Overview

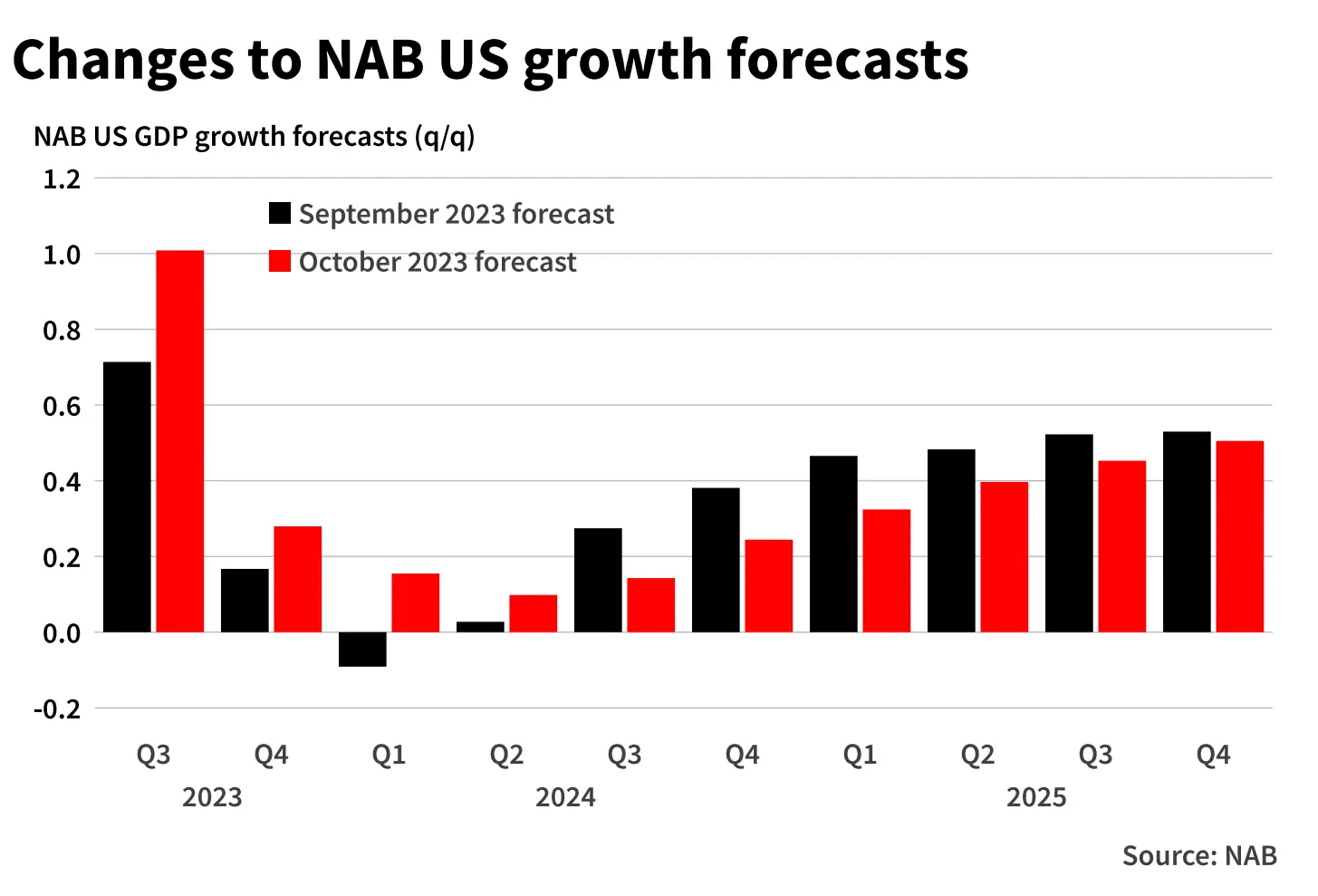

• Upwards revisions to past data for household

income and profits, as well as partial data

pointing to strong growth in Q3, see us revise up

our outlook for GDP growth out to mid-2024.

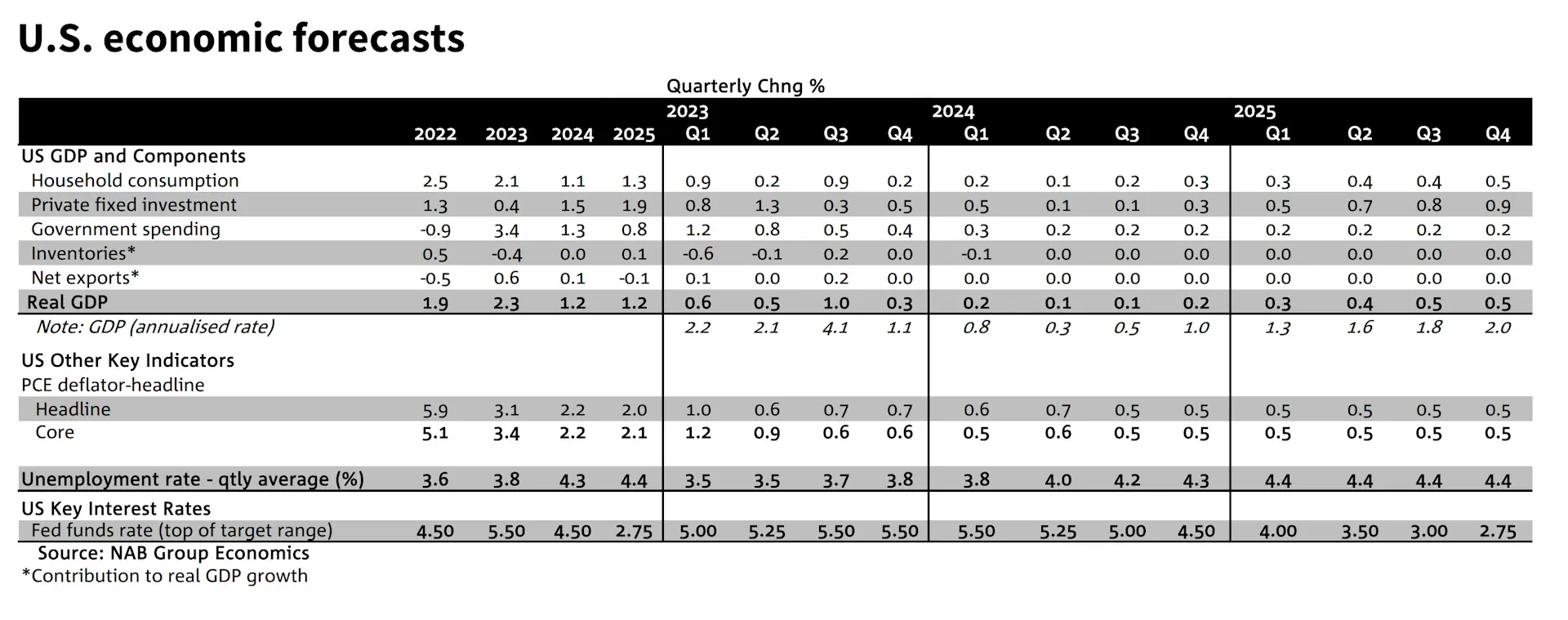

• For the full year, we see GDP growth of 2.3%

(from 2.1%) in 2023 and growth in 2024 and 2025

of 1.2% (previously 0.8% and 1.7% respectively).

• We have maintained our view that the Fed won’t

hike again this year, but acknowledge it is

possible, particularly if upcoming inflation data

are on the high side.

• We now don’t see the Fed cutting rates until June

2024 (previously March 2024).

The past looks better

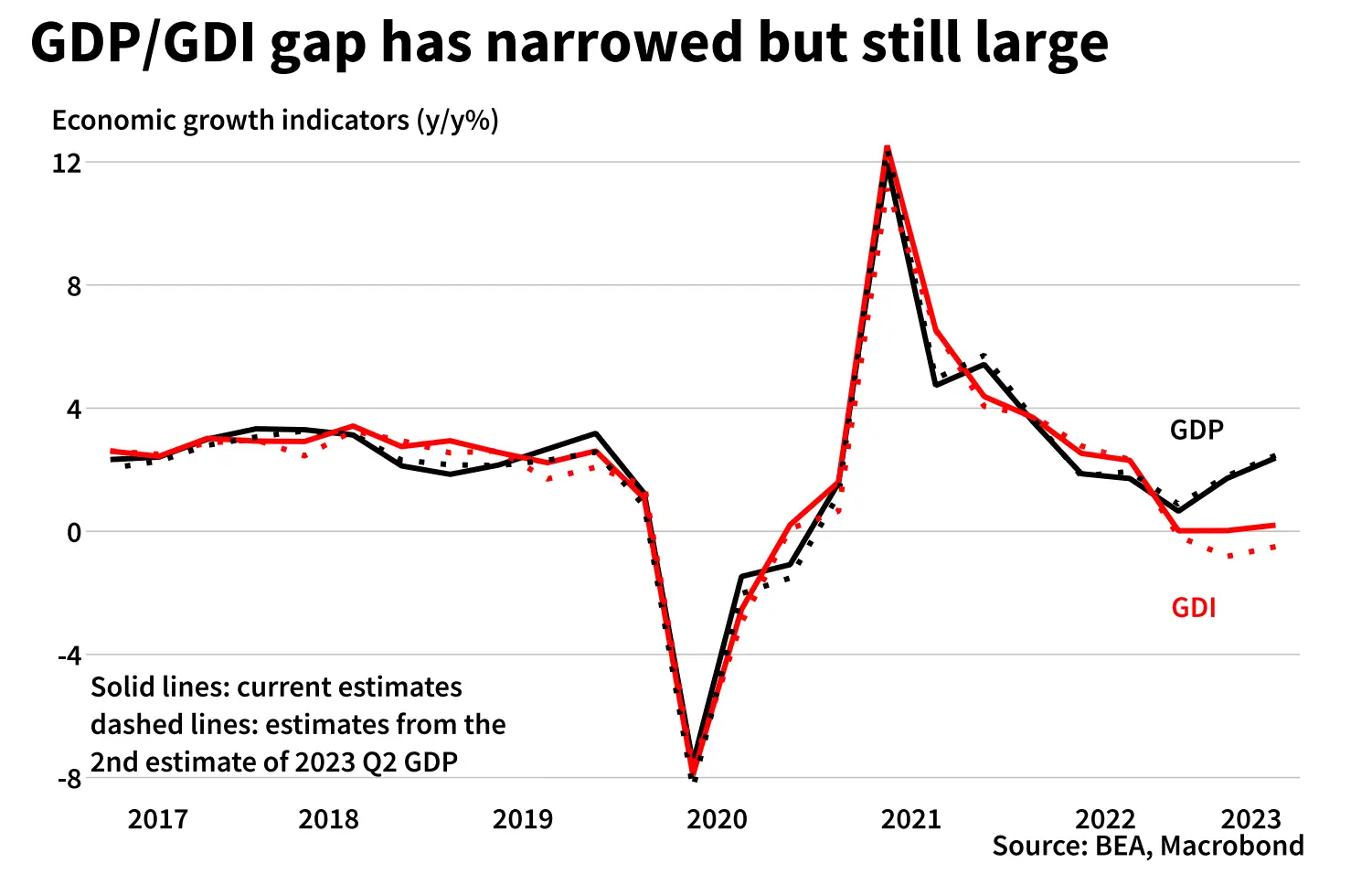

The third estimate of US GDP for Q2 2023 was released in

late September. We have noted in previous US Economic

Update reports the large difference between real GDP

and GDI growth (which conceptually should be equal).

GDP growth over the year to Q2 was revised down only

slightly (-0.1ppts) and GDI growth over the same period

was revised up 0.7ppts. Even after these changes, the

two measures continue to offer very different takes on

the strength of the economy. As normal, we continue to

take the GDP numbers at face value (and they also seem

more in line with labour market indicators) but it may be

that GDP is overstating growth.

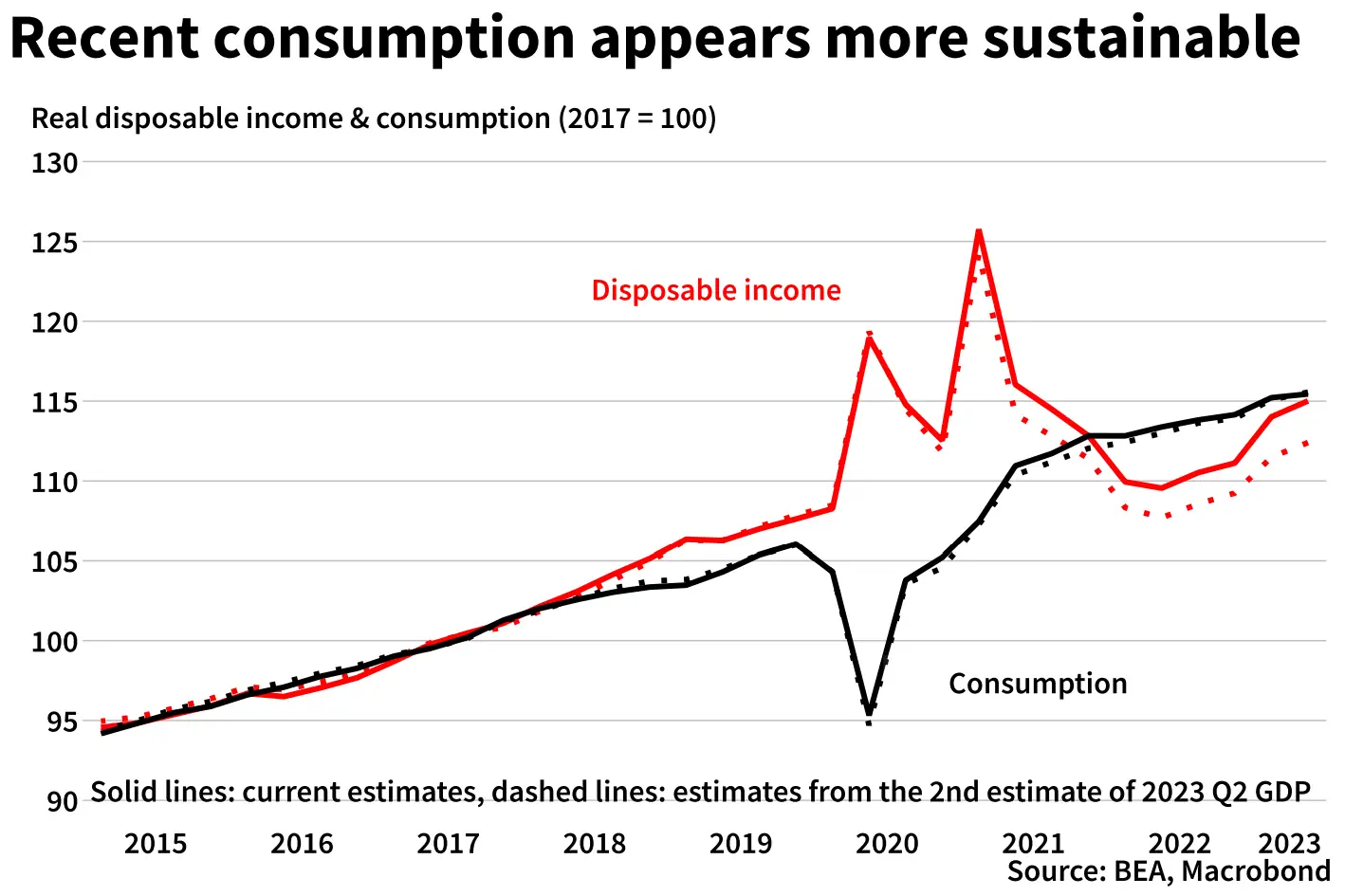

The income side revisions included noteworthy changes

to household incomes and corporate profits.

For households, while consumption was little changed,

the level of disposable income over the last two years

was revised upwards. The weakness in the level of

income relative to consumption had been a factor in our

view that consumption growth was set for a correction.

This changed picture can also be seen in the savings

rates – not only has it been revised upwards in recent

quarters, but the pre-COVID-19 level was also revised

down.

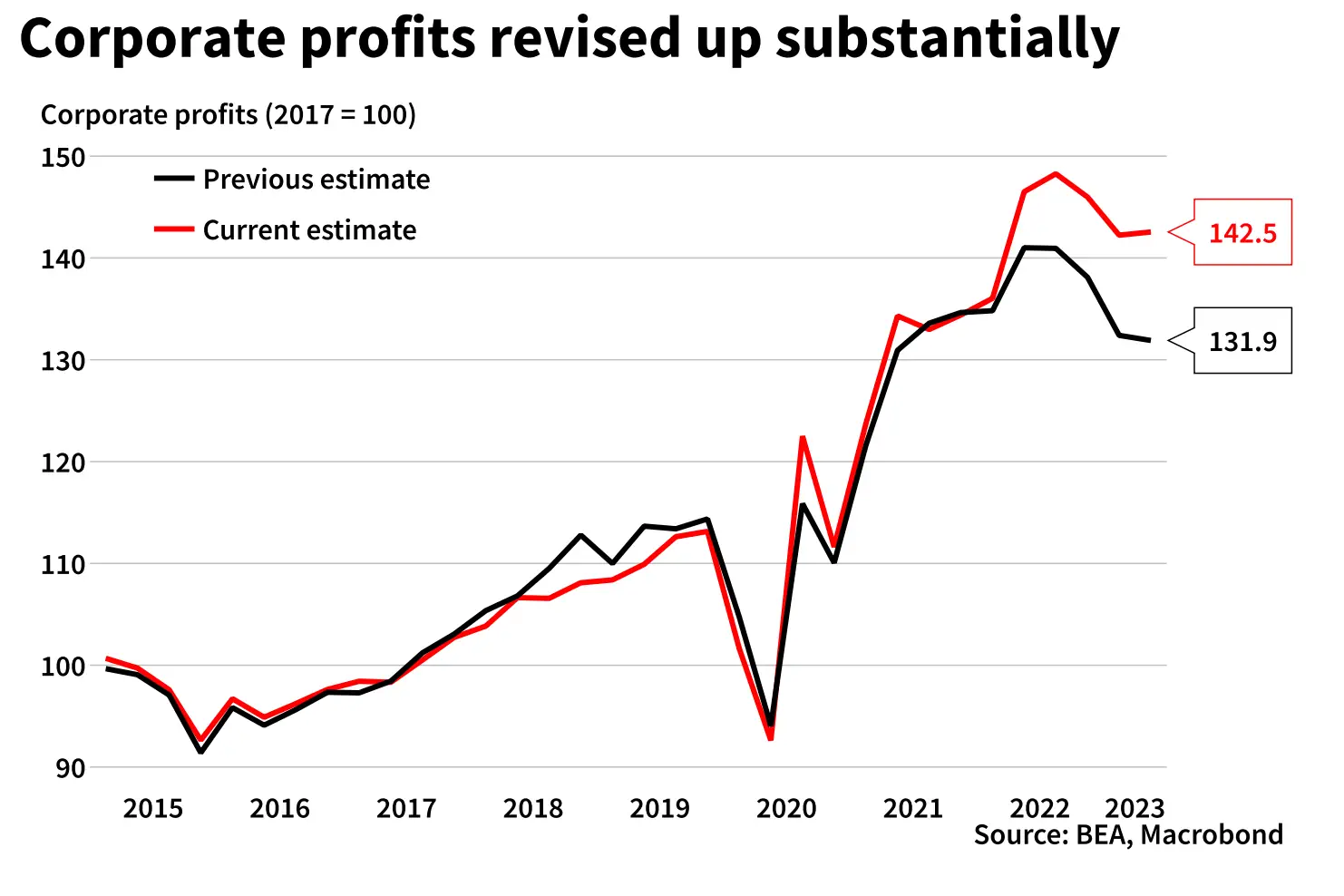

Similarly, corporate profits have been revised

substantially higher (the Q2 level between the 2nd and 3rd

estimate moved up over 10%). Profits are still estimated

to have declined from their peak, but the fall is smaller

than previously estimated.

Q3 looking even stronger

Incoming data continue to point to strong GDP growth in

Q3. Last month we revised up our forecast for Q3 and

this month we take it higher again (to 4.1% q/q

annualised from 2.9% q/q).

As expected, consumption growth slowed materially

from the boomy 0.6% m/m growth seen in July, growing

by 0.1% m/m in August. However, we had expected a

small correction over August/September and with auto

sales up in September this is looking less likely.

More significant are recent net trade and inventory data.

Real goods imports declined 1.9% m/m in August, while

exports rose 0.1% m/m. This means the most likely result

is a solid net trade contribution to Q3 growth. Similarly,

inventory data available for July/August point to

stronger inventory accumulation in Q3.

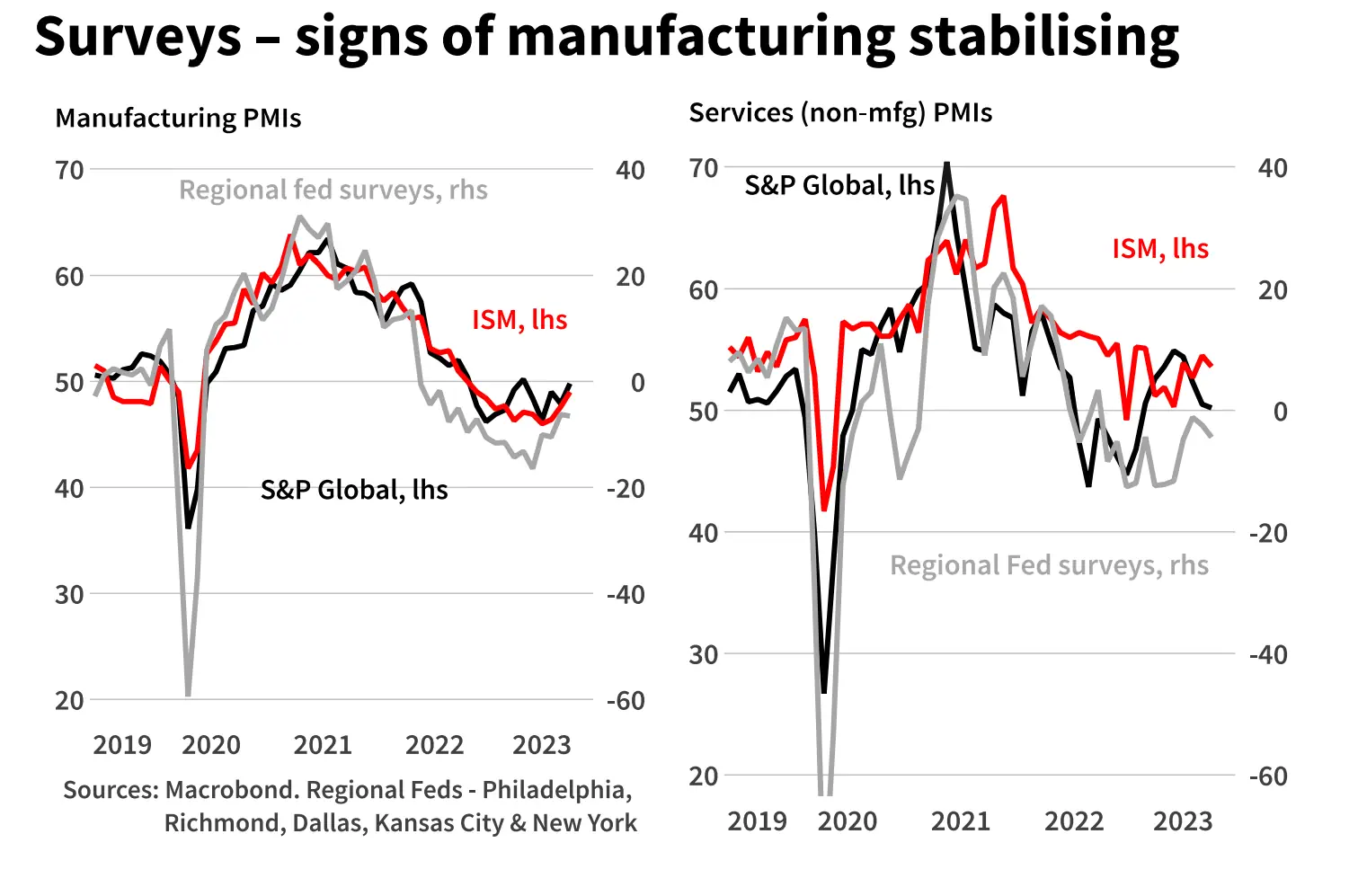

The strength in Q3 is somewhat at odds with the

business surveys. The business surveys are not reliable

indicators of quarterly GDP growth but over time do tend

to follow the same trend, and so provide an independent

signal of how the economy is performing. Of note, while

still weak in level terms, the PMIs for the manufacturing

sector have shown some improvement in recent months.

The services sector remains stronger, although may have

come off in recent months, although there are wide

differences across the various surveys.

Outlook

As a result of the revisions to the household income and

corporate profit data, as well as the underlying strength

of incoming data (suggesting greater momentum in the

economy), we have lifted our forecasts for GDP growth

over the four quarters to Q2 2024. We still expect growth

to slow materially, as the full impact of past monetary

tightening comes through, but with mid-2024 the point

where it is likely to be softest (previously early 2024).

Beyond that we expect growth to start recovering, albeit

a bit more slowly than before, partly because we now

expect rates to be on hold for longer.

In year average terms, these changes see higher growth

in 2023 (2.3% from 2.1%) and growth of 1.2% in both

2024 and 2025 (previously 0.8% and 1.7% respectively).

As noted above, consumption growth was soft in August,

in part reflecting the renewed pressure on household

incomes from a lift in petrol prices. Further pressure on

household spending power will come from the re-start of

student loan interest and principal repayments. As a

result, we expect materially lower consumption growth

in Q4.

Similarly, the run up in tech related manufacturing

construction appears to have peaked (so even it remains

elevated, a further large boost to growth appears

unlikely).

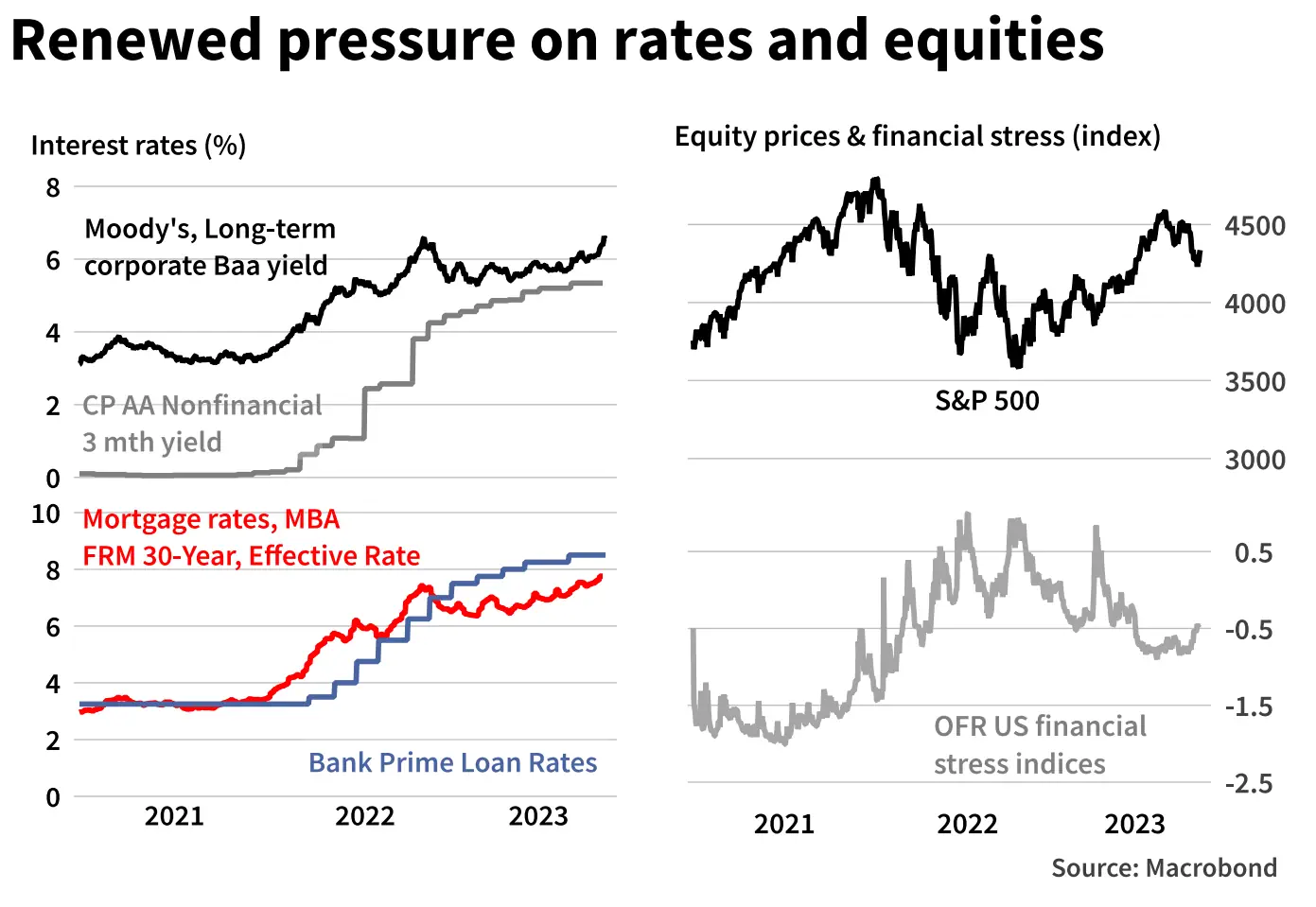

The resilience in the economy – and the resulting

expectation that the Fed will keep rates high for longer

than previously thought – has also seen a lift in interest

rates with corporate bond yields, mortgages rates, bank

loan rates all shifting higher. Importantly, however,

measures of market stress remain muted. At the same

time, there has been a fall in equity prices, reversing

some of the gains in wealth that households experienced

over the first half of the year.

The rise in interest rates (and fall in equities) represents

a tightening in financial conditions, which, if sustained,

will constrain future activity, particularly in interest rate

sensitive sectors such as residential investment and

durables consumption. It can also impact business

investment where surveys of business capex intentions

remain soft even with some recent improvement.

Strike activity has come to the fore this year, notably the

Writers strike (May-September) and the current auto

workers strike (started mid-September). The impact of

the former on intellectual property investment is highly

uncertain and a downside risk to Q3 (and upside risk to

Q4) intellectual property investment. The impact of the

auto workers strike is also hard to determine –

September auto data held up but depending on the

duration (and breadth across manufacturing plants), it

may hold down Q4 activity.

There is also the possibility of a US Federal Government

shutdown later this year. A shutdown was only just

recently averted but funding was only extended to

17 November.

Labour market and inflation

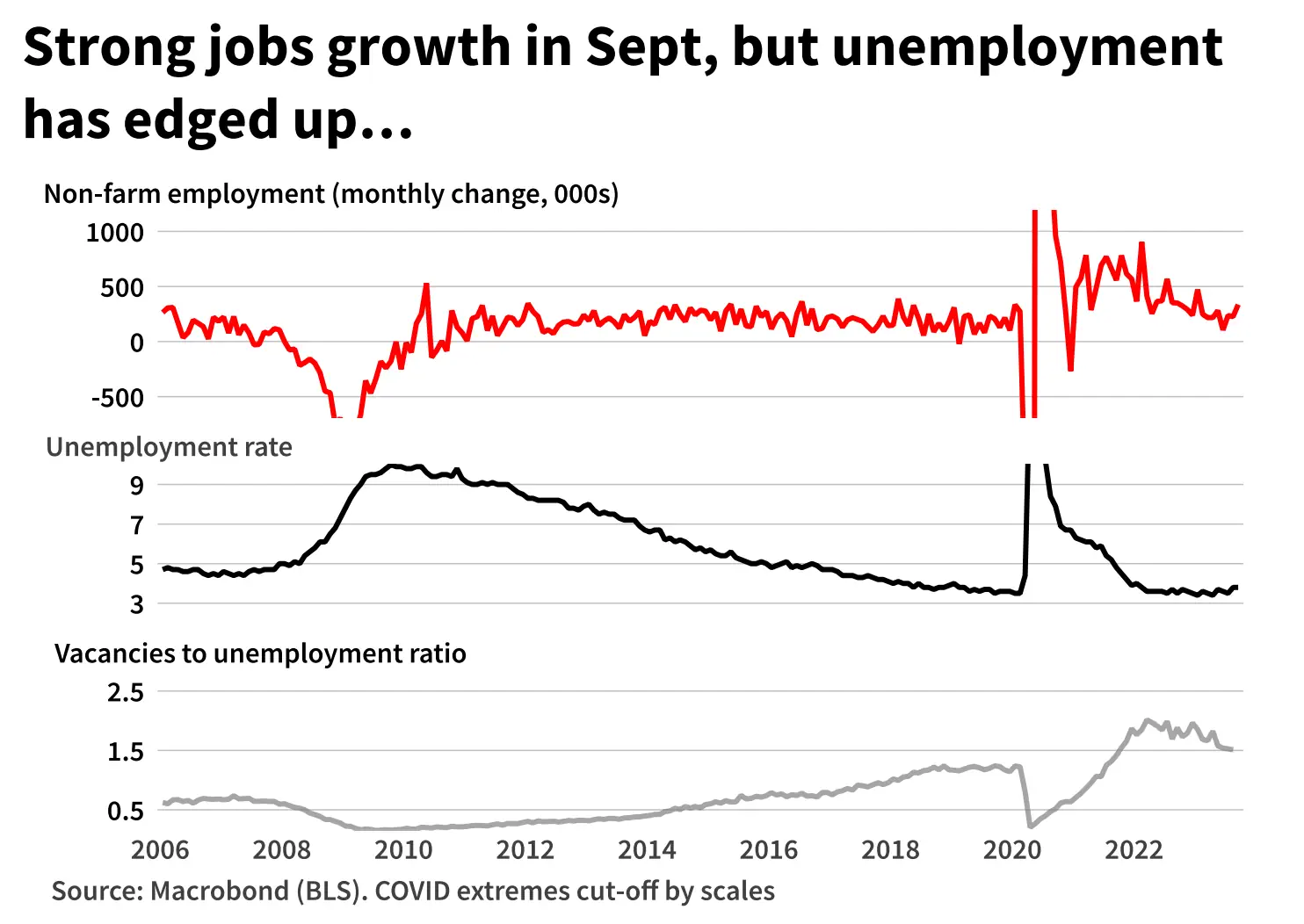

There was notable 336k increase in non-farm

employment in September, with a solid upwards revision

to the two previous months (albeit entirely in public

sector employment). In contrast, the unemployment rate

remained at 3.8% (after jumping up to this level in

August from 3.5%) and average hourly earnings growth

was again low at 0.2% m/m.

Job vacancies for August also jumped higher, although

relative to the number of unemployed they continue to

move down.

Overall, data over the last month were mixed. Monthly

data are volatile; on a quarterly basis non-farm

employment growth was little changed in Q3. It is not the

first time there has been a pause in the downwards trend

in job creation evident since early 2022. That said, even if

conditions are still easing, it is only slowly and the labour

market remains tight. The Fed’s concern with a tight

labour market is that it feeds into wages growth (and

then onto prices) but the modest growth in the August

and September hourly earnings data possibly indicates

that wage cost growth has come off further (although

again, a couple of readings are not enough to be

definitive).

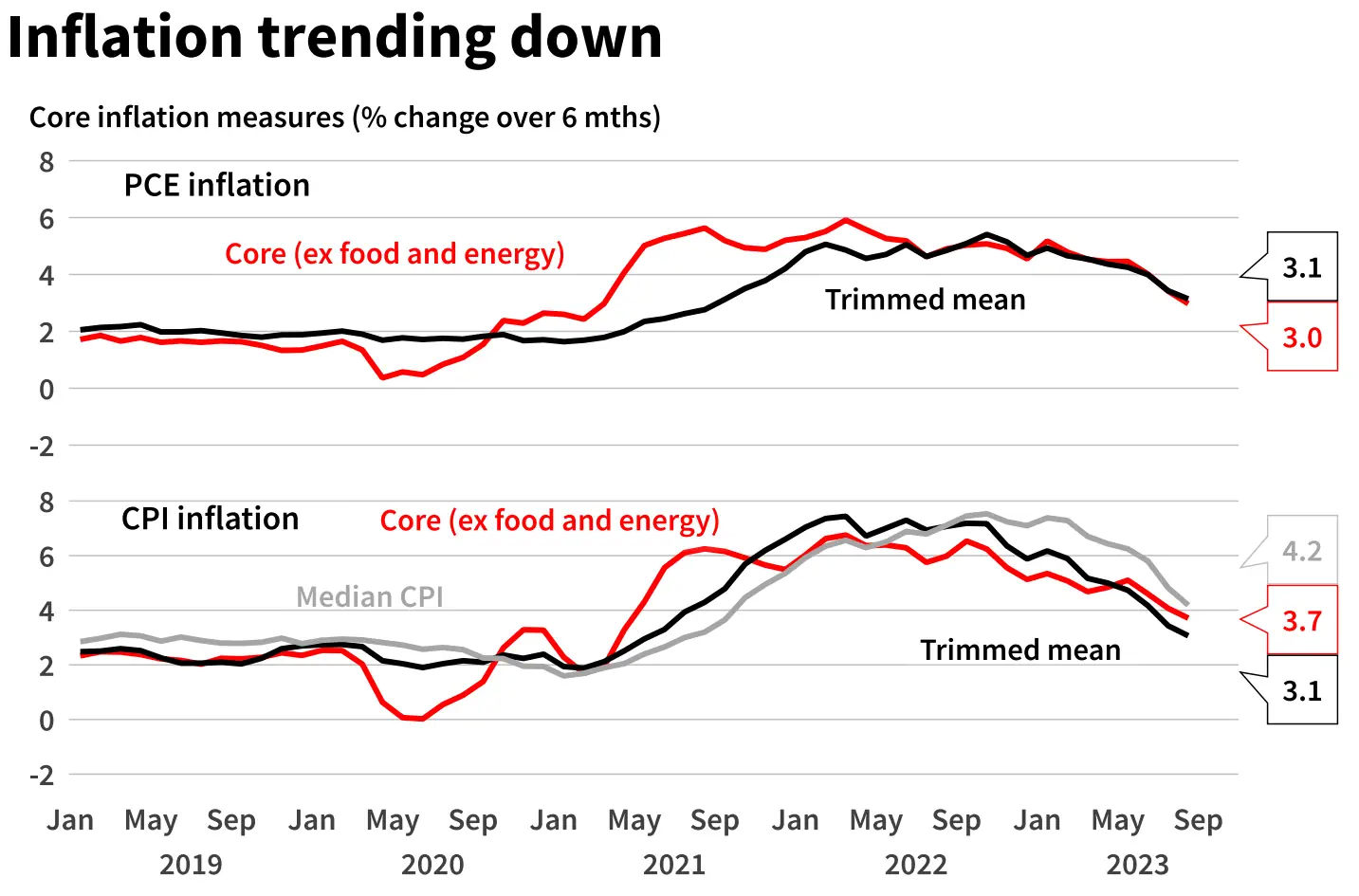

On the inflation front there was mixed news for August.

Headline CPI grew 0.6% m/m – its highest level since

mid-2022. This was largely due to a rise in gasoline

prices, although the core CPI, at 0.3% m/m, was also up

on the previous two months. The Fed’s preferred

inflation measure – PCE inflation, also rose to 0.4% m/m,

but the increase in the core measure was only 0.1% m/m,

its lowest level since late 2020.

In his September FOMC press conference, the Fed Chair,

noted that monthly data can be volatile and that it is

important to look at longer time frames. While noting

that this is why they tend to look at price changes over a

12-month period, he indicated that when there has been

a turn in inflation they also look at inflation over 3 and 6

month periods. Importantly, regardless of how it is

examined, inflation is shifting down across the range of

underlying inflation measures.

The changes to our GDP outlook now mean that, while

we still expect the unemployment rate to rise over the

next two years, it will occur more gradually. We still

expect it to rise to around 4½%, but for this level to be

reached in H1 2025 (previously H2 2024).

In contrast, we have not made material changes to the

inflation outlook. While a stronger near-term outlook for

growth and the labour market should mean, other things

equal, stronger inflation, inflation has broadly matched

our expectation in Q3. The disinflationary effects coming

from supply chain normalisation on goods prices still has

further to run – most notably for auto prices where

inventories have not fully recovered – especially when

coupled with the softness in the global economy.

Housing services inflation will almost certainly continue

to decline given trends in rents for new leases.

A key uncertainty remains at what level inflation will

settle once some of these (dare we say ‘transitory’)

factors pushing inflation down subside. However, with

most measures of inflation expectations still well

anchored, we retain our forecast that inflation will move

close to the Fed’s 2% target.

Monetary policy

At its meeting this month the Federal Reserve

maintained the target range for the federal funds rate at

5.25% to 5.50%.

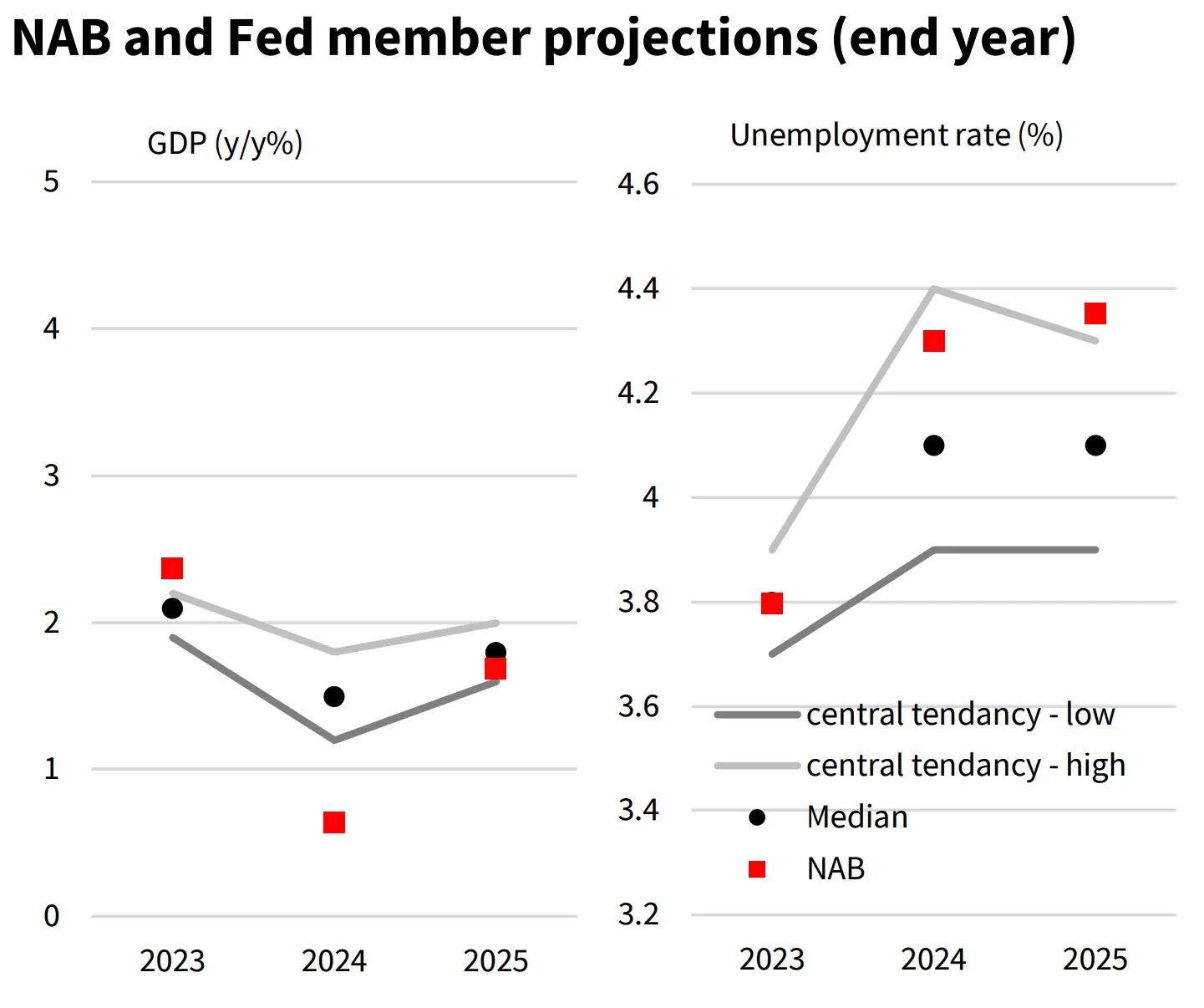

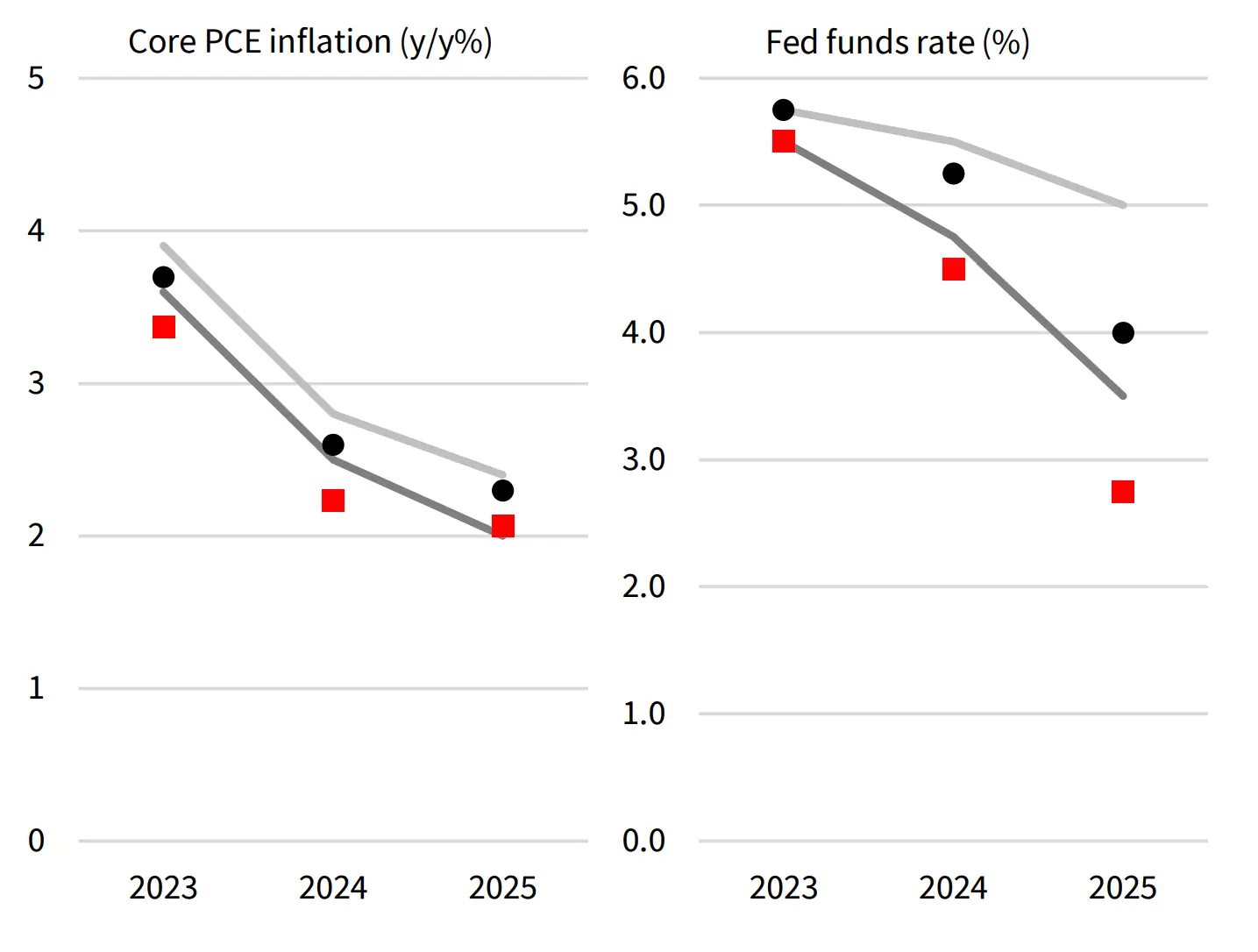

New Fed member economic projections were released

following the meeting. The Fed median projections for

GDP growth over 2023 and 2024 were revised up.

Consistent with this, the expected unemployment rate

was lowered. The median inflation forecasts did not shift

much – slightly lower in 2023 and, for core PCE inflation,

slightly higher in 2025 but the 2024 forecast was

unchanged.

For the federal funds rate, the median projection for end

2023 remains at 5.50-5.75% (i.e. one more hike this year).

While retaining an expectation of rate cuts next year, the

amount has been halved (50bps compared to 100bps

previously). Despite the resilience in the economy

to-date in the face of the large lift in rates, the Fed’s view

of the long-run level of the funds rate (‘neutral’) remains

at 2.5%. That said, even while projecting inflation, the

unemployment rate and GDP growth to be at their longrun level in 2026, the fed funds rate projection at the end

of the year is 2.9%, above ‘neutral’.

In terms of whether the Fed will increase rates one more

time this year, this is clearly possible, but we retain our

view that it will remain on hold given the better run of

inflation data of late.

In August, the Fed Chair stated that “Evidence that the

tightness in the labor market is no longer easing could

also call for a monetary policy response.” So it was little

surprise that the strong jobs growth reported for

September lifted market expectations of the chance of a

rate hike, but it subsequently fell back. At the time of

writing, market pricing implies around a 25% chance of a

rate hike by the end of this year. The improvement in

inflation outcomes may be enough to stay the Fed’s

hand – but clearly, if the next 1-2 months of inflation

data are on the high side, the chance of a rate hike will

go from possible to probable. The Employment Cost

Index for Q3 will also be an important marker, with the

Fed looking for further signs that wage growth is

moderating. Given the inherent volatility in monthly data

around its underlying trend, the decision could go either

way.

With the change to our economic forecasts, we have

pushed out when we expect the Fed to start cutting rates

to June 2024 (previously March 2024). We also expect a

slower pace of cuts to start – one a quarter – initially but

as unemployment rises further and it is clear the

moderation in inflation is entrenched then we think they

are likely to start cutting at each meeting.

This still leaves a lower track for the fed funds rate than

in the median Fed member projections. This is consistent

with our more pessimistic view for GDP growth and the

unemployment rate, and our forecast that inflation will

be lower in 2024 than the Fed expects.

More broadly, the risks around this rate call mirror the

uncertainties around our economic projections. Inflation

outcomes will be central to this and there are upside and

downside risks to the inflation outlook. Moreover, rates

may end up lower than expected over the forecast period

if, as is the historical experience for monetary policy

tightening of the magnitude experienced, the economy

goes into recession. Conversely if growth, and the labour

market, continues to out-perform expectations,

particularly if this adds to inflation pressures, then rates

could be on hold for longer (or even move higher).

Growth outperformance would also see the Fed revise up

its view of ‘neutral’ which may affect the extent of rate

cuts.

Contact the author:

Tony Kelly

Senior Economist

Group Economics

Alan Oster

Group Chief Economist

+(61 0) 414 444 652

Dean Pearson

Head of Behavioural &

Industry Economics

+(61 0) 457 517 342

Jacqui Brand

Personal Assistant

+(61 0) 477 716 540

Australian Economics

and Commodities

Gareth Spence

Senior Economist

+(61 0) 436 606 175

Brody Viney

Senior Economist

+(61 0) 452 673 400

Behavioural & Industry

Economics

Robert De Iure

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 477 723 769

Brien McDonald

Senior Economist –

Behavioural & Industry

Economics

+(61 0) 455 052 520

International

Economics

Tony Kelly

Senior Economist

+61 (0)477 746 237

Gerard Burg

Senior Economist –

International

+(61 0) 477 723 768

Global Markets Research

Skye Masters

Head of Markets Strategy

Markets, Corporate &

Institutional Banking

+(61 2) 9295 1196

Important notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (“NAB”). Any advice

contained in this document has been prepared without taking into account your objectives, financial situation or needs.

Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for

your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document,

before making any decision about a product including whether to acquire or to continue to hold it.

Please click here to view our disclaimer and terms of use.