and

further evidence of activity slowing, we now see only

one more rise in the cash rate, taking the peak to 4.35%

– most likely in November. - Our forecasts for GDP growth have strengthened

marginally, reflecting stronger Q2 exports, but we

nonetheless continue to expect growth to be well below

trend at 0.7% y/y in 2023 and 0.9% y/y in 2024. - High inflation and the ongoing pass through of rate rises

continues to weigh on households. Real consumption

was most likely flat in Q2 and we see small falls in H2

2023. Importantly, consumption growth should improve

in 2024 as inflation moderates and rates begin to

normalise. We see the RBA beginning to cut in August

2024, returning the cash rate to around 3% by early

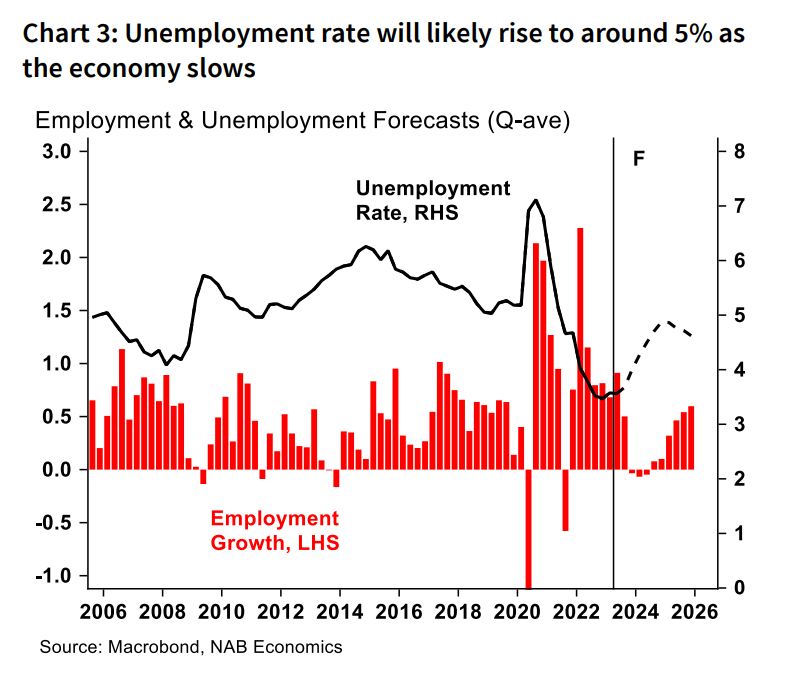

2025. - The labour market has remained very tight with the

unemployment rate still at 3.5% in June. This should

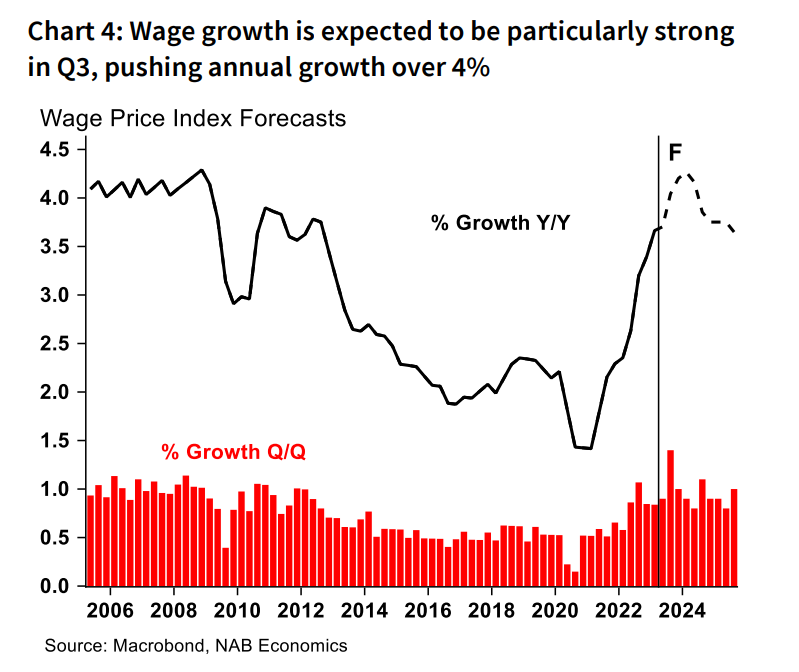

continue to support wage growth in the near term, and

we expect a strong WPI print for Q3 with growth around

4.2% y/y by end-2023. - As the economy slows, however, softening labour

demand should see the unemployment rate rise back to

4% by end-2023 and around 5% by end-2024. We expect

this easing to be enough to bring wages growth back to

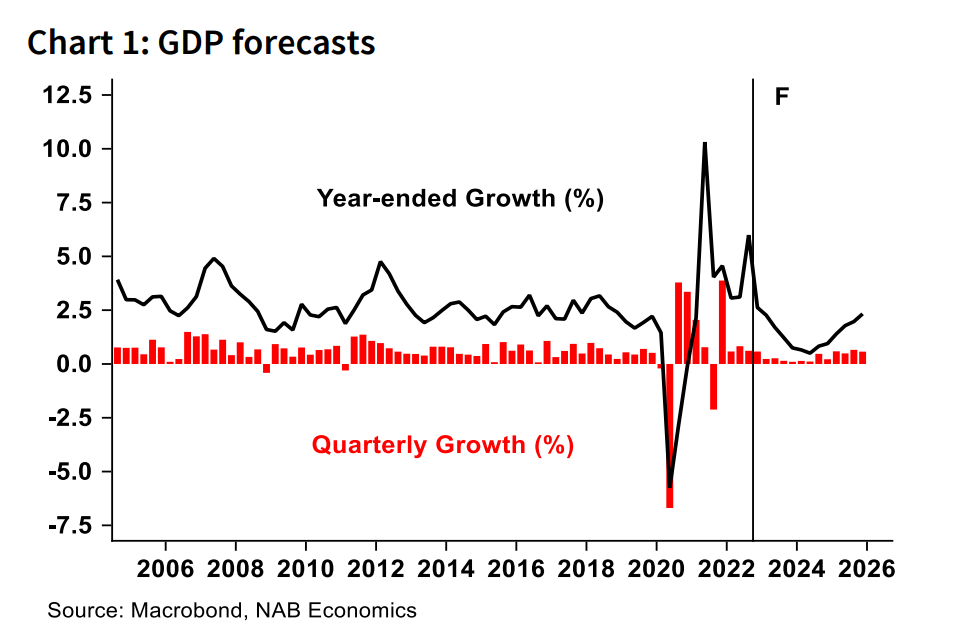

around 3.8% in 2024. - With the economy slowing and global supply chain

issues largely resolved, inflation has started to

moderate, falling to 6% y/y in Q2. We still see significant

pressures on the services side with Q3 CPI likely to show

a re-acceleration before further gradual easing to

around 3% in headline terms by end-2024. The easing in

the labour market and wage growth will play a part in

this but profit margins will also be squeezed as firms

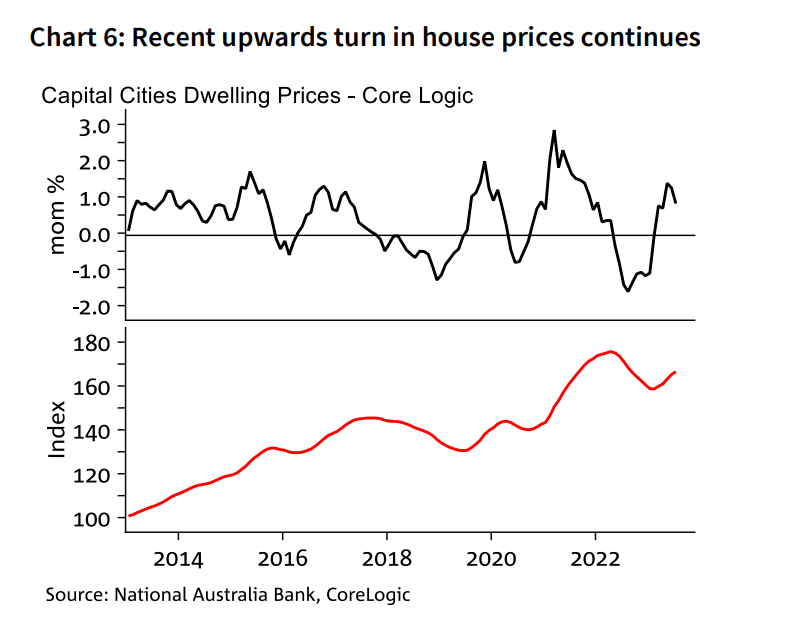

face into an environment of much softer demand. - House prices have continued to rise and have now

regained around half of the fall seen between mid-2022

and early 2023. Rents are also still rising strongly though

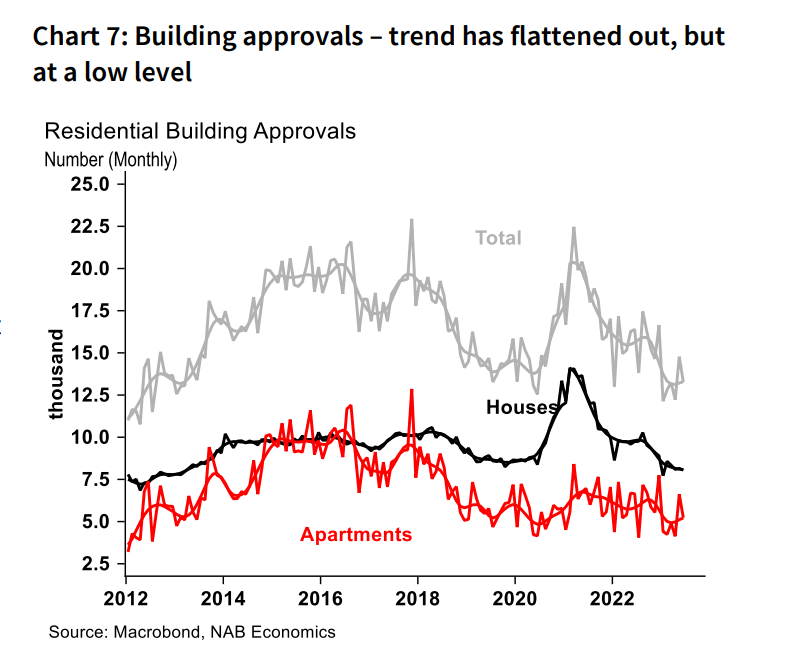

vacancy rates have started to edge back up. Building

activity is still set to ease further although approvals

have started to stabilise after falling early in the year.

Labour Market, Wages & Consumption

Wage growth is set to strengthen in the second half of

2023 as the labour market continues to show few signs

of easing – though we still expect unemployment to

rise eventually as the economy slows.

The unemployment rate was steady in June at 3.5% (with

the May result revised down from 3.6%). Employment rose

33k in the month, continuing a run of strength that has

kept the employment-to-population ratio at a historic

high of 64.5%. There are now more than one million more

people employed than in March 2020.

We continue to see the unemployment rate beginning to

rise later in the year as the economy slows and labour

demand softens, reaching around 4% by end-2023 and 5%

by end-2024.

Wage growth is now a key focus with the Q2 Wage Price

Index (WPI) out today likely to show growth remaining

around 3.7% y/y. Further ahead, we expect a strong rise in

Q3 as minimum and award wage increases take effect and

other wage adjustments occur in the context of a very

tight labour market. There is also some evidence that the

share of wages adjusting in July is rising, contributing to a

larger than usual seasonal effect.

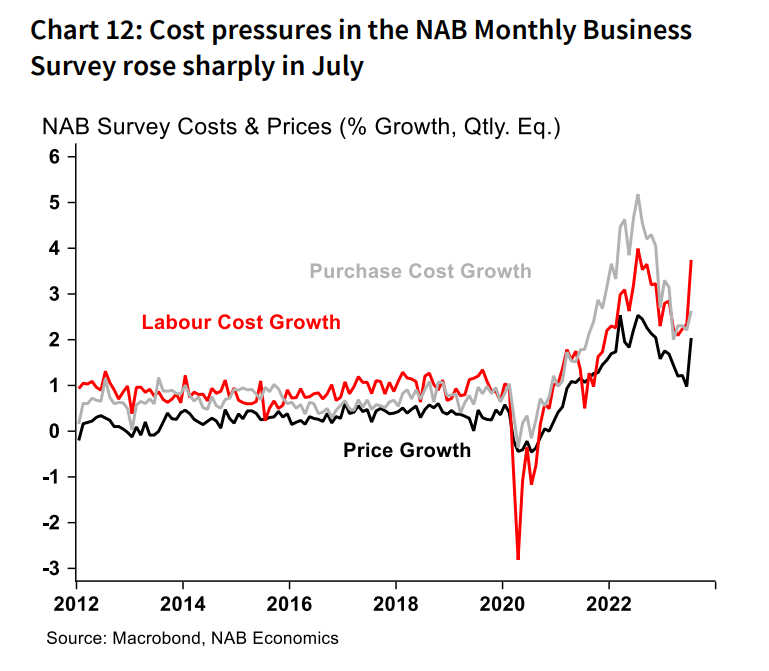

Labour cost growth in the NAB Business Survey rose

sharply in July, from 23% to 3.7% in quarterly terms, likely

reflecting a combination of these factors (though labour

cost growth also captures employment growth). In terms

of hourly wage growth (as measured by the WPI), we

expect to see growth of around 4.2% y/y for 2023 as a

whole, easing slightly to around 3.8% y/y for 2024.

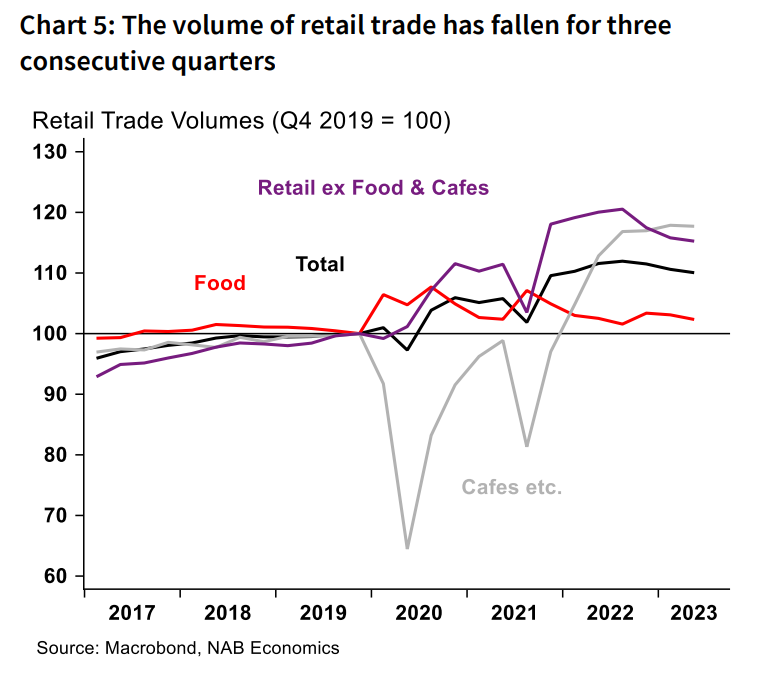

Real retail turnover fell in Q2, foreshadowing a soft

quarter of consumption growth with further weakness

likely to follow.

Retail trade declined by 0.5% in volume terms in Q2,

marking the third consecutive quarterly decline. Falls in

retail volumes have been rare outside of major downturns,

but the decline since late 2022 partly reflects the ongoing

rebalancing from elevated goods consumption towards

services consumption.

Nonetheless, there was a small 0.1% decline in cafes &

restaurants in Q2, the first fall in this component since

lockdowns ended and a possible sign the recovery in

services consumption has run its course. Components

such as health and rents should still rise, but we expect a

flat quarter for consumption growth overall.

Going forward, we expect the effects of inflation and

interest rates to dominate over coming quarters, seeing

real consumption declining slightly despite underlying

population growth. Consumption should begin to recover

from the second half of 2024 as rates begin to normalise

and real wage growth recovers.

Housing and Construction

House prices and rents continued to grow solidly in

July although the pace may have moderated. Housing

finance and (tentatively) building approvals have

stabilised of late and there are signs that construction

supply constraints are abating.

House prices again increased in July but at a slower pace

than prior months. The Core Logic Capital City Home Value

Index increased 0.8% m/m – down from 1.4% in May –

while the PropTrack measure rose only 0.2% (with its

recent high of 0.8% also being in May). Over the last five

months capital city prices rose 5.0% (Core Logic),

reversing about half the fall seen between mid-2022 and

early 2023. Dwelling prices grew by 1% m/m or more in

July in Brisbane, Adelaide and Perth and with no clear

softening from prior months, while they fell in Canberra

and were flat in Hobart.

Capital city rents also grew by 0.8% m/m in July (Core

Logic hedonic measure). The growth rate has eased from a

few months ago, but it is too early to identify any clear

downwards trend as the series has been somewhat

volatile. That said, vacancy rates have started to edge

back up although they remain at a very low level.

Housing finance approvals fell slightly in June (-1.0%

m/m) and are 18% lower than a year ago. That said, they

broadly appear to have stabilised (up over 7% over the last

four months). The number of loans to owner-occupiers for

new home construction increased in June (up 6%), but

remains very low by past standards. Similarly, in trend

terms, dwelling approvals have levelled off for now (the

7.7% fall in June followed a larger rise in May) although

this improvement is driven by the volatile other (nonhouse) dwelling category so it is a tentative conclusion.

We still expect to see further falls in residential investment

even as we near the peak for interest rates in this cycle.

Residential investment has fallen in six of the last seven

quarters (to Q1 2023) and is forecast to continue falling

through the rest of this year and into 2024. It should be a

relatively gradual decline as there is still a large pipeline of

work.

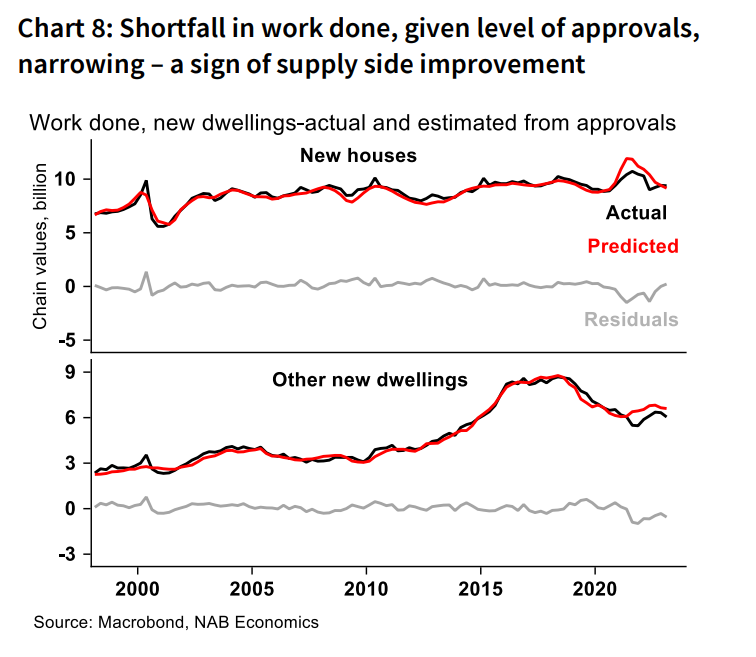

Supply disruptions and labour shortages meant that in

recent years work done has been well below what would

be expected given approvals. There are signs that this is

now turning around. Construction sector respondents to

NAB’s Quarterly business survey suggest labour

constraints have become less significant (even though

they remain an issue) while material constraints have also

eased. Housing cost construction inflation is now running

at 1% q/q or below depending on the measure used – well

down on the 4-6% q/q pace seen in 2022. This still leaves

the level of housing costs well above their pre-COVID level

(over 30%) which, together with the lift in interest rates,

will be an impediment to investment for a time to come.

Business and Trade

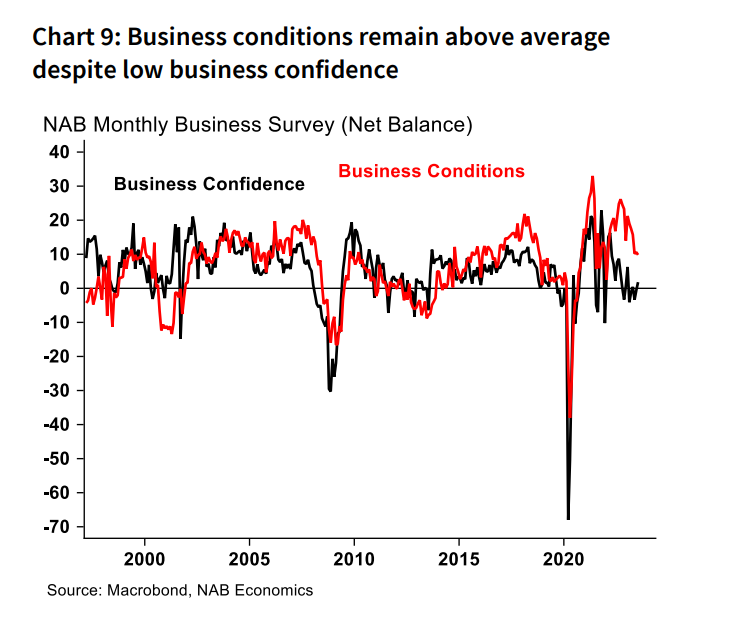

Business conditions have remained resilient despite

weakness in forward indicators, and capacity

utilisation remains elevated.

Business conditions in the NAB Monthly Business Survey

were broadly steady at +10 index points in July with the

trading, profit and employment sub-components all

steady. Retail conditions strengthened, reversing a fall in

June, and remain above average despite the weakness in

recent retail trade data. Overall capacity utilisation also

rose in July, back to 84.6% to remain well above average.

The resilience of the survey’s conditions measures

continues to contrast with soft leading indicators with

business confidence still low (+2 index points) and forward

orders still negative (-1 index point).

Higher rates and low confidence levels continue to cloud

the outlook for investment. Total business credit growth

slowed further in June, to 0.3% m/m (from 0.5% in May).

We continue to see softer growth in business investment

over the period ahead as a result.

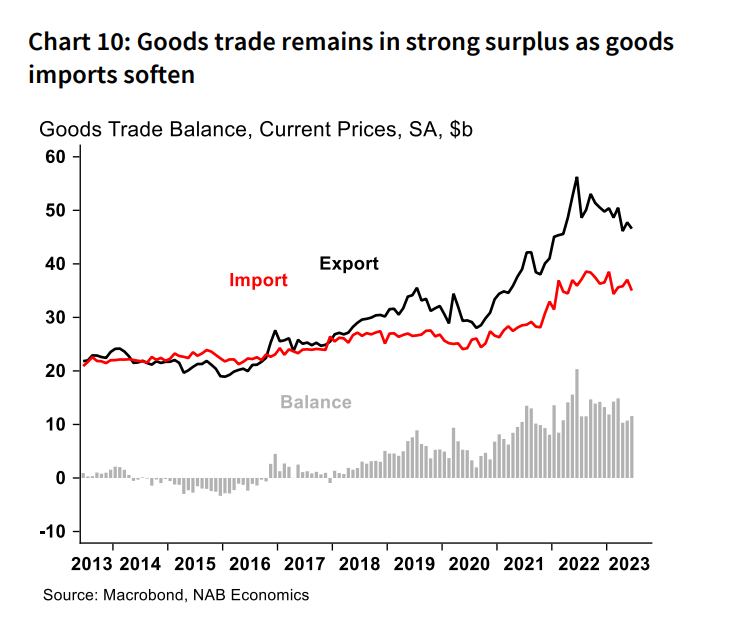

The nominal trade surplus rose to $11.3b in June (from

a revised-down $10.5b in May). Net exports likely made

another strong contribution to real GDP growth in Q2,

and should continue to support growth as weak

consumption weighs on imports.

Exports declined 1.7% in the month, largely driven by coal

and oil and gas as prices fell. However, the decline in

exports was more than offset by a 3.9% fall in imports,

driven by a large fall in consumption goods (down 12.4%).

This was largely the result of a sharp fall in non-industry

transport equipment imports which have been volatile as

backlogs have cleared and the 30 June end of the instant

asset write-off scheme has approached.

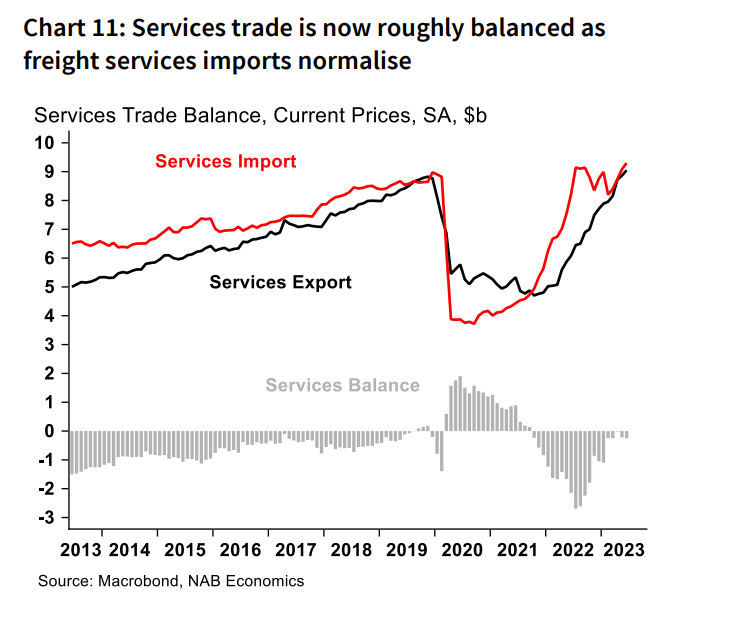

For services, there was a further pickup in both exports

and imports in the month with services trade now roughly

balanced. Freight services – which surged during the

supply chain crisis – have continued to normalise, now

down to 4.1% of the total value of goods imports.

For Q2 as a whole, nominal exports declined but this was

more than explained by price movements with large falls

across key commodities. As such, the underlying volume

of exports likely increased by around 4%, while import

volumes are expected to have been broadly flat. As a

result, net exports likely contributed 0.5-0.7ppts to GDP

growth in the quarter.

Further ahead, we continue to expect weak demand to

weigh on imports more broadly over coming quarters,

while the continued normalisation of global trade should

support export volumes.

Monetary Policy, Inflation and FX

The Q2 CPI showed some further progress on inflation

but significant pressures remain – particularly in Q3.

Headline CPI in Q2 rose 0.8% q/q (6% y/y) and the

trimmed mean grew at 0.9% q/q (5.9% y/y), marking

significant progress from the very elevated rates seen in

2022. In the detail, there was improvement across both

goods (0.9% q/q, down from 1.2% in Q1) and services

(0.8% from 1.7%). However, market sector measures,

which better reflects general supply and demand

pressures, accelerated slightly.

Food price growth remained elevated at 7.5% y/y and

while new dwelling prices are moderating (7.8% y/y from a

peak of over 20% in 2022) rent inflation reached 6.7% y/y

to be the highest since 2009. There was also a large rise in

insurance prices in the quarter.

Further improvement in goods prices is expected but

progress on services inflation is likely to be slower with

pressure coming from higher wage growth, energy prices,

and the ongoing pass through of elevated market rents.

These challenges were evident in the NAB Monthly

Business Survey in July. As noted above, labour cost

growth jumped from 2.3% to 3.7% in quarterly terms, and

purchase cost growth also rose from 2.2% to 2.6%.

Businesses appeared to pass some of these pressures

directly to consumers with product price growth up from

1% to 2%. Price growth in the retail sector rose to 2.6%,

while in recreation and personal services it was 2.9%.

On balance we see a strong Q3 inflation print as likely

before inflation gradually moderates to around 4.5% by

end-2023 and 3% by end-2024.

With inflation moderating, the RBA kept rates on hold

again in August, and we now see scope for only one

further rise to a peak of 4.35% (previously 4.6%).

The Board viewed the risks around inflation as “broadly

balanced” and appear willing to wait to be pushed to raise

rates further. The longer they wait, the more we expect the

economy to slow, limiting the need for further increases.

However, we expect the strength of inflation through Q3

will push the Board to take out additional insurance

against inflation remaining above target. In fact, the

updated RBA staff forecasts published post-meeting

showed the crucial mid-2025 inflation forecast has crept

higher, to 3.2% – with an assumed rate path including one

further rise.

We see a rise in the cash rate to 4.35% in November as

most likely, after the release of the full Q3 CPI, and rates

should remain at that level until the second half of 2024.

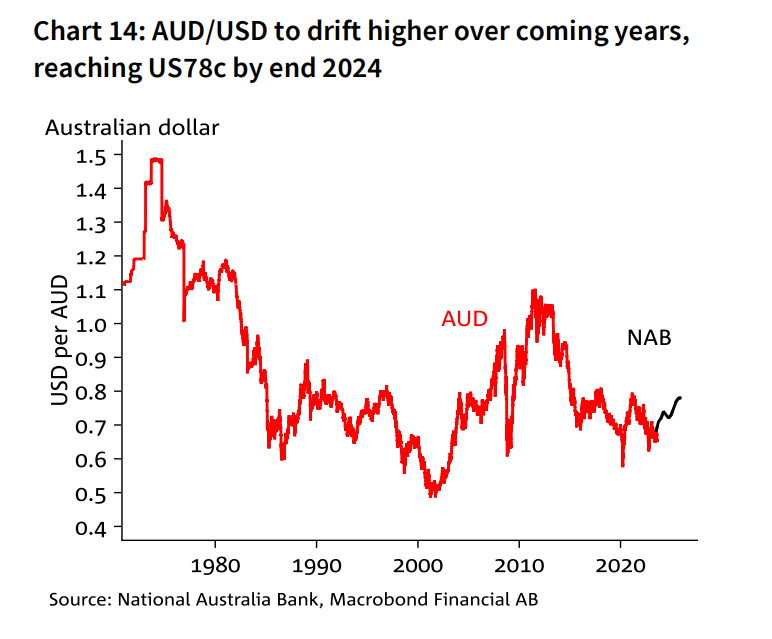

The AUD has weakened since mid-July, back to the low

US65c range after almost reaching US69c.

Rising US yields and weak China growth are weighing but

we still see the AUD returning to US72c by December.

Theme of the Month: Household Disposable Income

With interest rates rising more than 400bps in a year

and signs that consumption is slowing, household

disposable income is a critical factor shaping the

outlook. However, the forces acting on household

incomes are varied.

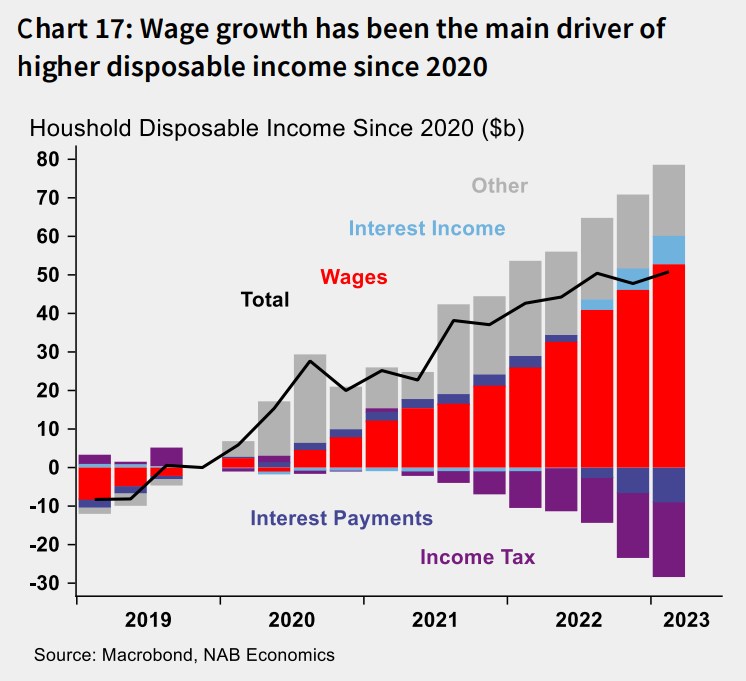

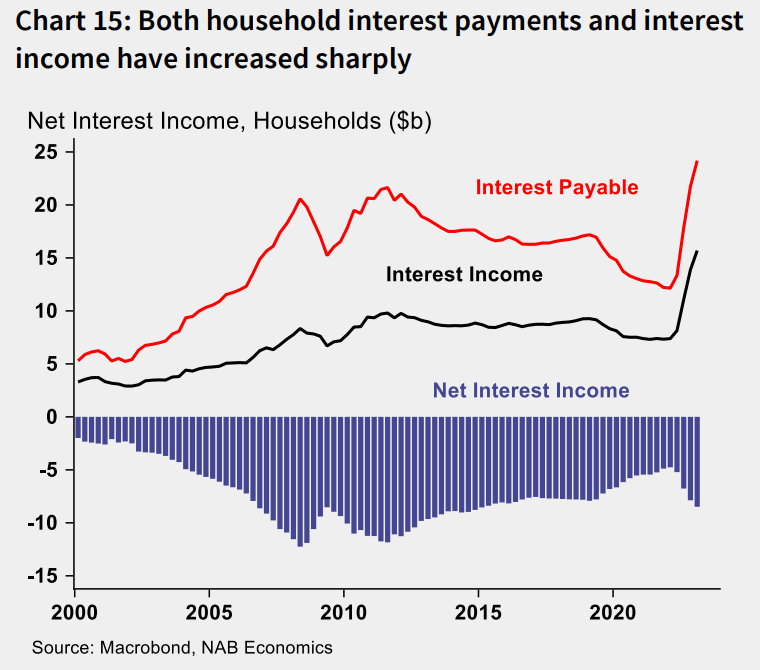

In aggregate, interest payments by households have

increased sharply to be around $12b per quarter higher in

Q1 2023 (relative to Q1 2021), but interest income has also

increased, with the net interest cost to the household

sector per quarter increasing only around $4b. Both

interest payable and income likely rose further in Q2.

The distribution of interest income and payments is likely

to be highly uneven across households, and not all

interest income is available to support cashflow (for

example, earnings within superannuation accounts).

Nonetheless, the two-sided impact of higher rates is an

important feature shaping disposable income.

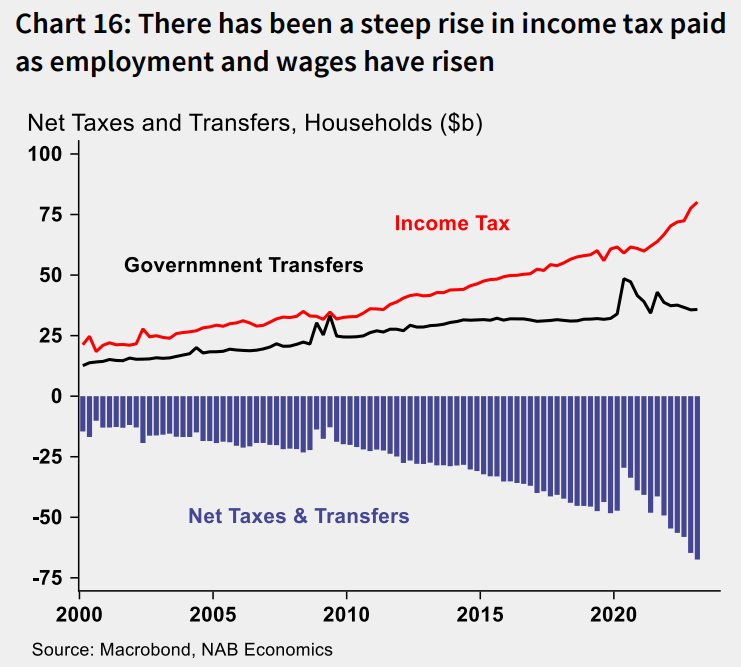

Importantly, the shifts in interest rates are relatively small

when compared to the shifts in wage income and taxes.

The strength of the labour market has meant that wages

income has grown rapidly, to be around $53b per quarter

higher than pre-COVID. There has also been a

corresponding rise in income taxes paid, which are around

$19b higher per quarter, while transfer payments have

normalised as pandemic payments have ended.

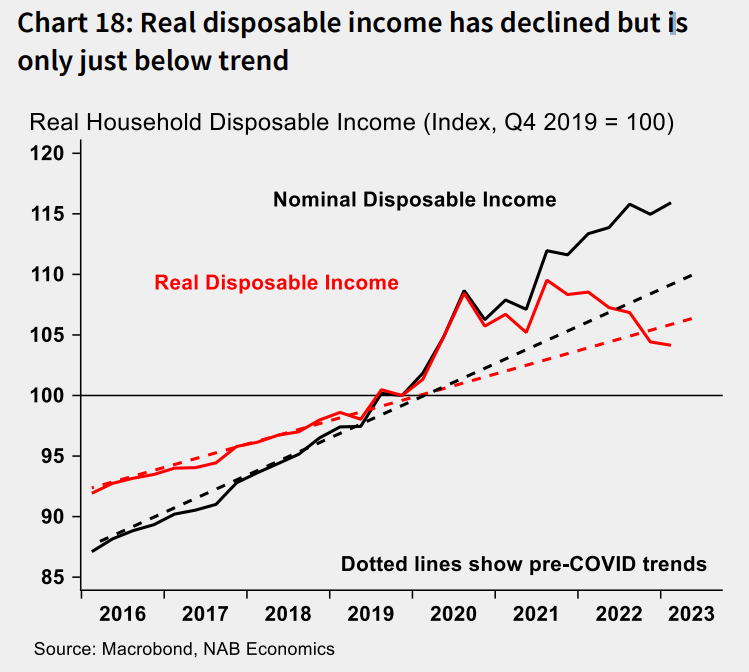

All of these effects have been swamped by the impact of

inflation. Adjusting disposable income for change prices

(using the consumption deflator), real disposable income

grew during the pandemic period as government support

flowed to households, but has declined steadily since Q3

2021 as prices have rapidly increased. In per capita terms,

this represents an even more dramatic correction,

underlining the significant pressures facing households.

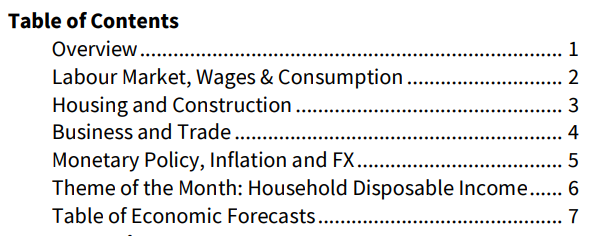

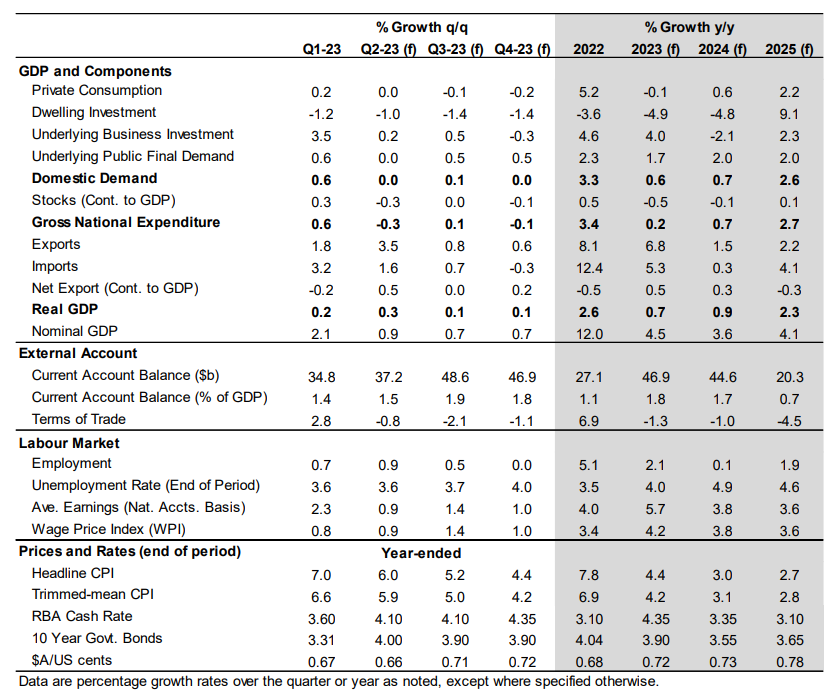

Table of Economic Forecasts

Group Economics

Alan Oster

Group Chief Economist

+(61 0) 414 444 652

Jacqui Brand

Executive Assistant

+(61 0) 477 716 540

Dean Pearson

Head of Behavioural &

Industry Economics

+(61 0) 457 517 342

Australian Economics

and Commodities

Gareth Spence

Senior Economist

+(61 0) 422 081 046

Brody Viney

Senior Economist

+(61 0) 452 673 400

Behavioural &

Industry Economics

Robert De Iure

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 477 723 769

Brien McDonald

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 455 052 520

International

Economics

Tony Kelly

Senior Economist

+(61 0) 477 746 237

Gerard Burg

Senior Economist –

International

+(61 0) 477 723 768

Global Markets

Research

Ivan Colhoun

Chief Economist

Corporate & Institutional

Banking

+(61 2) 9293 7168

Skye Masters

Head of Markets Strategy

Markets, Corporate &

Institutional Banking

+(61 2) 9295 1196

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice

contained in this document has been prepared without taking into account your objectives, financial situation or needs.

Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for

your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document,

before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.